Quantitative Easing can help to Reflate our Economies

经济论文代写 As noted in the above cases, the banking system and the credit channel in an economy need to be stable for this policy to work.

Abstract 经济论文代写

Quantitative easing (QE) or Asset Purchasing Facility (APF) is a tactic used by central bank to support national economy when conventional monetary measures are ineffective. When this policy is effective, it helps to fuel spending and to raise prices of commodities. In other words, it can be a useful tool in raising inflation in an economy. Therefore, this paper suggests that QE can be a useful tool in raising inflation in our economies and explains how that can be achieved.

To enhance better understanding of the paper examines the impact of this policy on inflation in United States. And in United Kingdom during the recent financial crisis and economic recession. It also looks at how the policy was applied in Japan, explaining the reasons why the policy was ineffective in raising inflation rate. Generally, the cases of US and UK demonstrate that QE can help to raise inflation in our economies.

译文:

摘要

量化宽松 (QE) 或资产购买工具 (APF) 是中央银行在常规货币措施无效时用来支持国民经济的策略。 当这项政策有效时,它有助于刺激支出和提高商品价格。 换句话说,它可以成为提高经济体通胀的有用工具。 因此,本文认为量化宽松可以成为提高我们经济体通胀的有用工具,并解释了如何实现这一目标。

为了加深对本文的理解,本文考察了在最近的金融危机和经济衰退期间该政策对美国和英国通货膨胀的影响。 它还研究了该政策在日本的应用情况,解释了该政策未能有效提高通胀率的原因。 总的来说,美国和英国的案例表明,量化宽松有助于提高我们经济的通胀率。

Introduction

QE is an unconventional means of stimulating national economies employed by central banks when conventional monetary policies are no longer effective. It is an expansionary monetary policy in which the central bank injects money into national economy through purchasing of public and private financial assets (Blake & Kirsanova, 2011, p. 41). Central banks often achieve this through the use of open market operations and standing lending facilities.

In the past, central banks have primarily relied on monetary measures that seek to reduce interest rates during periods of recession so as to counter deflation or to raise inflation rates.

However, the recent financial crisis and economic recession has posed unusual challenges to central banks, making the use of conventional policy measures to be ineffective. In several cases, central banks have reduced their lending rates to levels close to zero without realising the intended objectives. This has made it necessary for monetary authorities to use QE to stimulate their national economies and to realise the inflationary objective (Blake & Kirsanova, 2011, p. 41). In most of the economies where this policy has been employed, the key inflationary objective has been to maintain the inflation rate at a particular set target. 经济论文代写

According to Hamouda (2009, p. 20) the QE policy was used in Japan in 2001 to counter the effects of a severe depression which had hit the country’s economy for a long time. Though this policy helped Japan to stop inflation from falling down further, various issues made the policy ineffective in raising inflation to the target. However, application of this policy during the recent economic crisis by various nations such as the UK. And the US has demonstrated that QE is not only a useful tool in preventing inflation from falling below the target; but it can also help to raise inflation to the target. This paper seeks to explain how QE can help to counter deflationary forces and to raise the inflation rate to the target. It examines its effectiveness in reflating our economies, drawing examples from cases of the US, the UK and Japan.

译文:

介绍 经济论文代写

当常规货币政策不再有效时,量化宽松是央行采用的一种刺激国民经济的非常规手段。这是一种扩张性货币政策,其中中央银行通过购买公共和私人金融资产向国民经济注入资金(Blake 和 Kirsanova,2011 年,第 41 页)。中央银行通常通过使用公开市场操作和常设贷款工具来实现这一目标。

过去,中央银行主要依靠货币措施在经济衰退期间降低利率,以应对通货紧缩或提高通货膨胀率。

然而,近期的金融危机和经济衰退给央行带来了不同寻常的挑战,使得常规政策措施的运用效果不佳。在一些情况下,中央银行在没有实现预期目标的情况下将贷款利率降低到接近于零的水平。这使得货币当局有必要使用量化宽松来刺激本国经济并实现通胀目标(Blake 和 Kirsanova,2011 年,第 41 页)。在采用该政策的大多数经济体中,主要的通胀目标是将通胀率维持在特定的设定目标。

根据 Hamouda (2009, p. 20) 的说法,日本于 2001 年使用量化宽松政策来应对长期打击该国经济的严重萧条的影响。尽管这一政策帮助日本阻止了通胀进一步下降,但各种问题使得该政策未能将通胀提高到目标。然而,近期英国、美国等各国在经济危机中的应用表明,量化宽松不仅是防止通胀低于目标的有用工具,而且是防止通胀低于目标的有效工具。但它也有助于将通胀提高到目标。本文旨在解释量化宽松如何帮助对抗通货紧缩力量并将通胀率提高到目标。它从美国、英国和日本的案例中汲取了例子,研究了它在重新调整我们的经济方面的有效性。

