SUMMER TERM 2021

24-HOUR ONLINE EXAMINATION

行为经济学代考 Interpret the parameters of the demand function. What predictions does the neoclassical full- optimisation modelmake?

ECON0040: BEHAVIOURAL ECONOMICS

All work must be submitted anonymously. Please ensure that you add your candidate number and the module code to the template answer sheet provided. Note that the candidate number is a combination of four letters plus a number, e.g. ABCD9. You can find your candidate number in your PORTICO account, under “My Studies” then the “Examinations” container. Please, note that the candidate number is NOT the same as your student number (8 digits), which is printed on your UCL ID card. Submitting with your student number will delay marking and when your results might be available.

Page limit: 10 pages

Your answers, excluding the cover sheet, should not exceed this page limit. Please note that a page is one side of an A4 sheet with a minimum margin of 2 cm from the top, bottom, left and right borders of the page. The submission can be handwritten or typed, but the font size should be no smaller than the equivalent to an 11pt font size. This page limit is generous to accommodate students with large handwriting. We expect most of the submissions to be significantly shorter than the set page limit. If you exceed the maximum number of pages, the mark will be reduced by 10 percentage points, but the penalised mark will not be reduced below the pass mark: marks already at or below the pass mark will not be reduced. 行为经济学代考

The estimated amount of time it should take to complete this examination is 2 hours. Answer ALL questions from Part A and Answer ONE question from Part B.

All questions carry equal weight. Please keep your answers for both parts precise and concise.

In cases where a student answers more questions than requested by the examination rubric, the policy of the Economics Department is that the student’s first set of answers up to the required number will be the ones that count (not the best answers). All remaining answers will be ignored.

Allow enough time to submit your work. Waiting until the deadline for submission risks facing technical problems when submitting your work, due to limited network or systems capacity. 行为经济学代考

By submitting this assessment, I pledge my honour that I have not violated UCL’s Assessment Regulations which are detailed in https://www.ucl.ac.uk/academic-manual/chapters/chapter-6-student-casework- framework/section-9-student-academic-misconduct-procedure, which include (but are not limited to) plagiarism, self-plagiarism, unauthorised collaboration between students, sharing my assessment with another student or third party, access another student’s assessment, falsification, contract cheating, and falsification of extenuating circumstances

PART A 行为经济学代考

Answer ALL questions from this section.

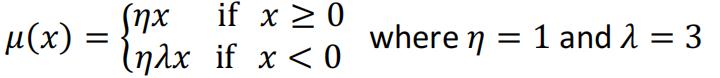

A1 Izzy and Jack both have Kozsegi-Rabin preferences with m(c) = (c), and their gain-loss utility function is given by:

Izzy is considering to play Lottery 1, where ![]() ; and Jack is considering to play Lottery2, where

; and Jack is considering to play Lottery2, where ![]()

(a)Suppose they both played their associated lotteries and each won £10. Who is happier, Izzy or Jack? Show and explain the intuition behind your answer. 行为经济学代考

(b)Is it a personal equilibrium for Izzy to expect to play lottery ℒ!and then to play it?

(c)Is it a personal equilibrium for Izzy to expect NOT to play the lottery ℒ!and then NOT play it?

(d)Whatis Izzy’s preferred personal equilibrium? What features of the model led to this outcome? What do personal equilibrium and preferred personal equilibrium concepts refer to intuitively?

A2

There is an agent that lives for three periods t ∈ {0, 1,2}, and has an initial wealth of w0. At the end of each period, she may divide savings between putting in a liquid savings account (xt) with interestrate r, or an illiquid savings account (zt) with zero interest. In the last period, the agent consumesall the wealth that she has available. The agent cannot borrow against its illiquid savings zt, hencect ≤ (1 + r)xt. Moreover, she is perfectly patient but a sophisticated quasi-hyperbolic discounter,i.e. she has beta-delta preferences with δ = 1, β < 1. Finally her instantaneous utility function takes the form u(c) = ln(c).

(a)Write down and solve this sophisticated agent’s optimisation problem by deriving how much this agent would consume and save in each period without a commitment mechanism. 行为经济学代考

(b)Nowimagine a commitment mechanism was available to this agent, explain if this agent would be willing to take up the commitment device. If yes, propose a mechanism that could work in this set-up.

(c)What are the main features of the Save More Tomorrow Programme by Thaler and Benartzi (2004)? Explain the principles of behavioural economics this programme uses to increase savingsrates and discuss how these features relate to sophistication and naivete of agents.

PART B 行为经济学代考

Answer ONE question from this section.

