Assignment 4

计算机程序代写 The file COINT PPP.XLS contains monthly values of the Japanese, Canadian and Swiss consumer price levels and the bilateral exchange rates

1.The file COINT XLS contains monthly values of the Japanese,计算机程序代写

Canadian and Swiss consumer price levels and the bilateral exchange rates with the United States. The file also contains the U.S. consumer price level. The names on the individual series should be self-evident. For example, JAPANCPI is the Japanese price level and JAPANEX is the bilateral Japanese/U.S. exchange rate. The starting date for all vari- ables is January 1974 while the availability of the variables is such that most near the endof 2013. The price indices have been normalized to equal 100 in January 1973 and only the U.S. price index is seasonally adjusted.

(a)Form the log of each variable and pretest each for a unit root. Can the null hy- pothesis of a unit root be rejected for any of the series? How might you proceed ifyou found that the S. CPI was trend stationary?

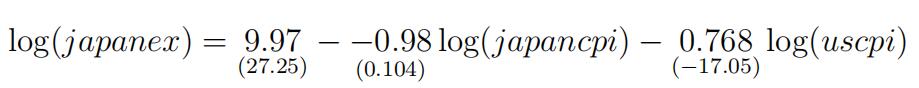

(b)Form the log of each variable. Estimate the long-run relationship between Japan the U.S.as

i.Do the point estimates of the slope coefficients seem to be consistent with long-runPPP?

ii.From the t-statistics, can you conclude that the Japanese CPI is not signifi- cant at the 5%level?计算机程序代写

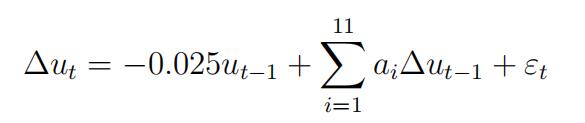

(c)Let utdenote the residuals from the long-run relationship. Use these residuals to perform the Engle-Granger test for cointegration. If you use eleven lagged changes, you should find

- The t-statistic on the coefficient for ut—1 is 3.44. From Table C, with three variables and 457 usable observations, the 5% and 10% critical values are about 3.760 and 3.464, respectively. Do you conclude that long-run PPP fails?

(d)Repeat parts (i) and (ii) using Canada and Switzerland. If you use the residuals from the long-run equilibrium relationships you shouldfind

Canada (10 lags) Out = —0.012ut—1 + X aiOut—i + “t; t-stat = -1.89 Switzerland (10 lags) Out = —0.027ut—1 + X aiOut—1 + “t; t-stat = -3.02.计算机程序代写

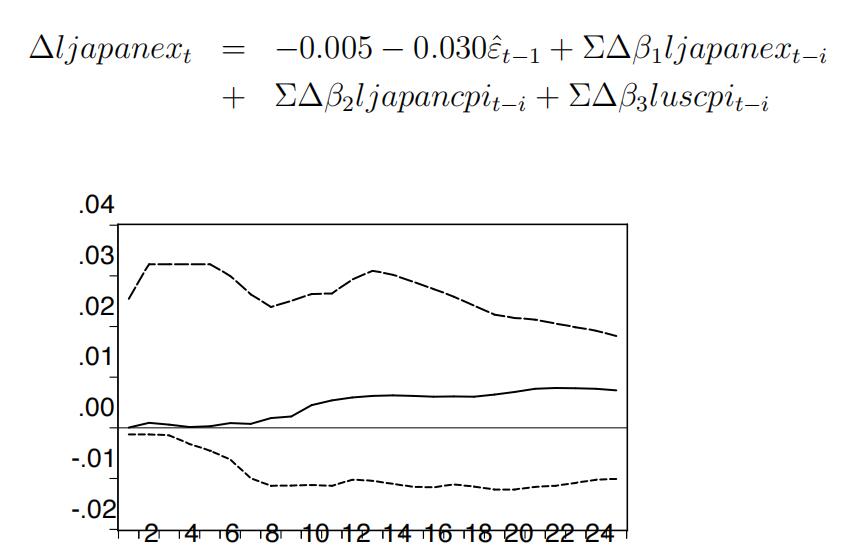

(e)Although (at conventional significance levels) we reject the null hypothesis of long-run PPP between Japan and the United States, estimate the error-correction model for ljapanext. If you use 11 lagged changes of each variable, you should find

Figure 1: (solid) U.S. Price Shock, (short dash) Japanese Price Shock, (long dash) Ex Rate Shock

- where “ˆt—1 is the residual from the equilibrium relationship above and eleven lagged changes are used for each variable. The t-statistic on the error cor- rection term is 3.54. Which of the variable(s) can be said to be weakly exogenous?

