Case Western Reserve University Weatherhead School of Management

经验金融作业代写 Please check the document “MSFI 435 Individual Assignment Allocation.pdf” on Canvas to verify whether this is the version you should be working on.

MSFI 435 – Empirical Finance Fall 2020

Individual Assignment (Version C)

(Please check the document “MSFI 435 Individual Assignment Allocation.pdf” on Canvas to verify whether this is the version you should be working on. Only students allocated to Version C should be working on this version of the assignment.)

Due 11h59PM, December 11, 2020 经验金融作业代写

(Important: This assignment is to be implemented on an individual basis. No sharing of material—including data, results, inferences and write-ups—may take place among members of a group nor across different groups.)

(About the significance level: For all the tests of significance in this assignment, please assume a 5% significance level.)

Examining Mergers 经验金融作业代写

Mergers are a big deal in Finance—and to the economy as whole. To give you a sense, merger deals in 2019 in the United States involved $1.6 trillion.

A merger involves two companies: an acquiror and a target—in that the acquiror company acquires the target company. Here we do not need to make a distinction between merger and acquisition—as this distinction is always fuzzy anyway. The data we have will always identify a party as the acquiror and the other as the target—even when someone may identify the transaction as a merger of equals.经验金融作业代写

The dataset “d_merger_1990_2007.sas7bdat”, available on Canvas, contains data on our sample of mergers. The sample includes randomly chosen merger announcements in US from 1990 to 2007. Each row of the dataset identifies a different merger announcement.

The variables of this dataset are:

- DEALNO:a unique identifier of the merger, defined by SDC, the database provider for the merger data;

- ACQUIROR_NAME: the name for the acquiror in themerger;

- ACQUIROR_PERMNO: the CRSP identifier for the acquiror in themerger;

- TARGET_NAME: the name for the target in themerger;

- TARGET_PERMNO: the CRSP identifier for the target in themerger;

- INITIAL_OFFER: the initial offer price for each stock of the target; indollars;

- ANN_DATE: the date the merger was announced;and

- COMPLETION: a dummy equal to one if the merger is completed, and zero if the merger attempt failed.

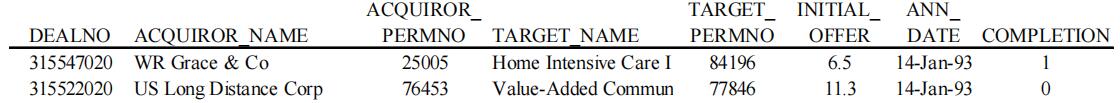

Figure 1 shows some observations in our sample of mergers.

The first row refers to a merger attempt announced on January 14th, 1993. WR Grace & Co attempted to acquire Home Intensive Care Inc, offering $6.5 for each of its shares. This merger eventually went through (as indicated by COMPLETION=1). The second row shows an attempt by US Long Distance Corp to acquire Value-Added Communications, at an offer price of $11.3 per share, but in this case the merger offer was later revoked (COMPLETION=0).

Figure 1: A few data points on the merger data

There are three relevant questions that you will examine with respect to mergers:

I.Do mergers have valuation implications? If so, markets should react to the firm’s decision to acquire another firm. If mergers convey good news about the firm, say for the acquiror, market reactions should be positive.经验金融作业代写

II.What are the determinants of market reactions to merger news? You examine in a regression framework what are the determinants of the market reactions to merger announcements (as measured by the reaction to the target’sstock).

III.Whatdetermines whether a merger goes through? When mergers are announced, it does not mean that the merger will go through. You examine the determinants of the likelihood that a merger indeed comes to completion.

Part I: Valuation Implications 经验金融作业代写

There are many reasons companies get involved in mergers (that is, why companies acquire other companies). A more controversial question is whether mergers create value—in the sense that the involved parties are better off together, rather than staying independent. It happens that testing whether a merger creates value is very difficult. When two companies merge, one can see the post-merger outcome, but we cannot see the counterfactual—what would have happened to each involved party if the merger had not happened.

An alternative is to look at what the market (and its investors) think about mergers.

One can examine market reactions to the news of an incoming merger. A merger announcement involves two companies: an acquiror and a target—in that the acquiror company announces the intention to acquire the target company. If the acquiror’s stock go up with the news, it means markets think the merger will create value, and the markets are anticipating this value creation; on the other hand, if market reactions to the acquiror’s stock are negative, markets think the merger will destroy value.