Using QE to control inflation

Central banks in most cases control inflation by use of use interest rates. They achieve this by pegging a specific lending rate on loans to financial institutions (Hamouda, 2009, p. 20). The central bank rate (also called bank rate) influences many other rates available to borrowers and savers in financial institutions. This affects the rate of spending by individuals and companies, which in turn affects the rate of inflation. Thus, when inflation rises or is expected to rise beyond the set target, Central banks raise their rates. This affects rates in financial institutions, leading to reduced spending and eventually, reduced inflation. On the other hand, if inflation falls or is expected to fall below the set target, central banks reduce bank rates, which helps to boost spending and to raise inflation. 经济论文代写

In some cases, inflation may become very low or it may fall to a point where it is very far below the target. In this case, central banks respond by reducing bank rates. But as the Bank of England (BoE) (2011, p. 10), points out, the interest rate may be reduced up to zero, without realising the objective of raising inflation. At this point, the central bank can achieve the reflationary objective by increasing the quantity of money circulating in the economy. This can be done through the QE process explained in the Keynesian monetary theory (Hamouda, 2009, p. 20). This model assumes that there is a direct relationship between spending. And the prices of various commodities in a national economy. As such, the model suggests that increased spending can lead to a higher inflation rate while reduced spending corresponds to a low rate of inflation (Hamouda, 2009, p. 20).

译文:

使用量化宽松控制通胀 经济论文代写

在大多数情况下,中央银行通过使用利率来控制通货膨胀。他们通过与金融机构贷款的特定贷款利率挂钩来实现这一目标(Hamouda,2009 年,第 20 页)。中央银行利率(也称为银行利率)会影响金融机构中借款人和储户可获得的许多其他利率。这会影响个人和公司的支出率,进而影响通货膨胀率。因此,当通胀上升或预计超过设定的目标时,中央银行就会提高利率。这会影响金融机构的利率,导致支出减少,最终降低通货膨胀。另一方面,如果通胀下降或预计低于设定的目标,央行会降低银行利率,这有助于刺激支出和提高通胀。

在某些情况下,通胀可能会变得非常低,或者可能下降到远低于目标的程度。在这种情况下,中央银行的反应是降低银行利率。但正如英格兰银行 (BoE) (2011, p. 10) 所指出的,利率可能会降至零,而不会实现提高通胀的目标。此时,央行可以通过增加经济中的货币流通量来实现通货紧缩目标。这可以通过凯恩斯主义货币理论(Hamouda,2009,第 20 页)中解释的量化宽松过程来完成。该模型假设支出与国民经济中各种商品的价格之间存在直接关系。因此,该模型表明,增加支出会导致更高的通胀率,而减少支出对应于低通胀率(Hamouda,2009,第 20 页)。

According to the Keynesian monetary theory, the central bank can employ a QE policy during a time of recession to raise inflation rates in a national economy.

This can be achieved by directly purchasing public and private financial assets, thereby helping to boost spending in a variety of ways. First, purchasing of financial assets means that the seller will have more money in liquid form (Hamouda, 2009, p. 20). This is most likely going to stimulate them to increase spending. Also, the sellers of these assets may purchase other assets such as company bonds and shares. In this case, the prices of these assets will increase, making the owners of these assets better off. This may stimulate them to spend more. Further, according to Joyce et al (2011a, p. 113), an increase in the prices of such assets leads to lower yields, thereby reducing the cost of borrowing for households and businesses. A low cost of borrowing means higher spending rates. 经济论文代写

Purchasing of financial assets from non-bank institutions increases financial reserves in banking institutions especially due to increased deposits. Increased reserves may stimulate banking institutions to increase lending to businesses and households. Again, increased borrowing leads to increased spending. However, according to BoE (2011, p. 10), it is not always true that purchasing financial assets from banks may boost spending. Banks may hold on lending especially in cases when they feel that their financial health is at risk, such as during periods of financial crises.

译文:

根据凯恩斯主义货币理论,中央银行可以在经济衰退期间采用量化宽松政策来提高国民经济的通货膨胀率。

这可以通过直接购买公共和私人金融资产来实现,从而有助于以多种方式增加支出。首先,购买金融资产意味着卖方将拥有更多的流动资金(Hamouda,2009,第 20 页)。这很可能会刺激他们增加支出。此外,这些资产的卖方可能会购买其他资产,例如公司债券和股票。在这种情况下,这些资产的价格会上涨,从而使这些资产的所有者变得更好。这可能会刺激他们花更多的钱。此外,根据 Joyce 等人 (2011a, p. 113) 的说法,此类资产价格的上涨会导致收益率降低,从而降低家庭和企业的借贷成本。较低的借贷成本意味着较高的支出率。

向非银行机构购买金融资产增加了银行机构的金融储备,特别是由于存款增加。增加的准备金可能会刺激银行机构增加对企业和家庭的贷款。同样,借贷增加会导致支出增加。然而,根据英国央行 (2011, p. 10) 的说法,从银行购买金融资产可能会刺激支出并不总是正确的。银行可能会继续放贷,尤其是在他们认为自己的财务状况受到威胁的情况下,例如在金融危机期间。

Another impact of the asset purchases is increased confidence. As BoE (2011, p. 10) explains, increasing the quantity of money in circulation may lead to an improved economic outlook.