(f)Obtainthe impulse response functions using the ordering uscpit ! ljapancpit ! ljapanext. As in Figure above, you should find that the U.S. price shock has little e↵ect on the exchange rate but that the shock to the Japanese price level causes the yen to The response of the exchange rate to its own shock is immediate and permanent.计算机程序代写

(g)Are the results of the cointegration test sensitive to the normalization (i.e. which of the variables is used as the ’dependent’ variable) used in the equilibrium re- gression?

2.In the previous question,计算机程序代写

you were asked to use the Engle-Granger procedure test for PPPamong the variables log(canex), log(cancpi), and log(uscpi).

(a)Nowuse the Johansen methodology and constrain the constant to the cointegreat- ing vector to obtain:

Rank λi λmax λtrace

| 1 | 0.0535 | 25.647 | 35.987 |

| 2 | 0.0138 | 6.460 | 10.339 |

| 3 | 0.0083 | 3.879 | 3.879 |

- Usethe table to show that there is a cointegrating

(b)Consider the estimated cointegratingvector:

−0.949 log(canex) − 6.484 log(cancpi) + 1.600 log(uscpi) + 31.653 = 0

- Normalize with respect to the exchange rate. Does the long-run relationship seem to be consistent with PPP?计算机程序代写

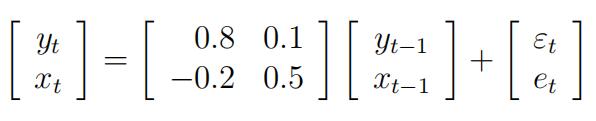

- An econometrician estimates a vector autoregression for two variables x and y using onelag of each The estimated VAR is

The variance covariance matrix of the shocks et and ut is known to be diagonal.

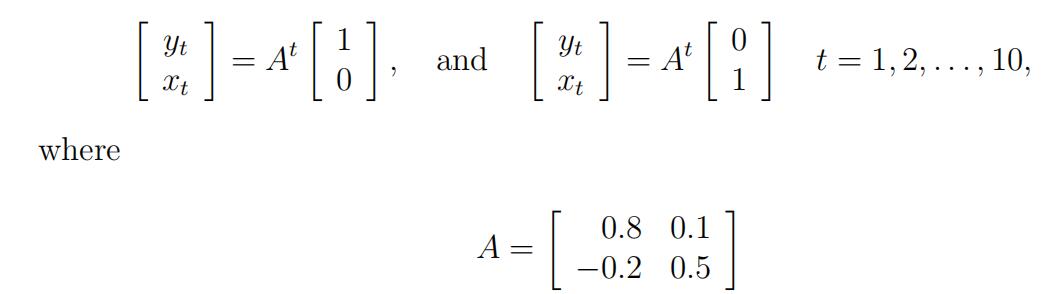

(a)Write a computer program to, compute the impulse response functions out toten periods for a shock to εt, as well as et. (Hint: Simulate the following difference equation)

(b)Plot the four impulse response functions for t = 1, . . . ,

1.文件COINT PPP.XLS包含日本,加拿大和瑞士消费者价格水平的月度值以及与美国的双边汇率。该文件还包含美国消费者价格水平。各个系列的名称不言而喻。例如,JAPANCPI是日本的价格水平,JAPANEX是双边的日本/美国。汇率。所有变量的起始日期为1974年1月,而变量的可用性使得最晚于2013年底。价格指数已在1973年1月标准化为100,并且仅对美国价格指数进行了季节性调整。计算机程序代写

(a)形成每个变量的日志,并对每个变量进行单位根预测试。是否可以拒绝任何一个系列的单位根的零假设?如果您发现美国CPI保持趋势不变,该如何处理?