You will also examine market reactions to the target’s stock, but here market reactions cannot be directly linked to whether the merger is supposed to create value. This is because when a merger is announced, it usually means the acquiror announces the intention to buy the target’s stock at a value above the current trading value (otherwise, nobody would sell shares to the acquiror). Thus, a positive reaction to the target’s stock may simply mean the investors are anticipating the target’s stock going up when the merger concludes.经验金融作业代写

In this part of the project, you will examine how markets react to announcements of mergers.

You will address this question through event studies—employing the techniquecovered in module 4. Since you have two firms involved in each merger, you will examinetwo event studies, one based on the sample of acquirors and another on the sample of targets. For each such sample, you examine the pattern of abnormal and cumulative abnormal returns over the 21-day window (relative days –10 through +10) around the merger announcement day (variable ANN_DATE).

For the definition of abnormal return, use the constant-mean return model—that is, defineabnormal return as the stock raw return (the variable RET in the CRSP dataset DSF, located in “/wrds/crsp/sasdata/a_stock”) minus the average return of the firm’s stock. For an announcement involving firm i at time t, define average return as the average of the variable RET for firm i over the window [t – 365, t – 21]—that is, from 365 calendar days before the announcement date up to 21 calendar days before the announcement date. Important: notice that the abnormal return here is different from the abnormal return used in module

4.Inmodule 4 we employed the market-adjusted return as proxy for abnormal

Thus, the event study for the sample of acquirors is based on the variables DEALNO (the merger identifier), ACQUIROR_PERMNO (the identifier of the firm for which you will collect abnormal returns) and ANN_DATE (the announcement date). For the event study based on the sample of targets, you compute abnormal returns for the firms identified by TARGET_PERMNO.

With the event studies’ outputs you can formally examine how markets react to merger announcements. Anchor your inferences on formal hypotheses testing. Also, examinewhether markets respond efficiently to news in merger initiations (for this you can assume that some announcements happen after the close of the market—that is, market reactions to such announcements could happen up to one day after the event date).

Part II: Determinants of Market Reactions

Market reactions to merger announcements can be enormous, particularly with respect to the target’s stock. You now examine in a regression framework what are the determinants of the market reactions to merger announcements, as measured by the reaction to the target’s stock. (From this point onwards, we ignore the reactions to acquiror’s stock.)经验金融作业代写

One motivation is that a event study does not allows us to examine what really is driving the reactions to mergers. When looking at the merger’s offer price (the variableINITIAL_OFFER) on the target’s stock, one could argue that the higher the offer price, thehigher the reaction. The event study does not address this question because it pools together all mergers, disregarding the information about the mergers’ characteristics.

For that, one needs a regression framework that relates the market reaction with the information in the initial offer price. The left-hand side variable (named CAR) is defined as the cumulative abnormal return from relative day 0 (the announcement day) to relative day +1 (the day after the announcement). This variable can be obtained from the data used to analyze the event study in part I.

(You can start part II even without concluding part I.

The dataset “d_merger_car.sas7bdat”, available on Canvas, contains a measure of the CAR variable generated by the instructor. Each row of this dataset has the variables DEALNO and CAR, so that you can combine this dataset with the mergers dataset in order to obtain the CAR measure for each merger.经验金融作业代写

The CAR measure in “d_merger_car.sas7bdat” is not exactly the measure you may obtain from your event study, and thus should not be used to evaluate whether you event study is correct. However, the CAR measure in this dataset is close enough to the true measure and can be employed as a starting point for your analysis in part II.

If you do not conclude part I, you can still rely on the supplied measure of CAR to finish part II; otherwise, you should in your final version of part II employ the CAR measure extracted from your own event study.)

The right-hand side variable is the premium implied by the merger’s initial offer price, defined as

PREMIUM=(INITIAL_OFFER – PRC_DAY_BEFORE)/PRC_DAY_BEFOREwhere PRC_DAY_BEFORE is the target’s stock price in the day preceding the merger announcement. The dataset “d_merger_prc.sasb7dat” contains the PRC_DAY_BEFORE measure for each merger.经验金融作业代写

For example, if the target’s stock price is $40 before the merger announcement, and the initial offer price is $50, then PREMIUM=(50 – 40)/40=0.25, or a 25% premium over the stock price right before the announcement.

