Examination Paper

| Examination Session:

January |

Year:

2021 |

Exam Code:

ACCT 40415-WE01 |

||||||

| Title: Financial Planning and Control | ||||||||

| Time Allowed: | Two hours | |||||||

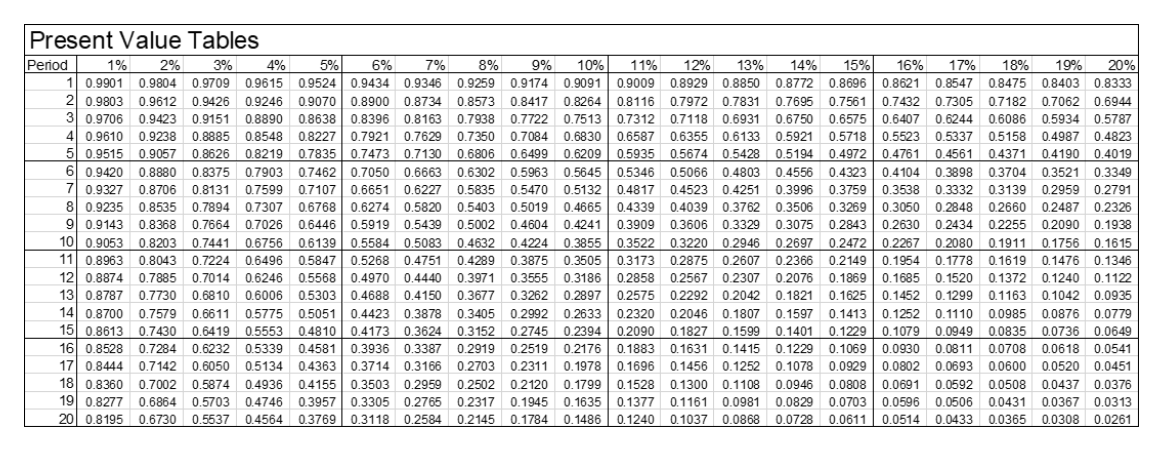

| Additional Material provided: | Present Value Table | |||||||

| Materials Permitted: | None | |||||||

| Calculators Permitted: | Yes | Models Permitted: Only the following calculators are permitted in this examination: Casio FX83; Casio FX85; Texas TI-30XS; Sharp EL-531. Calculators with additional text after model designations are acceptable (e.g. Casio FX85GT). Other models of calculator will not be considered on the day of the examination. If your calculator is not permitted, it will be confiscated. | ||||||

| Visiting Students may use dictionaries: No | ||||||||

| Instructions to Candidates: | Answer any three questions. All questions carry equal marks. | |||||||

| Revision: | ||||||||

1. 财务规划与控制代写

SL Ltd manufactures beds that are available in premium and standard ranges. The company has manufactured the standard range for several years. The premium range has been introduced a few years ago to capture a new market segment. Since the introduction of the premium range, the company’s profits have steadily declined, and the management has become increasingly concerned about the accuracy of their costing system. Sales of the premium range have been increasing rapidly.

Manufacturing overhead is assigned to products on the basis of direct labour hours. For the current year, the company has estimated that it will incur £1,800,000 in manufacturing overhead cost and produce 5,000 units of the premium range and 40,000 units of the standard range. The premium range requires two hours of direct labour per unit and the standard range requires one hour of direct labour per unit. Material and labour costs are as follow:

| Range | ||

| Premium

(£) |

Standard

(£) |

|

| Direct Materials | 80 | 50 |

| Direct Labour | 28 | 14 |

Required: 财务规划与控制代写

i. Compute the predetermined overhead rate using the direct labour hours as a base for assigning the overhead cost to products. Determine the unit cost of each range. (15 marks)

ii. As a newly hired management accountant of the company, you are adamant that the company should use activity based costing system as their costing method. The management has provided you with the following information. The activity based costing system would have the following four activity cost centres:

| Activity cost pool | Activity measure | Estimated overhead cost

(£) |

| Purchasing | Purchase orders issued | 408,000 |

| Processing | Machine-hours | 364,000 |

| Scrap/rework | Scrap/rework orders issued | 758,000 |

| Shipping | Number of shipments | 270,000 |

| 1,800,000 | ||

| Expected activity | |||

| Activity measure | Premium | Standard | Total |

| Purchase orders issued | 200 | 400 | 600 |

| Machine-hours | 20,000 | 15,000 | 35,000 |

| Scrap/rework orders issued | 1,000 | 1,000 | 2,000 |

| Number of shipments | 250 | 650 | 900 |

Compute the total amount of manufacturing overhead cost that would be applied to each range using the activity based costing system. Determine the amount of manufacturing overhead cost per unit of each range. (25 marks)

iii. Compute the unit product cost of each range under the activity based costing system. (10 marks)

iv. From the data you have developed in (i) to (iii) above, discuss factors that may account for the company’s declining profit. (25 marks)

v. In your opinion, discuss the strengths and weaknesses of the activity based costing method when compared to the traditional overhead costing method. (25 marks)

Total 100 marks

2. 财务规划与控制代写

Linda, a friend of yours, has recently set up a small business making side tables. She has supplied you with the following figures, and has asked your advice on number of issues:

| Costs per month | £ |

| Materials | 4,100 |

| Labour | 5,000 |

| Production overheads | 2,000 |

| Selling and distribution overheads | 1,000 |

| Administration overheads | 500 |

The above costs are based on producing and selling 1200 side tables per month at a selling price of £15 each. 80% of the labour costs, 75% of the production overheads, 60% of the selling and distribution overheads, and 100% of the administration overheads are fixed costs. All other costs vary directly with output.

Required:

Advise Linda on each of the above points, showing your calculations, explaining both the financial and non-financial implications of each, where appropriate.

i. How much profit she will make at the proposed production level and selling price? (10 marks)

ii. How many side tables she needs to sell to break even at this price? (10 marks)

iii. If sales are slower than expected, by how much can she reduce her selling price in order to maintain the budgeted level of sales, without making a loss. (20 marks)

iv. Linda estimates her maximum capacity is 1500 side tables; would it be worthwhile dropping the price in order to increase sales to capacity? If so, by how much? marks)

v. If Linda bought another machine, she could increase her production capacity to 2500 side tables. Repayments on the machine would be £700 per month, and she would need an extra member of staff, costing £1000 per month. She would also have to pay a bonus to all staff of 50p per side table, over and above their current wages, and variable production overheads would increase by 30p per side table.

