Examination Paper

ACCT40315-WE01 :FINANCIAL ACCOUNTING AND REPORTING

| Format of Exam | Take home exam |

| Duration: | TWO HOURS |

| Word/Page Limit: | 3,000 words |

| Additional Material provided: | None |

| Expected form of Submission | Word Document or PDF of Handwritten Work

Your uploaded file should be named with your anonymous ID and the Exam Code e.g. Z0123456-ACCT40315-WE01 |

| Submission method | Turnitin |

| Instructions to Candidates: | YOU MUST ANSWER TWO QUESTIONS.

QUESTION 1 IS COMPULSORY. YOU CAN ANSWER ANY ONE OF QUESTIONS 2–4. ALL QUESTIONS CARRY EQUAL MARKS IN TOTAL |

Question 1 (THIS QUESTION IS COMPULSORY) 财务会计和报告代考

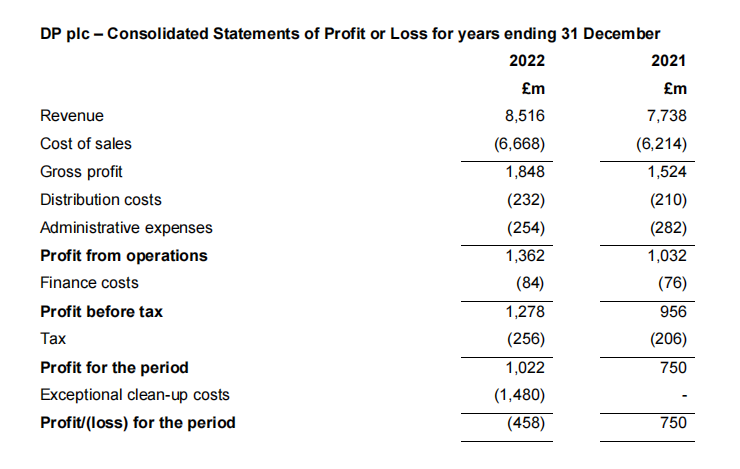

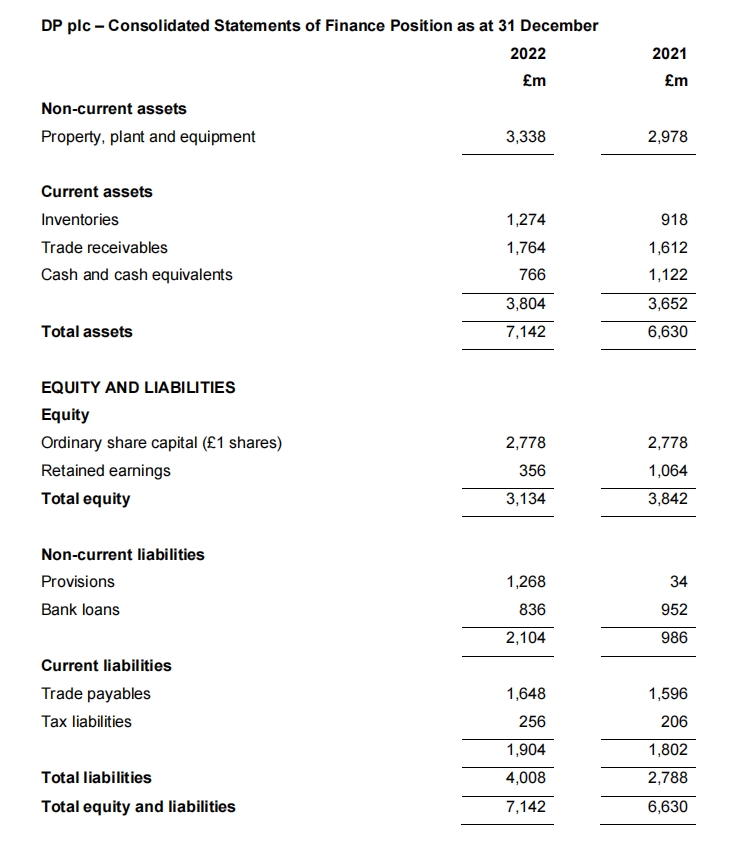

You have recently joined IA & Co. as a trainee investment analyst. Your manager has tasked you with reviewing the consolidated financial statements of Durham Petroleum (DP) plc, a multinational oil and gas company registered in the UK. The company has been profitable for many years through fully integrated operations from exploration and extraction of natural resources through to retail sale.

