Examination Paper

ACCT40315-WE01 FINANCIAL REPORTING & ACCOUNTING (SPECIMEN PAPER)

| Release Date/Time | e.g. 5 th January 09:30 |

| Latest Submission Date/Time | e.g. 6 th January 09:30 |

| Format of Exam | Take home exam |

| Duration: | TWO HOURS |

| Word/Page Limit: | 3,000 words |

| Additional Material provided: | None |

| Expected form of Submission | Word Document or PDF of Handwritten Work

Your uploaded file should be named with your anonymous ID and the Exam Code e.g. Z012345ACCT40315-WE01 |

| Submission method | Turnitin |

| Instructions to Candidates: | YOU MUST ANSWER TWO QUESTIONS.

QUESTION 1 IS COMPULSORY. YOU CAN ANSWER ANY ONE OF QUESTIONS 2–4. ALL QUESTIONS CARRY EQUAL MARKS IN TOTAL. |

Question 1 (THIS QUESTION IS COMPULSORY) 财务报告和会计考试代考

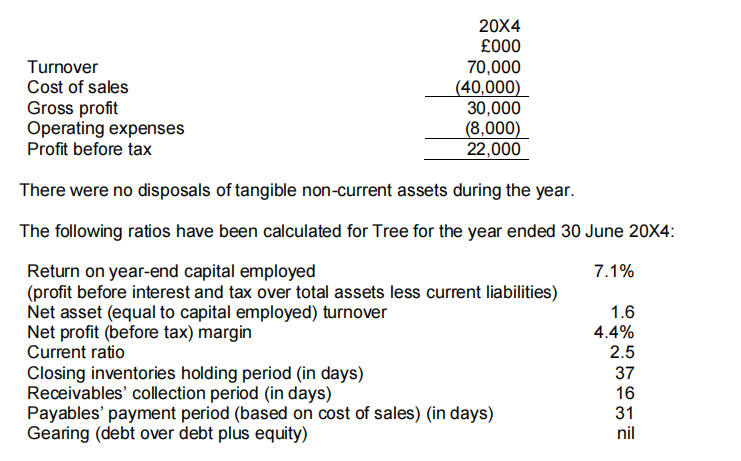

Shown below are the recently issued (summarised) financial statements of Tree, a publicly listed company, for the year ended 30 June 20X5, together with comparatives for 20X4 and extracts from the Chief Executive’s report that accompanied their issue.

Extracts from the Chief Executive’s report:

”Highlights of Tree’s performance for the year ended 30 June 20X5:

a 39% increase in turnover

gross profit margin up from 16.7% to 20%

profit doubled for the period

In response to the improved position the Board paid a dividend of 10p per share in June 20X5, an increase of 25% on the previous year.’

You have also been provided with the following information

On 1 July 20X4, Tree purchased the whole of the net assets of Leaf (previously a privately owned entity) for £100 million. The contribution of the purchase to Tree’s results for the year ended 30 June 20X5 was:

Required:

Assess the financial performance and position of Tree for the year ended 30 June 20X5 compared to the previous year. You should support your analysis with a suitable range of accounting ratios (worth up to 26 marks). Your answer should refer to the information in the Chief Executive’s report and the impact of the purchase of the net assets of Leaf. (100 marks)