The idea is thus to run a regression as

CARi= b0 + b1PREMIUM i + e i

With the results of the regression (please show them), you can analyze whether PREMIUM and CAR are related, and, if so, what is the magnitude of the effect of the merger’s target premium on the market reaction to the target’s stock price.

However, the problem with inferences from the simple regression model above is that we may need to control for other potential determinants of market reactions. For example, perhaps the premium is related to the size of the target—let’s say, if smaller targets attract higher premia. If smaller firms have lower returns, then this size effect might be biasing our results. Under these conditions, not controlling for the size of the target may bring concerns regarding the omitted variable bias.经验金融作业代写

Similar stories can be raised regarding past performance of the firms involved in the merger.

If the acquiror has had a good run in the terms of past performance, it can offer higher premia (since the offer can be paid via stock of the acquiror, which becomes more valuable if the firm has performed well recently). To the extent that recent performance is a measure of return, it might also relate to reactions, and therefore recent performance may be another omitted variable. A case can also be made that the size of the acquiror matters, as well as the past performance of the target (can you think of reasons for that?).

Therefore, let’s include the following control variables in our regression model:

- SIZE_ACQUIROR: the natural logarithm of the market value of equity of the acquiror, measured at the end of the year prior to the merger. That is, if themerger occurs in 1995, use market value from December Market value of equity can be defined as MVE=PRCC_F*CSHO, where both PRCC_F (stock price) and CSHO (shares outstanding) are variables available in the Compustat dataset FUNDA, located at “/wrds/comp/sasdata/nam”). We use the log formulation so

that our analysis refers to rates of change in size being associated with market reactions;

- SIZE_TARGET:same as above, just this time related to market value of the target;

- PERF_ACQUIROR: the proxy for firm past performance, call it AVGRET, is defined as the average daily stock return for the acquiror’s stock in the period ANN_DATE – 365 and ANN_DATE – 5. Stock return is the variable RET, available in the CRSP dataset “dsf.sas7bdat” (located in “/wrds/crsp/sasdata/a_stock”).

- PERF_TARGET: same as above, just this time related to past performance of the target.

(Important: When collecting data from the FUNDA dataset, you first need to map the TARGET_PERMNO into a GVKEY, a procedure described in section 7.6 of the notes. However, in this case you will need a new mapping file. In section 7.6, and the other assignments, you relied on the “mapping_permno_gvkey.sas7bdat” dataset, but here you will use a slightly different mapping file: the file is available on Canvas and it is called “mapping_permno_gvkey_updated.sas7bdat”.经验金融作业代写

The reason you need a new dataset is that many times a target firm “dies” at the year of the merger (if the acquisition is successful, the company with that TARGET_PERMNO ceases to exist), so there is no mapping between that TARGET_PERMNO and a GVKEY for the year of the merger. The updated mapping extends the mapping between PERMNO and GVKEY for one extra year. For example, if a merger with TARGET_PERMNO=10000 is announced in 1995, and that firm ceases to exist in 1995,

the mapping between

| TARGET_PERMNO=10000 and | a | GVKEY ends in | 1994 | for | the |

| “mapping_permno_gvkey.sas7bdat”, | but continues into | 1995 | for | the |

“mapping_permno_gvkey_updated.sas7bdat”. Therefore, if you base your search on the “mapping_permno_gvkey_updated.sas7bdat”, you can use the code in section 7.6 with the restriction

- ARGET_PERMNO=B.PERMNO ANDBEGIN_YEAR<=A.YEAR<=B.END_YEAR,

where A.YEAR refers to the year of the merger announcement.)经验金融作业代写

Given that all these variables are new, it is a good idea to create a summary statistics of the variables involved in this study. You can also create a correlation table involving them. Having the summary statistics and the correlation table, discuss whether the concerns about the omitted variable bias are warranted.

To avoid the perils of the omitted variable bias, the idea is to run a multiple regression model, as in

CARi = b 0 + b1PREMIUM i + b 2SIZE _ ACQUIRORi + b3SIZE _ TARGETi + …

… + b 4 PERF _ ACQUIRORi + b5PERF _ TARGETi + e i

One can learn a lot from the regression results. In particular, you should address the following items:

- For each of the control variables in the regression, discuss whether it is related to marketreactions to the target’s If so, please discuss the magnitude of the

effect. In particular, are higher premia still related to higher market reactions? How so?

- Discussthe R2 of the What does the R2 represent here? (You should present the adjusted-R2.)