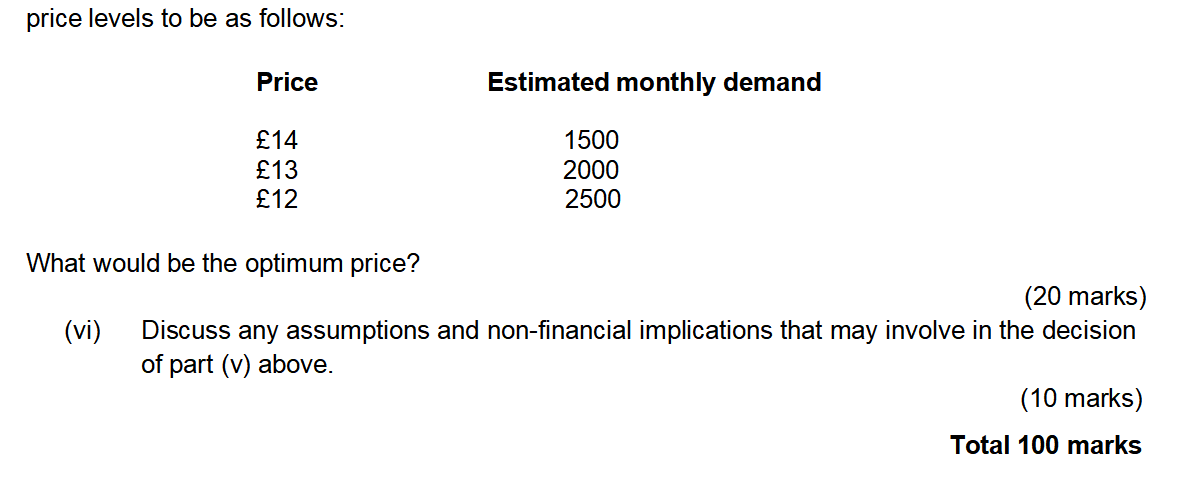

To increase sales, she would have to reduce the price. She estimates demand at different

What would be the optimum price? (20 marks)

vi. Discuss any assumptions and non-financial implications that may involve in the decision of part (v) above. (10 marks)

Total 100 marks

3.

KIKI Ltd. is a divisionalised company. The manager of its South division is considering two mutually exclusive alternative proposals for investing in new machinery. Both proposals involve an initial outlay of £250,000 but will yield different levels of savings over the life of the machinery, which is estimated at five years, after which will have no residual value. Depreciation is charged on a straight line basis by the company. The savings will give rise to increased cash flows as follows:

| Year

|

Machine

A Cash flows |

Machine

B Cash flows |

| 1 | 80000 | 100000 |

| 2 | 80000 | 90000 |

| 3 | 80000 | 80000 |

| 4 | 100000 | 60000 |

| 5 | 100000 | 40000 |

Required:

i. There has been a proposal to appraise the project based on the payback period. Explain the payback period method and provide comment of the method. (20 marks)

ii. The management of the company has agreed to appraise each project, based on net present value, using the company’s cost of capital of 10%. You are required to calculate the appraisal of the projects based on this method. (30 marks)

iii. Based on your results from (ii), explain which machine the Divisional Manager is likely to choose. Discuss the assumptions underlying the method. (20 marks)

iv. What other factors could be considered in the investment appraisals of KIKI Ltd. (30 marks)

Total 100 marks

4. 财务规划与控制代写

Mimosa Ltd manufactures two models of electric heaters: HM1 and HM2. The HM1 is sold for £400 and the HM2 for £100. The Sales Director has provided the following sales projections for the next three months.

| HM1 | HM2 | |

| July | 6,000 | 45,000 |

| August | 7,150 | 44,200 |

| September | 8,300 | 46,000 |

In the factory, the production supervisor has received the projected sales figures and gathered information needed to compile production budgets. He found that 650 units of HM1 and 585 units of HM2 were in stock at the start of July. Company policy dictates that ending inventory should equal 20 percent of the next month’s sales for HM1 and 10 percent of next month’s sales for HM2.

In the process of collecting the information for the above budgets, you discover that the Sales Director and production supervisor have included budgetary slack in their estimates. Despite this, you continue to produce the budgets based on the details provided by the Sales Director and production supervisor.

Required:

i. Prepare a sales budget for each month and for the quarter in total. Show sales by models and in total for each month. (25 marks)

ii. What factors might the company consider in preparing the sales budget? (20 marks)

iii. Prepare a separate production budget for each model in July and August. (20 marks)

iv. What factors should the company consider in deciding the inventory levels? (10 marks)

v. Explain the issues that arise from the inclusion of slack in budgets. (25 marks)

Total 100 marks

5. 财务规划与控制代写

Management accounting has a number of control systems including budgetary control which has been criticised as being too focussed on financial performance measures. Balanced scorecard has been developed to provide a more diverse perspective. Provide a critical discussion on the use of budgets and Balanced scorecard.

Total 100 marks

更多代写:cs北美final代写 线上考试作弊方法 英国会计final quiz代考 北美英文论文摘要代写 澳洲文科作业代写 财务会计和报告代考