Question 2 财务报告和会计考试代考

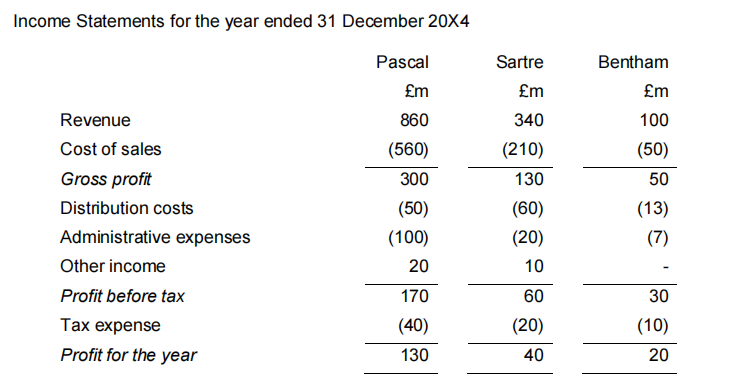

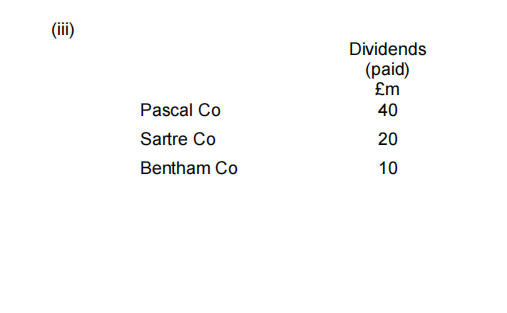

The following consolidation schedule relates to the Pascal Co group for the financial year ended 31 December 20X4.

Additional information:

(i) Pascal Co purchased 60% of the ordinary share capital of Sartre Co on 1 April 20X4 for £120m.

(ii) Pascal Co purchased 80% of the ordinary share capital of Bentham Co on 1 January 20X3 with the intention of selling this shareholding at a profit within a relatively short timeframe. This duly occurred on 31 March 20X5. Group profit for the year on discontinued operations to 31 December 20X4 is calculated at £6m. At 31 December 20X4 Bentham Co was classified as a discontinued operation under IFRS 5 Non-current assets held for sale and discontinued operations.

(iv) Included in the inventories of Sartre Co at 31 December 20X4 were goods purchased from Pascal Co during the year totalling £20 million upon which Pascal Co received a 20% margin.

(v) During the year ended 31 December 20X4 Sartre sold to Pascal Co a consignment of goods to the value of £10 million. These were in turn sold to a major customer. Sartre Co charged a mark-up of 25% on these goods.

Required:

a) Briefly explain why Bentham Co. would be classified as a discontinued operation under IFRS5 Non-current assets held for sale and discontinued operations and the disclosure requirements relating to Bentham Co. in the consolidated financial statements of the Pascal Co group. (20 marks)

b) Produce a consolidated income statement for the Pascal Co group for the year to 31 December 20X4 based upon the financial statements provided and notes (i) to (v) inclusive. (60 marks)

c) With reference to the consolidated income statement for the Pascal Co group for the year to 31 December 20X4, explain why it is necessary to eliminate unrealised profit when preparing group financial statements. (20 marks)

Question 3 财务报告和会计考试代考

You have been asked to help prepare the financial statements of Walrus plc for the year ended 31 March 20X4. A trial balance as at 31 March 20X4 is shown below.

The following further information is available:

- The company’s non-depreciable land was valued at £300,000 on 31 March 20X4 and this valuation is to be incorporated into the accounts for the year to 31 March 20X4.

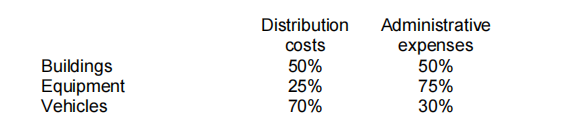

- The company’s depreciation policy is as follows:

Buildings 4% p.a. straight line

Equipment 40% p.a. reducing balance

Vehicles 25% p.a. straight line

In all cases, a full year’s depreciation is charged in the year of acquisition and no depreciation is charged in the year of disposal. None of the assets had been fully depreciated by 31 March 20X3.

- On 1 February 20X4, a vehicle used entirely for administrative purposes was sold for £10,000. The sale proceeds were banked and credited to a disposal account but no other entries were made in relation to this disposal. The vehicle had cost £44,000 in August 20X0. This was the only disposal of a non-current asset made during the year to 31 March 20X4.

- Depreciation is apportioned as follows:

- The company’s inventory at 31 March 20X4 is valued at £119,000.

- Trade receivables include a debt of £8,000 which is to be written off. Theallowance for receivables is to be adjusted to 4% of the receivables which remain after this debt has been written off.