You are provided here with extracts from the company’s Annual Report to 31 December 2022.

These include comparative figures for the previous year.

Additional information:

- DP plc is the subject of US criminal investigations, worldwide press interest and targeting by environmental groups following a major oil spill off the Gulf of Mexico in August 2022.

The company has made a provision of £1,480m for reparation costs. This is an estimated cost net of taxation. It includes £212m of expenditure through to 31 December 2022 plus conservative estimates of future clean-up costs, fines, and compensation payments to relevant parties. The Finance Director would acknowledge the likelihood that all relevant costs have not yet been identified. A major uncertainty is the level of fines potentially applied to the company from US authorities, who are still investigating the spill. Fines for similar past incidents have run in excess of £1bn. 财务会计和报告代考

- Starting in Q2 2022, DP plc has rapidly vertically integrated its operations, acquiring and rebranding a large number of petrol stations across Europe.

- The price of oil has increased by approximately 40% during 2022. DP plc’s oil reserves are at their highest recorded levels at 31 December 2022.

- Investors in the company are understandably concerned about immediate claims against the company and its prospects, notwithstanding the company’s substantial reserves, the generally healthy risk/reward trade-off of the industry and the company’s dividend policy (DP plc maintained its dividend payment for the two years to 31 December 2022).

Required:

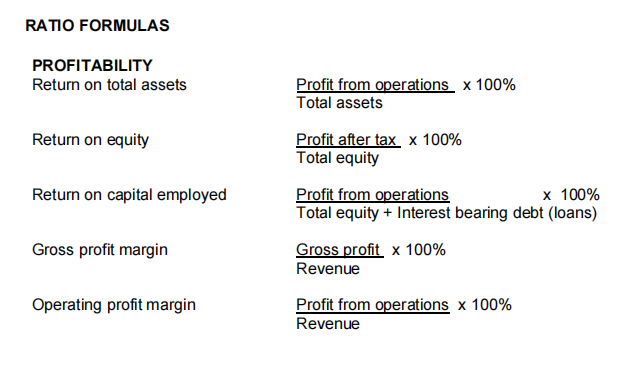

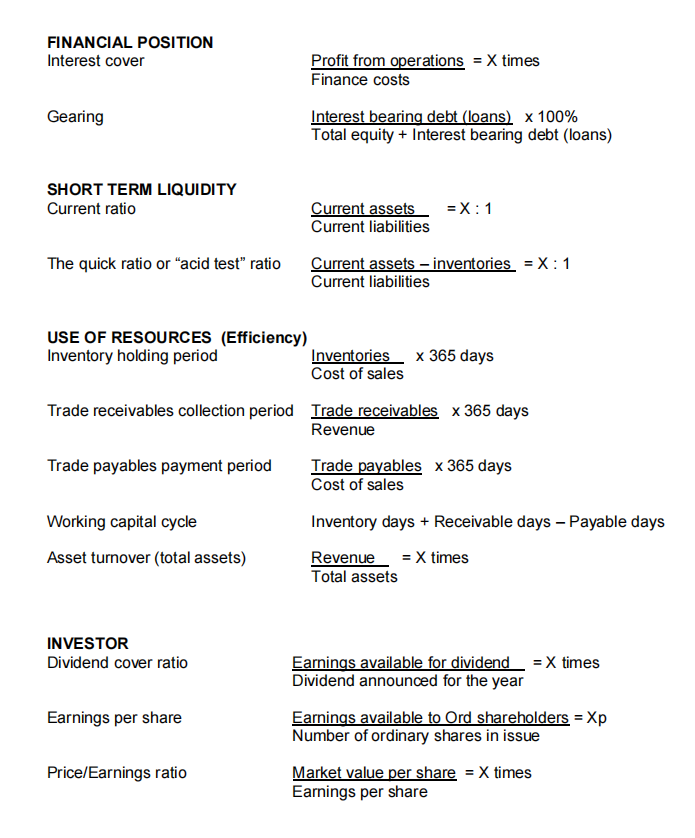

Provide a detailed report analysing the financial performance and position of DP plc. You should support your analysis with appropriate accounting ratios and observation of trends. (100 marks)

