Name

Tutor

Course

Date

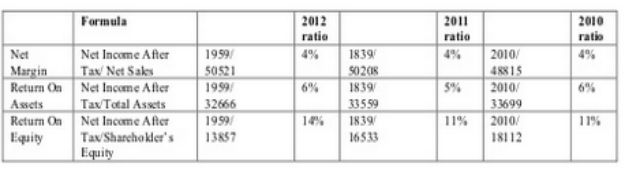

英国金融essay代写 Based on the above calculations, ROA has increased with the increase in Net assets and margin from the acquisition in years 2011 and 2012.

Question 1

Home Depot

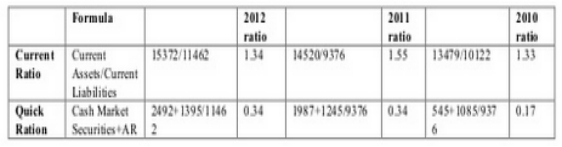

Liquidity Ratios

Quick Ratio and Current Ratio 英国金融essay代写

The current ratio of home depot has been constant for a long time at 1.3 except for 2011 and 2009. It went down to 1.2 in 2009 due to the world economic downturn or crisis. In the same year, the company increased its liabilities hence the decrease of the ratio. As for 2011, the repayment of long-term debts caused the anomaly; current portion of capital lease and long-term debt went down to 31m, but their debt went up to $12B. This was caused by the consistent of long-term financing. This is seconded by the fact that the total cash in the 2001 decreased to $500 from $1.3 n in 2010. This attributes to the quick ratio of 2010 to be different from that of 2012 and 2011. It can be evaluated based on the above two ratios that Home Depot has performed better than the average of the ratio at 1.5. A quick glance of their ratio offers more evidence on their performance efficiency even though the company was on a major financial crisis.

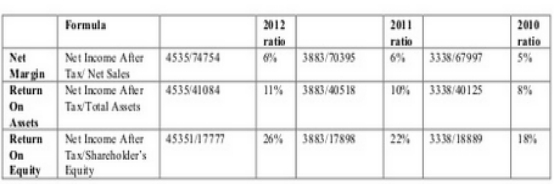

Profitability Ratio 英国金融essay代写

All the sale related information or data indicates that Home Depot has improved its performance in the last years. 英国金融essay代写

Return on Assets

Based on the above calculations, ROA has increased with the increase in Net assets and margin from the acquisition in years 2011 and 2012. As compared to 2010 ratio, the ratio indicates that the Home Depot used its assets in generating more profits. Home depot evaluation on long term is done at the lowest identifiable cash flows at individual stores. The ratio not only indicates that the company is performing well, but also explaining how profitable it has been in the past five year.

Return on Equity

The company has an outstanding trend on ROE based on the above calculation with also an increase consistent Net Income rates from 2010 to 2012. It has a steady 5% on ROE year after year for three years. This ratio indicates that the company not only performed well, but also managed its shareholders investment in developing wealth and generating profits.

Lowe’s Company 英国金融essay代写

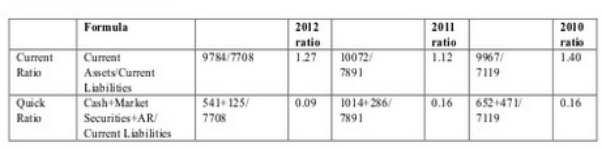

Liquidity Ratios

Lowe’s company is facing a fall in net sale; hence, they are trying to inflate their earnings per share by purchasing back large amounts of stock. This has affected both the quick ratio and the current ratio. The company used most of the cash they had from reserves and operation to buy stocks. As compared to Home depot, Lowe liquidity ratios are below the company’s average of 1.5 as of the retail sector. In addition, the total assets have reduced from 2011 to 2012 with reducing quick and current ratios. Moreover, marketable and cash have also reduced from 2011 to 2012. Far from indicating that the company has poor performance compared to Home depot, it has to improve housing market, though struggling. 英国金融essay代写

Profitability Ratios

For 2012, Lowe’s Net income has improved, and the net margin is constant at only 6%. The company has no growth despite having an increased net margin. The ROE is between 4% to 6%, which is less as compared to other competitors such as Home Depot. ROE performed well-compared to an industry average for the last two years (2011 and 2012).