- Discuss whether the residuals in the model in Figure 2 are homoscedastic or not. That is, implement the White test and conclude whether you should worry about heteroscedasticity.

- Use the model to compute the predicted CAR for the merger attempt with DEALNO=248669020(Raymond James’ attempt to acquire Stifel Financial). First, write down the 95% confidence interval for the CAR of an individual merger attempt exactly like the merger attempt by Raymond James (individual prediction), then compute the 95% confidence interval for the mean CAR across all merger attempts that look like the one by Raymond James’ 经验金融作业代写

Finally, examine a possible nonlinearity in the multiple regression model above, in that the effect of PREMIUM increases as SIZE_ACQUIROR increases. That is, add the variable SIZE_ACQUIROR_PREMIUM=SIZE_ACQUIROR*PREMIUM in the model, rerun the regression, and discuss the inferences you learn from SIZE_ACQUIROR_PREMIUM.

Part III: Determinants of Successful Merger Completion 经验金融作业代写

Your last step is to understand what predicts the successful completion of a merger. It happens that many merger attempts do not go through, either because the government blocks the completion (say to avoid too much concentration in the industry) or because the target firm says no to the acquirer. Right now, for example, AT&T (the acquirer) is still in discussion with Time Warner (the target) and with government officials on whether its attempted purchase—call it a merger or acquisition if you like—of Time Warner can go through.

Knowing whether a merger goes through can be very profitable.

Take our previous example of a target whose stock was priced at $40 before the merger. If the target stock price is priced at $45 after the merger announcement and the offer price is $50, merger completion implies the stock will jump to $50, while a merger not completing implies the stock will go back to $40. So, knowing (or being reasonably confident) about whether the merger will complete or not gives you a clear trading strategy: buy the stock if you know the merger will complete, sell if you know it will not complete. In fact, there are hedge funds that are experts in trying to predict whether a merger will complete—and they really trade based on that prediction!经验金融作业代写

Let’s start a simple prediction model to mimic what the hedge funds are doing. Our analysis thus involves understanding what may predict completion of a merger.

We assume this prediction is done at day after the merger announcement, so we can rely on any information available at that time. Find below the proposed explanatory variables. Five of them were part of your examination in part II,

and two other variables are new:

- GAP:the percentage difference between the initial offer and the target’s stock price

after the announcement. It is defined as

GAP=(INITIAL_OFFER – PRC_DAY_AFTER)/PRC_DAY_AFTER

If the market thinks that the merger will go through, it will bid up the price of the target closer to the initial offer. Therefore, the smaller the gap, the higher the likelihood that the merger will successfully complete. The variable PRC_DAY_AFTER is available to you in the dataset “d_merger_prc.sasb7dat”;

- SIZE_ACQUIROR (the same explanatory variable collected for part II): a bigger acquiror may be more powerful in enticing the target to accept the merger offer,or in arguing with the government that the merger should go through;

- SIZE_TARGET (the same explanatory variable collected for part II): the smaller the target, the smaller the power it has to reject anoffer;

- PERF_ACQUIROR (the same explanatory variable collected for part II): recent performanceof the acquiror turns its stock more valuable and thus the acquiror has more currency to pay for the deal;经验金融作业代写

- PERF_TARGET (the same explanatory variable collected for part II): recent performance of the acquiror turns its stock more expensive and less attractive fora merger

- WAVE:perhaps the fraction of recent mergers that successfully completed indicate a market that is more receptive of mergers—say, because the government becomes more lenient in allowing companies to merge. For each merger, announced at ANN_DATE, one defines the variable WAVE as the proportion of mergers that were “successful” (that is, with COMPLETION=1) amongst the ones announced in the 180 calendar days between ANN_DATE – 210 and ANN_DATE – That is, you first collect the mergers announced between ANN_DATE – 210 and ANN_DATE – 30, then take the average of the COMPLETION variable.

Given that you need past data to compute WAVE, after you define the control variables,

restrict your sample to start in 1991. (Think this way: the very first merger announcement in the sample, sometime in 1990, will have the variable WAVE undefined, but just because you do not have data on mergers prior to your first observation.)