Question 2 财务会计和报告代考

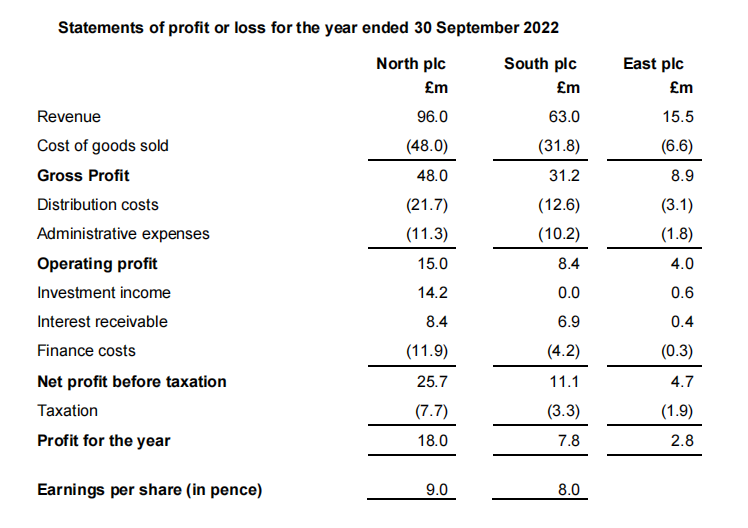

The following comprise the draft statements of profit or loss for three companies: North plc, South plc and East plc, for the financial year ended 30 September 2022.

Additional information:

1) South is a subsidiary of North. North purchased 80% of the shares in South on 1 June 2022.

2) North purchased 25% of the shares in East on 1 October 2021 in conjunction with three other companies each taking a 25% share. Control of East is jointly held between the four parent companies and each company has rights to 25% of the net assets of East.

3) During the financial year ended 30 September 2022 North received dividends of £2.5m and £0.7m from South and East respectively.

4) During the period 1 June 2022 to 30 September 2022 North made sales of £16.8m to South. These goods cost North £10.5m. South had resold 90% of the goods by 30 September 2022.

5) On 1 July 2022 North made a long-term loan of £50m to South. The loan bears interest at 12% per year and is payable half yearly. The first half yearly payment of interest is due on 31 December 2022. 财务会计和报告代考

6) An impairment test was conducted on 30 September 2022. This concluded that goodwill in South plc should be written down by £1m. This is chargeable as an administrative expense. Accounting entries have not been entered for this.

7) Items in the statement of profit or loss are deemed to accrue evenly over time.

Required:

(a) Prepare the consolidated statement of profit or loss for North plc for the year to 30 September 2022. Record group profit for the year as a balancing figure. (75 marks)

(b) Provide a detailed reconciliation of group profit by way of a note to the accounts. (15 marks)

(c) If Earnings per Share (EPS) is calculated as Earnings / Number of Ordinary Shares (where earnings equate to Profit after tax less preference dividends), calculate the number of ordinary shares in issue by North plc and the group EPS figure for the year ended 30 September 2022. (10 marks)

