FM320/FM322

Derivatives

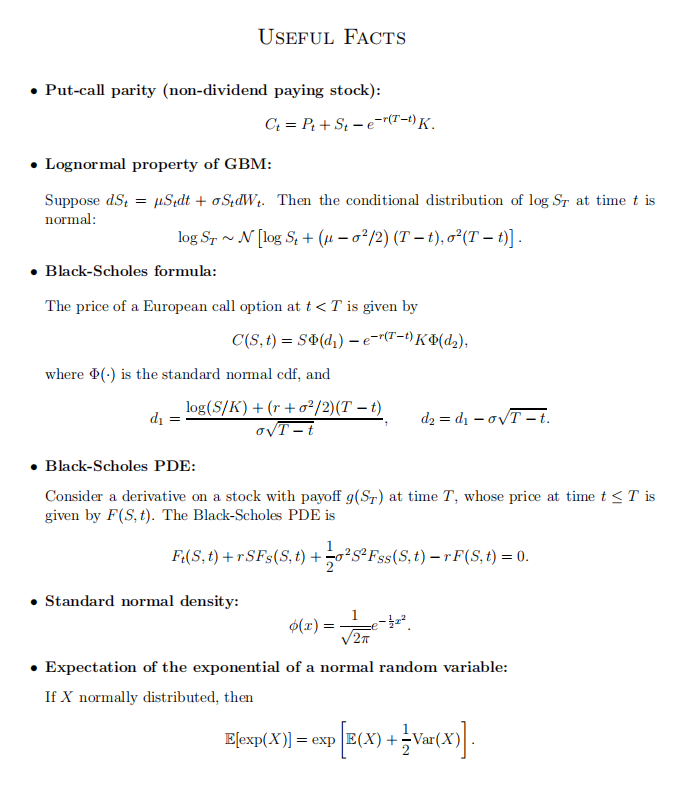

衍生品考试代写 1. Suppose the price of a stock over the next 6 months evolves as follows. The initial value of the stock, S0, is £20.

1.

Suppose the price of a stock over the next 6 months evolves as follows. The initial value of the stock, S0, is £20. The value of the stock in 3 months, S1/4 , can be either £25 or £15, with equal probability. Conditional on the price going up in the fifirst three months, the value S1/2 of the stock in 6 months can be either £30 or £20 with equal probability, whereas if the stock price falls in the fifirst three months, S1/2 can take values £19, £15 or £10 with equal probability. Suppose the riskfree interest rate is constant at 4% per annum with quarterly compounding.

Do your calculations to at least three decimal places.

(a) [9 marks]

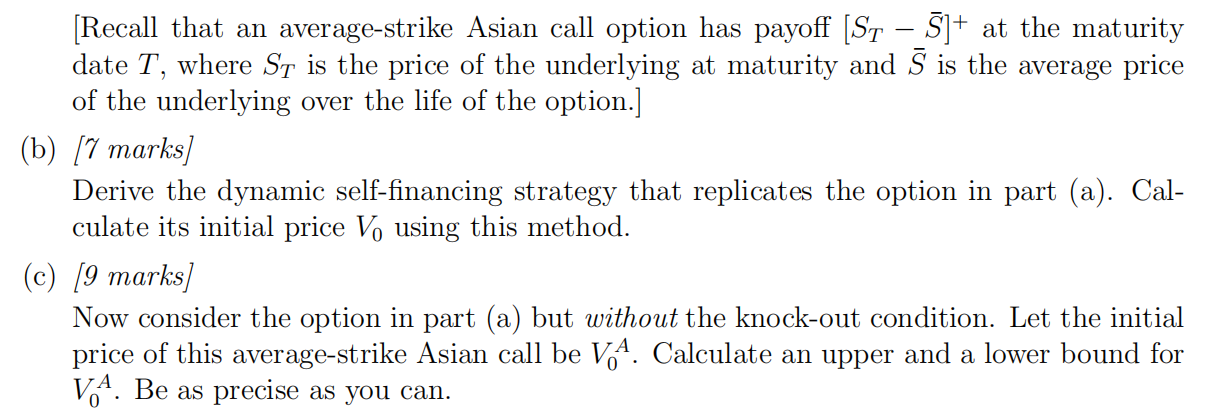

Consider a down-and-out average-strike Asian call option on the stock expiring in 6 months, with barrier £17. Draw a tree showing the evolution of the stock price and the payoffff of the option at the terminal nodes. Let V0 be the initial price of the option. Determine V0 without calculating a replicating strategy (you will be asked to do that in the next part).