This is likely to boost consumer confidence and thus, raise their willingness to spend. Therefore, purchasing of assets directly by the central bank increases the amount of money held by households and businesses, raises asset prices, reduces borrowing costs. And may increase consumer confidence, thereby stimulating expenditure. Increased expenditure especially on consumer goods may lead to increased demand and higher prices. According to the Keynesian monetary model, this will result into higher inflation rates. Therefore, QE can help to raise inflation during times of recession and where convectional policy tools are unable to raise the inflation rate BoE (2011, p. 10). However, according to Joyce et al (2011, p. 113), the principles described in the Keynesian monetary model may not be effective in raising inflation in cases where there are other limiting factors, as demonstrated in Japan’s case.

译文:

资产购买的另一个影响是信心增强。正如英国央行 (2011, p. 10) 所解释的,增加流通货币数量可能会改善经济前景。

这可能会提振消费者信心,从而提高他们的消费意愿。因此,央行直接购买资产增加了家庭和企业持有的货币量,提高了资产价格,降低了借贷成本,并可能增强消费者信心,从而刺激支出。尤其是消费品支出的增加可能会导致需求增加和价格上涨。根据凯恩斯主义的货币模型,这将导致更高的通货膨胀率。因此,在经济衰退时期以及对流政策工具无法提高通胀率的情况下,量化宽松有助于提高通胀率 英国央行(2011 年,第 10 页)。然而,根据 Joyce 等人 (2011, p. 113) 的说法,凯恩斯货币模型中描述的原则在存在其他限制因素的情况下可能无法有效提高通货膨胀率,如日本的案例所示。

Japan case study

According to the International Monetary Fund (IMF) (2006, p. 27), Japan started experiencing persistent deflation since the early 1990s as a result of persistent financial bubble burst. Consequently, the Bank of Japan (BoJ) reduced lending rates from 6% in 1990 to 0.5% in 1995, in a move to try to get out of the crisis. Though this policy intervention led to several recovery phases, the economy of Japan continued to deteriorate in late 1998. In response, BoJ reduced the lending rate to a level close to zero in 1999 (IMF, 2006, p. 27). 经济论文代写

As a result, prices stabilised and the economy became strong until 2001 when it started to decline and deflation worsened. The BoJ could not reduce its lending rate anymore since it was close to zero and thus, it was forced to adopt a more aggressive monetary policy. It adopted a Quantitative Monetary Easing Policy in March 2001 by purchasing long-term government bonds primarily from banks.

译文:

日本案例研究 经济论文代写

根据国际货币基金组织(IMF)(2006 年,第 27 页),由于持续的金融泡沫破灭,日本自 1990 年代初开始经历持续的通货紧缩。 因此,日本银行 (BoJ) 将贷款利率从 1990 年的 6% 降低到 1995 年的 0.5%,以试图摆脱危机。 尽管这种政策干预导致了几个复苏阶段,但日本经济在 1998 年底继续恶化。作为回应,日本央行在 1999 年将贷款利率降低到接近于零的水平(IMF,2006,第 27 页)。

结果,价格趋于稳定,经济变得强劲,直到 2001 年开始下降,通货紧缩恶化。 由于接近于零,日本央行无法再降低其贷款利率,因此被迫采取更激进的货币政策。 它于 2001 年 3 月采取了量化宽松政策,主要从银行购买长期政府债券。

According to the IMF (2006, p. 27) BOJ later widened the range of assets it purchased to cover other private assets held by private banks such as asset-backed securities and equities.

This process provided banks with excess reserves amounting to 5 trillion yen. The process continued for several years and by October 2005 the amount of bank reserves had increased by 63 trillion yen (Meier, 2009, p. 39). BoJ significantly reduced direct purchases of assets in 2006, though the policy has been applied severally since then. 经济论文代写