Question 3 财务会计和报告代考

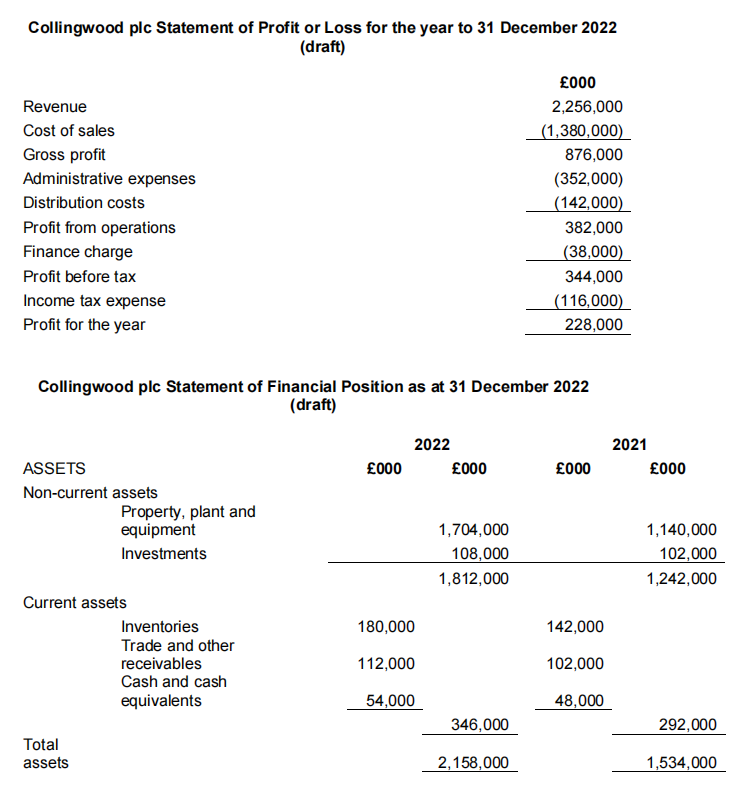

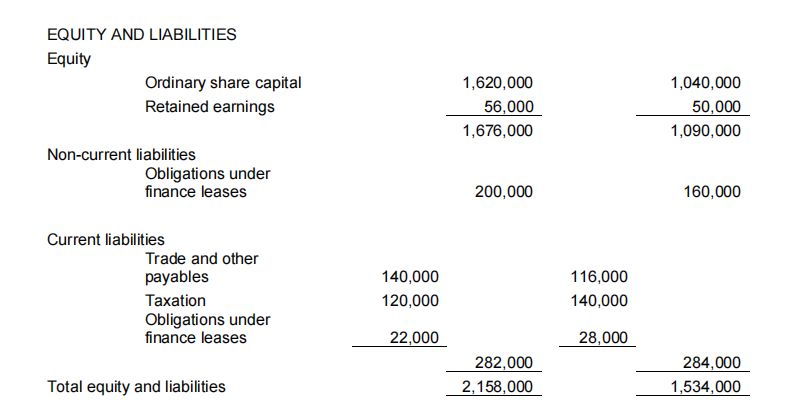

The following comprise the draft financial statements of Collingwood plc for the year to 31 December 2022:

Additional information:

1) An impairment review was conducted on 31 December 2022 considering ongoing market-based difficulties. This review identified a reduction in the recoverable amount of one of Collingwood plc’s investments. The carrying value of this investment was £22 million. The calculated recoverable amount at 31 December 2022 was £17 million.

2) During the year to 31 December 2022 property was acquired for cash totalling £800 million. Equipment with a fair value of £280 million was acquired under a finance lease to replace obsolete equipment sold at a loss of £40 million. Collingwood plc has no other long-term borrowings. 财务会计和报告代考

3) The depreciation charge to the Statement of Profit or Loss for the year to 31 December 2022 amounted to £290 million.

4) No dividends were payable at 31 December 2022 or 31 December 2021.

Required:

(a) Prepare a statement of cash flows for Collingwood plc for the year to 31 December 2022 in accordance with IAS 7 Statement of Cash Flows using the indirect method. (60 marks)

(b) Explain why depreciation and the loss made on disposal of equipment are both treated as a source of cash. (10 marks)

(c) For comparative purposes, re-calculate the cash generated from operations using the direct method. (30 marks)

Question 4 财务会计和报告代考

McQueen plc has a financial year end of 31 December. During the second half of the year to 31 December 2022, the company put all its staff through intensive training courses, the costs of which totalled £4.5 million. The training was designed to improve staff efficiency and workflow on the company’s manufacturing lines. The directors of the company firmly believe that this is money well spent because anticipated improvements will ultimately lead to lower production costs and higher profitability. The company is estimated to benefit from the training for the next five years. The directors have therefore requested that the training costs be capitalised initially and amortised over a five-year period going forward. The accountant has expressed reluctance leading the directors to upgrade their request to a demand.