Prepare a summary statistics table of the explanatory variables for the sample with COMPLETION=1 vs. the sample with COMPLETION=0. Then run the logistic regression explaining whether a merger successful completes,

Pr{Completion = 1) = f(b0 + b1GAPi + b2SIZE _ ACQUIRORi + …

… + b3SIZE _ TARGET + b4PERF _ ACQUIRORi + b5PERF _ TARGETi + b6WAVEi )

Report the regression results. Discuss the significance of each coefficient, and interpret the effect of each variable on the likelihood that the merger completes.经验金融作业代写

The effect can be based on the change in the odds that the merger completes. You can play with some specific changes; for example, when examining the effect of changes in GAP, you may examine the effect of having the GAP increase by 0.1—say from 0.1 to 0.2.

Appendix: Some comments and suggestions:

- Most if not all of the data analyses here are replications of data analyses implemented in other assignmentsthroughout the For example, a very good starting point for the event studies in part I come from the event studies we implemented either in module 4 or in assignment 4. Also, any single control variable described here is some variation of control variables that we used throughout the course.

- The same rules on how to generate write-ups for all assignments in the course apply here. In particular, the write-up should not mention SAS or codes, and an appendix should beincluded with all the codes used in the generation of your An assignment without a code, or any result that is not supported by a code will not be graded.经验金融作业代写

- The assignment does not demand any output specifically, but it is expected that you produce and show many outputs. For example, if you are going to discuss the results of a regression model, you should generate the output for that regression model. If any result is required for yourdiscussion, you should include it in your write-up. SAS output should be avoided; instead your outputs should be formatted to include only information relevant to the

4.Be as precise as you can in your discussion.

For example, when examining a relationship betweenY and X in a regression framework, make sure you state the hypothesis being tested in an unambiguous way (e.g., are you testing the regression coefficient based on an one-tailed or two-tailed alternative hypothesis?); then if you need a number to anchor your conclusion (the t statistic), refer to the specific number of your analysis. Then, if needed, examine the magnitude of the effect of X on Y, making sure that you properly describe the units of measurement of the variables involved in the

4.The individual assignment deliberately avoids having numbered questions. This way, your write-up is not an attempt to answer questions 1, 2, 3, etc, but to discuss the theme of mergers in a thorough way. Assume that the reader does not have access to this document, so that your write-up should be self-contained in explaining the motivation for the analyses, the methodologies adopted, the results, and the inferences. An example of such a self-contained write-upappears on Canvas, under “Modules”/”Supplementary Material”/”Example of Output for Individual Assignment”.经验金融作业代写

5.You do not need to be constrained by the control variables (and models) suggested in the assignment. These control variables are a minimum set of variables necessary for the project. If you deem another variable X relevant to, say, explain market reactions to announcementsof inclusion in the index (part II), you are free to expand the model and include your new

6.Partial grade is available. If you have problems generating a control variable for your model,

ignore it and go ahead with the model without that control variable. Partial grading is not available, though, for a code that does not run. Hence, a strong suggestion is for you to build your model incrementally. For example, in part II, run the initial regression model with only two explanatory variables. If it works, save your code (under a name, say, p1), then try to includeone more control If the inclusion is successful, then save the new code (call it p2). Repeat the process with each extra control variable. If you get to a point where the inclusion of an extra variable is unsuccessful, then return the previous version of the code. It is much better to have a partial model that runs than a complete model that does not run.经验金融作业代写

7.Whenrunning the event studies in part I, notice that the proper identifier of the event is not the pair of firm identifier and event date. For example, for the event study analyzing targets, one could think that a good event identifier would be the pair (TARGET_PERMNO, ANN_DATE), but that is incorrect. It happens that the same firm (that is, the same value for TARGET_PERMNO) may appear in the dataset multiple times—because a firm can be the target of many merger attempts. The right identifier should be the pair (DEALNO, ANN_DATE).

8.Mapping between PERMNO and GVKEY should be based on a special dataset,

supplied on Canvas and named“mapping_permno_gvkey_updated.sas7bdat”.

9.To summarize, there are four datasets that are supplied to you (all available on Canvas): the basicdata on merger announcements (“d_merger_1990_2007.sas7bdat”); the data on the CARmeasure for you to practice part II without finishing part I (“d_merger_car.sas7bdat”); the data on prices (“d_merger_prc.sas7bdat”); and the updated data on the mapping between permno and gvkey (“mapping_permno_gvkey_updated.sas7bdat”).

其他代写:web代写 program代写 cs作业代写 app代写 Programming代写 homework代写 source code代写 考试助攻 finance代写 代写CS C++代写 java代写 r代写 finance代写 加拿大代写 java代写