2. 衍生品考试代写

Consider a portfolio that is long a cash-or-nothing call option with strike price K1 and short a cash-or-nothing call option with strike price K2 (K2 > K1). Both calls have the same cash payoff X and the same maturity T. The price of the underlying follows a geometric Brownian motion and the riskfree interest rate is constant. Leave your answers in terms of the standard normal cdf Φ.

(a) [5 marks]

Graph the date T payoffff of the portfolio as a function of the price of the underlying.

(b) [12 marks]

Derive the value of the portfolio at time t < T (show all your calculations).

(c) [8 marks]

How can you approximate the payoffff of the portfolio using standard European calls? Be precise.

3. 衍生品考试代写

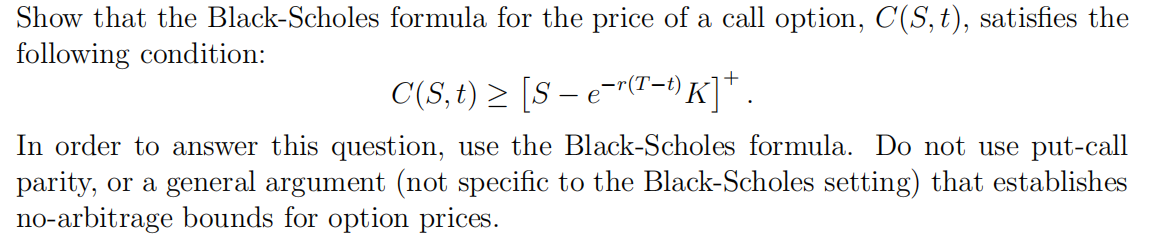

(a) [9 marks]

(b) [10 marks]

Suppose the instantaneous riskfree interest rate follows a stochastic process. Consider a European call and put on a non-dividend paying underlying with the same maturity date T and strike price K. For t ≤ T, let Ct and Pt be the timetprices of these options, F(t, T) the time t forward price for delivery atT, and B(t, T) the timet price of a zero-coupon bond with face value 1 maturing at T. Derive a no-arbitrage relationship between

i. Ct , Pt , St and B(t, T);

ii. Ct , Pt , F(t, T) and B(t, T).

(c) [6 marks]

Suppose a futures price f follows a binomial process: ft+1 takes two possible values, uft or dft , where 0 < d < 1 < u. There is also a money market account with interest rate rt from t to t + 1. Calculate the risk-neutral probability of an up move.

4. 衍生品考试代写

(a) [6 marks]

Suppose the 1-year and 2-year riskfree rates are currently 2.5% and 2.37%, respectively. In one year’s time, the 1-year riskfree rate will be either 1.5% (with probability 3/4) or 3% (with probability 1/4). Rates are expressed as annual rates with annual compounding.

Calculate the current price of a call option on a 2-year zero-coupon bond with face value £100, strike price £97, and expiration in one year. Do your calculations to at least three decimal places.

(b) You have bought a swaption giving you the right to pay a fifixed swap rate sK = 2% over a 2-year period (rates are expressed as annual rates with semi-annual compounding). The swaption expires today. The notional of the underlying swap is £1m and the swap has four payment dates – one payment every six months starting in six months. The prices of zero-coupon bonds with face value £100 and maturities 6, 12, 18 and 24 months are respectively £98, £96, £94 and £92. 衍生品考试代写

i. [5 marks] What is the fair swap rate today on a two-year swap with semi-annual payments?

ii. [5 marks] What is the value of the swaption today?

(c) Consider a swap, a cap and a flfloor with the same characteristics (i.e. the same flfloating interest rate, strike (or fifixed) interest rate, notional, and payment dates). The fifixed interest rate is exogenously given; it is not necessarily equal to the fair swap rate.

i. [4 marks] Derive a no-arbitrage relationship between the values of these three fifinancial instruments.

ii. [1 mark] Comment on the case where the fifixed interest rate is equal to the fair swap rate.

iii. [4 marks] How do the relative values of the swap, cap and flfloor change if the yield curve shifts upwards?

更多代写:网站代写 网络代考 英国Sociology psychology essay代写 台湾essay代写 申请简历代写 奖学金申请代写