(b)形成每个变量的日志。估计日本与美国之间的长期关系为

log(日本)= 9.97

–0.98 log(japicpi)-0.768 log(uscpi)

(27.25)

(0.104)

(—17.05)

i。斜率系数的点估计似乎与长期PPP一致吗?计算机程序代写

ii。从t统计量中,您是否可以得出结论,日本CPI并未达到5%的显着水平?

(c)让我们表示长期关系中的残差。使用这些残差执行Engle-Granger测试以进行协整。如果您使用十一个滞后更改,则应该找到

11

出= -0.025ut-1 + aiOut-1 +“ t

i = 1

ut-1的系数的t统计量是3.44。根据表C,具有三个变量和457个可用观察值,5%和10%的临界值分别约为3.760和3.464。您是否得出结论,长期PPP失败了?计算机程序代写

(d)使用加拿大和瑞士重复(i)和(ii)部分。如果使用长期均衡关系中的残差,则应该找到

加拿大(10滞后)出= -0.012ut-1 + X aiOut-i +“ t; t-stat = -1.89瑞士(10滞后)出= -0.027ut-1 + X aiOut-1 +” t; t-stat = -3.02。

(e)尽管(按常规显着性水平)我们拒绝了日本和美国之间长期PPP的零假设,但估计了ljapanext的错误校正模型。如果对每个变量使用11个滞后更改,则应该找到

Oljapanext = -0.005-0.030“ ˆt-1 + ⌃OØ1ljapanext-i

+ oØ2ljapancpit—i + oØ3lscpit—i.04

图1:(实盘)美国价格震荡,(短破折号)日本价格震荡,(长破折号)汇率异动

其中“ ˆt-1是来自上述平衡关系的残差,并且每个变量使用十一个滞后变化。误差校正项的t统计量为3.54。可以说哪个变量是弱变量外生的?计算机程序代写

(f)使用订购的uscpit获得脉冲响应函数! ljapancpit! ljapanext。如上图所示,您应该发现美国价格冲击对汇率影响不大,但是对日本价格水平的冲击导致日元贬值。汇率对其自身冲击的反应是立即和永久的。

(g)协整检验的结果是否对均衡回归中使用的归一化(即哪个变量用作“因变量”)敏感?

2.在上一个问题中,要求您对变量log(canex),log(cancpi)和log(uscpi)中的PPP使用Engle-Granger过程测试。

(a)现在使用Johansen方法并将常数约束在共整向量上,以获得:

等级λiλmaxλtrace

1 0.0535 25.647 35.987

2 0.0138 6.460 10.339

3 0.0083 3.879 3.879

•使用表格显示存在协整向量。

(b)考虑估计的协整向量:

−0.949 log(canex)− 6.484 log(cancpi)+ 1.600 log(uscpi)+ 31.653 = 0

关于汇率归一化。长期关系似乎与PPP保持一致吗?计算机程序代写

6,一位计量经济学家使用每个变量的一个滞后估计两个变量x和y的向量自回归。估计的VAR为

ΣytΣ=Σ0.8 0.1ΣΣyt−1

Σ+ΣεtΣ

xt -0.2 0.5

xt-1等

已知冲击et和ut的方差协方差矩阵是对角线的。

(a)编写一个计算机程序,以计算对εt的冲击的十个周期的脉冲响应函数,以及et。 (提示:模拟以下差分方程式)计算机程序代写

∑yt

Σ=在Σ1Σ和Σyt处

Σ=在Σ0Σt = 1,2,。 。 。 ,10,

在哪里

A = 0.8 0.1

−0.2 0.5

(b)画出t = 1时的四个脉冲响应函数。 。 。 ,10。

其他代写:algorithm代写 analysis代写 app代写 assembly代写 assignment代写 C++代写 code代写 course代写 dataset代写 java代写 web代写 北美作业代写 编程代写 考试助攻 program代写 cs作业代写 source code代写 dataset代写 金融经济统计代写 加拿大代写 jupyter notebook代写