- Corporation tax for the year to 31 March 20X3 was over-estimated by £6,000. The corporation tax liability for the year to 31 March 3014 is estimated to be £30,000.

- One-quarter of wages and salaries were paid to distribution staff and the remaining three-quarters were paid to administrative staff.

- General administrative expenses include bank overdraft interest of £9,000.

- A dividend of 10p per ordinary share was paid on 31 December 20X3. No further dividends are proposed for the year to 31 March 20X4.

Required:

Prepare the following financial statements for Walrus plc in accordance with the requirements of the international standards:

(a) A Statement of Profit or Loss and Comprehensive Income for the year to 31 March 20X4.

(b) A Statement of Financial Position as at 31 March 20X4. (100 marks)

Question 4 财务报告和会计考试代考

4(a)

Bodyline sells sports goods and clothing through a chain of retail outlets. It offers customers a full refund facility for any goods returned within 28 days of their purchase provided they are unused and in their original packaging. In addition, all goods carry a warranty against manufacturing defects for 12 months from their date of purchase. For most goods the manufacturer underwrites this warranty such that Bodyline is credited with the cost of the goods that are returned as faulty. Goods purchased from one manufacturer, Header, are sold to Bodyline at a negotiated discount which is designed to compensate Bodyline for manufacturing defects. No refunds are given by Header, thus Bodyline has to bear the cost of any manufacturing faults of these goods.

Bodyline makes a uniform mark-up on cost of 25% on all goods it sells, except for those supplied from Header on which it makes a mark-up on cost of 40%. Sales of goods manufactured by Header consistently account for 20% of all Bodyline’s sales.

Sales in the last 28 days of the trading year to 30 September 20X3 were £1,750,000. Past trends reliably indicate that 10% of all goods are returned under the 28-day return facility. These are not faulty goods. Of these 70% are later resold at the normal selling price and the remaining 30% are sold as ‘sale’ items at half the normal retail price.

In addition to the above expected returns, an estimated £160,000 (at selling price) of the goods sold during the year will have manufacturing defects and have yet to be returned by customers. Goods returned as faulty have no resale value.

Required: 财务报告和会计考试代考

(i) Explain the need for the accounting standard IAS37 Provisions, contingent liabilities and contingent assets. Illustrate your answer with three practical examples of how the standard addresses controversial issues.

(ii) Describe the nature of the above warranty/return facilities and calculate the provisions Bodyline is required to make at 30 September 20X3 for goods subject to the 28 day returns policy and for goods that are likely to be faulty. (60 marks)

4(b)

Rockbuster has recently purchased an item of earth moving plant at a total cost of £24 million. The plant has an estimated life of 10 years with no residual value, however its engine will need replacing after every 5,000 hours of use at an estimated cost of £7.5 million. The directors of Rockbuster intend to depreciate the plant at £2.4 million (£24m/10 years) per annum and make a provision of £1,500 (£7.5m/5,000 hours) per hour of use for the replacement of the engine.

Required:

Explain how the plant should be treated in accordance with relevant International Financial Reporting Standards and comment on the directors’ proposed treatment. (20 marks)

4(c) 财务报告和会计考试代考

The following information relates to Z plc:

(i) Alan owns 27% of the ordinary shares of Z plc. Elaine is his wife.

(ii) Z plc owns 60% of the ordinary shares of Y plc.

(iii) Z plc owns 15% of the ordinary shares of X plc.

(iv) Barbara is a director of Z plc. She owns 75% of the ordinary shares of W Ltd. David is her husband. He owns 10% of the ordinary shares of V Ltd.

(v) Colin works for Z plc as a manager but he is not a director. Fiona is his daughter.

(vi) Z plc has established a pension scheme for the benefit of its employees.

Required:

Identify those parties (if any) which are related to Z plc. (20 marks)

更多代写:cs北美Course课程代写 托福在家考试作弊 英国会计网课代修 北美留学生如何代写essay 澳洲BIO生物学代写 会计税法代写