MANG6298W1 MANAGEMENT OF FINANCIAL RISK

财务风险管理代考 This paper contains FOUR questions. Answer ALL FOUR questions in total. 100 Marks are allocated as follows: SECTION A: A total of 50 marks.

This paper contains FOUR questions.

Answer ALL FOUR questions in total.

100 Marks are allocated as follows:

SECTION A: A total of 50 marks.

SECTION B: A total of 50 marks.

SECTION A 财务风险管理代考

You must answer ALL question from this section.

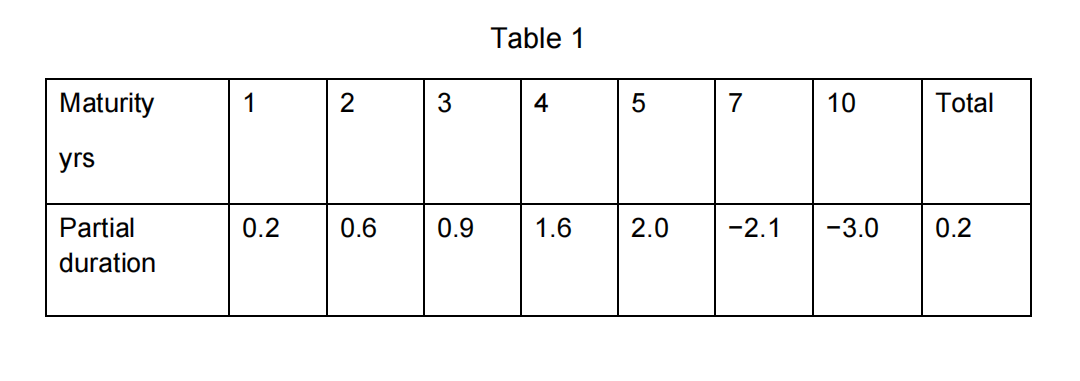

1.Consider the partial durations as from the Table 1 below and:

a) Estimate the effect of a shift in the yield curve where the ten-year rate stays the same, the one-year rate moves up by 9e, and the movements in intermediate rates are calculated by interpolation between 9e and 0. [20 marks]

b) Estimate the percentage change in the portfolio value arising from the rotation? [10 marks]

2.A financial institution has the following portfolio of over-thecounter options on sterling:

| Type | Position | Delta of Option | Gamma of Option | Vega of Option |

| Call | −1,000 | 0.50 | 2.2 | 1.8 |

| Call | −500 | 0.80 | 0.6 | 0.2 |

| Put | −2,000 | −0.40 | 1.3 | 0.7 |

| Call | −500 | 0.70 | 1.8 | 1.4 |

A traded option is available with a delta of 0.6, a gamma of 1.5, and a vega of 0.8.

(a) What position in the traded option and in sterling would make the portfolio both gamma neutral and delta neutral? [10 marks]

(b) What position in the traded option and in sterling would make the portfolio both vega neutral and delta neutral? [10 marks]

SECTION B 财务风险管理代考

You must answer ALL questions from this section.

1.Discuss the concept and theory of Value at Risk (VaR) and its shortcomings. Explain which other risk measure overcomes the limitations and how? [25 marks]

2.Discuss the concept of liquidity black hole. Are Hedge funds good or bad for the liquidity of the markets? [25 marks]

更多代写:c程序代做 多邻国网考 英国Econ网课托管 Definition Essay代写 ENGL英语论文代写 留学presentation代写