Also, during the year to 31 December 2022, the company’s research and development arm commenced work on two new manufacturing processes, 1 and 2, involving bespoke technology and software for each. The initial research costs for both amounted to £131,400. Process 1 was finalised in-year, following successful build and testing of the technology and software, both of

which appear to operate in tandem as required. The company plans to put this into operation from 1 June 2023. Development costs for Process 1 amounted to £521,550 for the year to 31 December 2022. Process 1 is anticipated to have a useful economic life of 6 years. Process 2 has stalled due to difficulties with the technology/software interface. Development costs for Process 2 amounted to £305,550 for the year to 31 December 2022.

Required: 财务会计和报告代考

(a) Detail how the above items should be accounted for in accordance with international financial reporting standards, explaining any issues. (30 marks)

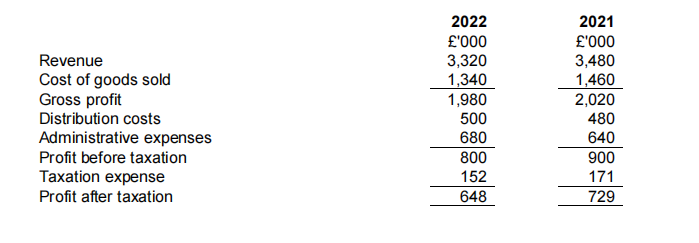

King plc has a financial year end of 31 December. In preparing financial statements for the year to 31 December 2022, it has come to light that the published revenue figure for the year to 31 December 2021 was understated by £200,000, with trade receivables understated similarly. It has been established that this was due to an accounting error and that the error is material. Prior to correcting this error, King plc’s draft statement of profit or loss for the year to 31 December 2022 showed the following:

No entries have been put through revenue or trade receivables to correct the identified understatement. King plc originally reported retained earnings of £2,440,000 at 31 December 2021. The company paid no dividends during the years to 31 December 2021 and 2022. You may assume that the company’s taxation expense is always equal to 19% of the profit before taxation.

Required:

(b) Revise the extract from the statement of profit or loss for the year to 31 December 2022, showing restated comparative figures for the previous year, and prepare an extract from the company’s statement of changes in equity for the year to 31 December 2022, showing changes to retained earnings. (30 marks)

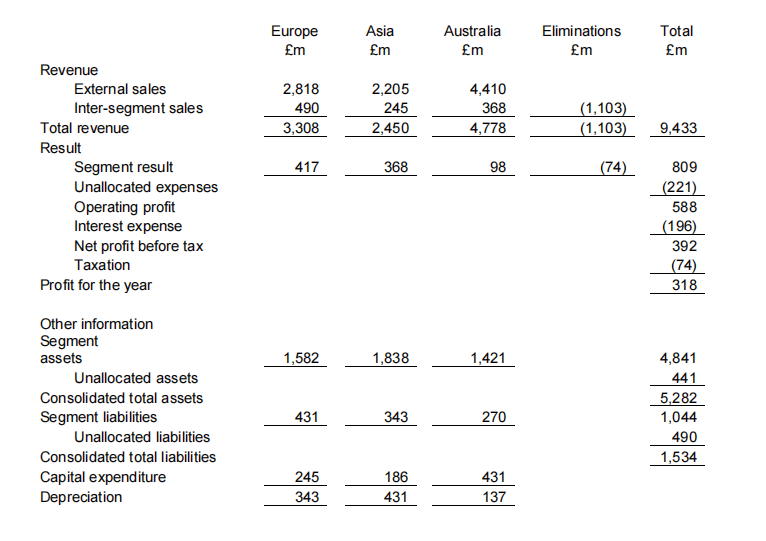

The following information relates to Allen plc, a company that operates in three separate continents and which reports segmental information on that basis in accordance with internal management reporting operations.

Required:

(c) Tabulate the following lines of key segmental information for the three continental segments, and analyse the results:

- External sales revenue

- Segment profit

- Net assets less liabilities

- Segment profit as a % of external sales revenue

- Segment profit as a % of net assets employed

- Capital expenditure (£m)

- Depreciation as a % of total assets (40 marks)

更多代写:cs北美exam代写 线上考试如何作弊 英国会计网课代上价格 北美留学生英文写作 澳洲经济代考 财务报告和会计考试代考