Spring 2016 Time Series Econometrics Exam

计量经济学代考 This is a closed book, closed note exam. You are subject to the honor code in that by taking this exam you agree to abide by this rule

This is a closed book, closed note exam. You are subject to the honor code in that by taking this exam you agree to abide by this rule, and you will neither give nor receive assistance in answering the questions. You have two hours to complete the exam. Please write your answers in the blue books that are provided. Be sure to write your name clearly on the books.

1Short Amswer Øuestioms (5 poimts for Number 1, amd Y poimts each for Numbers 2-6): 计量经济学代考

- Letyt be a univariate, stationary, first-order, autoregressive process, yt = c ‡ qyt—fi ‡ ot where ot is s.s.d. and N 0, o2 . What are the unconditional mean and variance of yt?

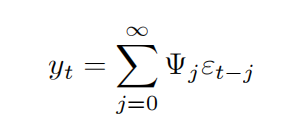

2. Let the Wold Decomposition of the zero mean, covariance stationary vector process yt be the following:

What is the forecast of yt‡s conditional on current and past values of yt?

3.Whatdoes it mean for a vector gt to be a martingale difference sequence? Suppose that gt,is also stationary and ergo What is the asymptotic limiting distribution of T g where g is the sample mean?计量经济学代考

4.Suppose that ,T 6 — 60 —‹d N (0, K), where 6 is the p-dimensional parameter vector, 60 is the vector of true parameters, and K is the asymptotic covariance matrix of the parameters. Armed with a consistent estimate of K denoted K, how would you test the null hypothesis that R60 = v,where R is a h p matrix of constants with h c p, vanh(R) = h and v is a h-dimensional vector of constants?

5. Demonstrate that the natural logarithm of the price-dividend ratio must predict either expected future returns or expected future dividend growth rates.

- Suppose that you have establishted that the natural logarithm of the spot exchange rate, st, and the natural logarithm of the forward rate, ƒt, are both I(fi) processes.You suspect that they are cointegrated with cointegrating vector (fi, fi). How would you test this hypothesis, and if you cannot reject it, what would be the appropriate error correction representation of (st,ƒt)t?

2.LomgAmswer Øuestioms (30 poimts for each):计量经济学代考

- Let M (yt‡fi, 8) be a non-linear function of data, yt‡fi, and P unknown para- meters, Your theoretical colleague thinks that M (yt‡fi, 8) is a model of the stochastic discount factor that prices all returns,Rs,t‡fi:

Et (M (yt‡fi, 8)Rs,t‡fi) = fi, s = fi, …, N

You do not know 8, but you do know the function M (yt‡fi, 8) and you have data on yt‡fi, the N returns, Rs,t‡fi, and a univariate process, st, which is in the time t information set and is correlated with future yt+1.

(a)Write down a set of £N moment conditions and explain how you would use GMM to estimate the parameters.

(b)How would you calculate the standard errors of theparameters?计量经济学代考

(c)How would you test the implications of the theory that the pricing errors arezero?

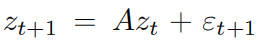

- Let

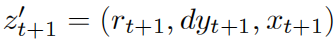

be a vector autoregression in three demeaned variables, where

be a vector autoregression in three demeaned variables, where  ,rt+1 is the log return on the market, dyt‡fi is the dividend yield, st‡fi is another forecasting variable,E(“t+1) = 0 and E(“t+1″0t+1) = :

,rt+1 is the log return on the market, dyt‡fi is the dividend yield, st‡fi is another forecasting variable,E(“t+1) = 0 and E(“t+1″0t+1) = :

(a)Howwould you estimate the parameters of A and K?计量经济学代考

(b)How would you use these estimated parameters to recover the implicit slope coefficient of the regression of rt+1 + ::: + rt+K on dyt?

(c)Explain how you would estimate the standard error of this implicit slope coefficient.

其他代写:web代写 program代写 cs作业代写 app代写 Programming代写 homework代写 source code代写 考试助攻 finance代写 代写CS C++代写 finance代写 java代写 金融经济统计代写