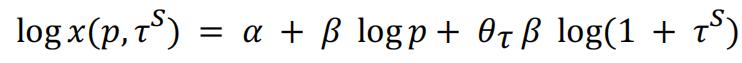

B1 Consider consumer behaviour in an economy with two goods, x and y. Normalize the price of y to one and let p denote the pre-tax price of x. Assume that y is untaxed and x is subject to a proportional sales tax τs

, which is not included in the posted price. The total price of x is q = (1 +

τs)p. Assume that the demand function takes the following form:

(a)Interpret the parameters of the demand function. What predictions does the neoclassical full- optimisation modelmake? 行为经济学代考

(b)Describethe field experiment that Chetty et (2009) conducted at a grocery store. Explain the empirical strategy they use to estimate θτ. [Hint: Derive an expression for (1 −θτ) and give an interpretation of this expression.]DDCS

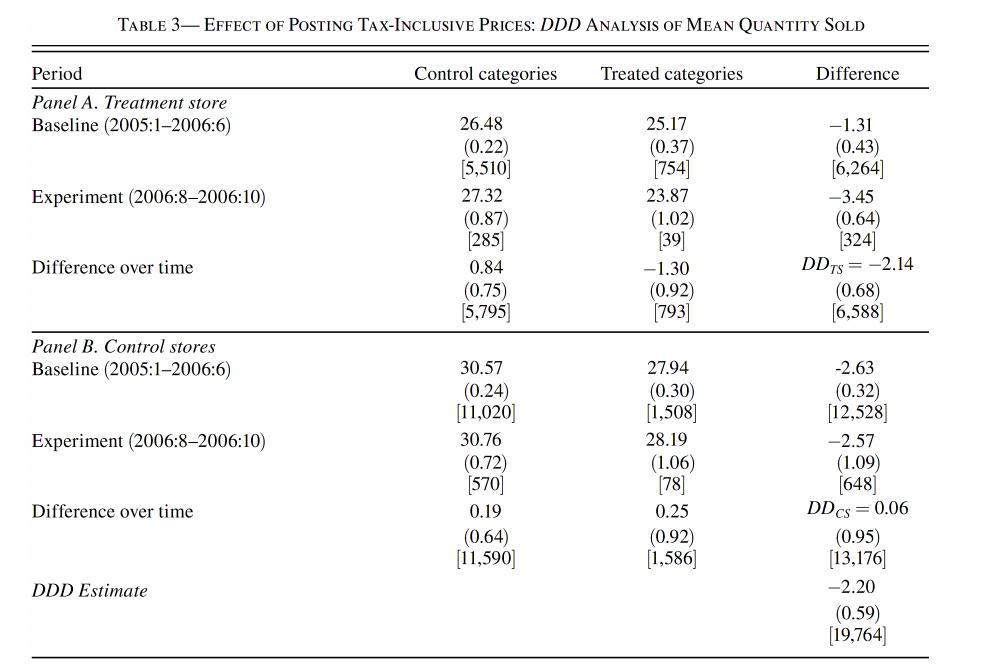

(c)Summarizethe findings in Table 3 of the Chetty et (2009) paper. Interpret the coefficients DDTS ,DDCS andDDD.

What is the most important result of the experiment? What is the identification assumption for consistency of the DDD estimator?

(d)What is the alternative empirical approach used by Chetty et al. to demonstrate theeffect?

(e)Could the underlying mechanism be used by market actors to ‘exploit’ customers? What are potential policy implications of Chetty et al.’s result?

B2 “Fairness as a constraint on profit seeking: Entitlements in the market.” Kahneman, Knetsch, and Thaler (1986) elicited community standards of fairness for the setting of prices and wages by telephone surveys. 行为经济学代考

(a)They state that: “The main findings of this research can be summarized by a principle of dual entitlement,which governs community standards of fairness…”. What does the concept of “dual entitlement” refer to in their context? How does it relate to the concept of “reference transaction” in the article?

(b)Accordingto their findings, what is the fairness perception of survey respondents towards firms protecting profits vs. increasing profits? Explain and provide examples.

(c)What are the four main economic implications the authors propose as a result of their findings from their surveys? Explain and give an example for each of these four propositions. Are all these four implications still empirically observable considering the impact of the current technological innovations onmarkets? 行为经济学代考

(d)Are the community fairness standards described in this paper affected by outcomes or intentionsof individuals and/or firms? Discuss, provide examples and cite relevant literature.

B3 Adam and Barbara, each with initial wealth of £100 just found a lottery ticket while walking down the street. The lottery ticket allows them to participate in a lottery in which they could win £300, with a probability of 20%.

(a)Adam is an expected utility maximiser over wealth and his utility functionis: 行为经济学代考

u(x) =x0.5

For what price would Adam be willing to sell this lottery ticket?

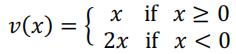

(b)Barbara maximises the value of a gamble given by prospect theory. Her reference point is the status quo (Hint: She unexpectedly found the ticket). Assume that π(p) = p and that the value function is linear in gains andlosses:

For what price would Barbara be willing to sell this lottery ticket?

(c)Charlie also lives in the same neighbourhood as Adam and Barbara. The day before Adam and Barbara found the lottery ticket, Charlie was walking down the same street and dropped his lottery ticket. Charlie also has an initial wealth of £100 in addition to the lottery ticket he used to own. Assuming Charlie has the same preference structure as Barbara, how much would Charlie be willing to pay to get his lottery ticketback? 行为经济学代考

(d)Marzilli Ericson and Fuster (2011) design two experiments in which they manipulate expectations separately from endowments. Explain the differences between the two experimentsthat the authors have What are the particular reasons for the authors to vary them? Please also state and explain their main findings and elaborate on how they relate to specific design elements in their experiments.