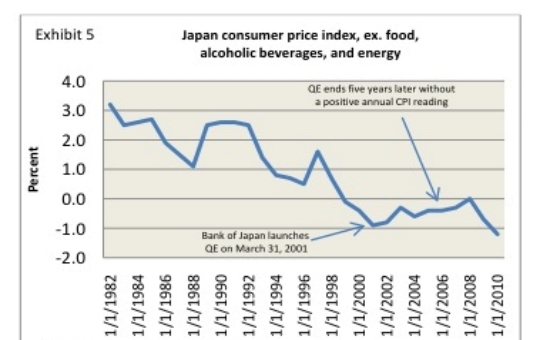

The IMF (2006, p. 27) noted that the QE policy in Japan helped to improve the lending attitude for financial institutions and to create a more accommodative environment for corporate financing. However, the policy had a limited impact on the overall economy and on deflation. According to Meier (2009, p. 39), lending by financial institutions declined constantly between 1999 and 2005 in spite of the ample liquidity injected in the banking system. This has been attributed to the weak banking system in Japan during the period, which impaired the credit channel leading to loss of confidence among businesses and households. The consumer price index (CPI) rate had declined from an annual rate of 2.6% in 1990 to -1% by 2001 and has remained negative since then as shown in the following diagram:

Figure 1: Japan CPI inflation rate trend

Source: Koo (2011)

Therefore, as a result of the aforementioned factors, the QE policy in Japan has not been effective in raising the inflation rate.

译文:

根据国际货币基金组织 (2006, P. 27) 的说法,日本央行后来扩大了其购买的资产范围,以涵盖私人银行持有的其他私人资产,如资产支持证券和股票。

这一过程为银行提供了 5 万亿日元的超额准备金。这一过程持续了数年,到 2005 年 10 月,银行准备金增加了 63 万亿日元(Meier,2009,第 39 页)。日本央行在 2006 年大幅减少了对资产的直接购买,但此后已多次实施该政策。

国际货币基金组织(2006 年,第 27 页)指出,日本的量化宽松政策有助于改善金融机构的贷款态度,并为企业融资创造更加宽松的环境。然而,该政策对整体经济和通货紧缩的影响有限。根据 Meier (2009, p. 39) 的说法,尽管向银行系统注入了充足的流动性,但金融机构的贷款在 1999 年至 2005 年间持续下降。这归因于在此期间日本银行体系疲软,削弱了信贷渠道,导致企业和家庭失去信心。消费者价格指数 (CPI) 率从 1990 年的年率 2.6% 下降到 2001 年的 -1%,此后一直为负,如下图所示:

图1:日本CPI通胀率走势

资料来源:古 (2011)

因此,受上述因素影响,日本的量化宽松政策未能有效提高通胀率。

The case of the United Kingdom

Quantitative easing was employed first in the UK in 2009 during the period of a serious global downturn (Chadha & Holly, 2011, p. 11). The global crisis which started in 2008 was intensified by the collapse of US Lehman Brothers in September 2008, which led to collapsing of confidence in the world economy. As a result, global financial markets became dysfunctional and credit channels were impaired. During the crisis, the world GDP fell to its lowest since World War 2. According to Chadha and Holly (2011, p. 11), the UK GDP fell by 2.4% during the first Quarter of 2009.

Consequently, the Bank of England’s Monetary Policy Committee (MPC) took measures to loosen monetary and support expenditure. According to Joyce et al (2011, p. 1), by the last Quarter of 2008, the MPC had already reduced its lending rate by 3% points which was followed by a further 1.5% points reduction in early 2009. By early March 2009, the MPC lending rate had been reduced to 1.2%. But MPC judged that there was risk that the reduction in lending rate would not be effective in achieving the 2% CPI inflation target. The MPC therefore found it necessary to ease monetary conditions further through a programme that would stimulate national spending (Joyce et al 2011, p. 1). 经济论文代写

MPC decided to inject money into the economy by purchasing private and public financial assets using central bank reserves, though the purchases were largely focused on UK government bonds (gilts).

The small quantities of private sector assets purchased were meant to boost the amount of money circulating in the economy, thereby increasing nominal spending and help to prevent inflation rate from falling below 2%. Initially, the MPC purchased £75 billion worth of assets and the figure increased gradually to £200 billion by November 2009. With instructions from the UK government, MPC adopted additional measures, which were meant to improve the performance of specific financial markets. These measures included purchases of high-quality corporate securities and commercial paper (Rolland, 2011, p. 65).

According to Gibbard and Stevens (2011, p. 105), the monetary policy measures helped to stimulate the UK GDP by between 1.5% and 2%. When MPC adopted the programme for injecting money into the economy, it was feared that inflation rate would fall below its 2% target. But a 2010 report by MPC indicated that amid higher commodity prices and tax rates, inflation shot up to 4.5% (Joyce et al, 2011, p. 1). By November 2011, the inflation rate had reached 4.8%, making it necessary for MPC to intervene to reduce it. The following figure provides the trend inflation rate since the first application of the QE policy in UK:

Figure 2: UK inflation rate trend

Source: Joyce, Tong & Woods (2011, p. 41)

Therefore, it is clear that the QE policy has been effective in raising inflation rates in the UK.

译文:

英国的情况 经济论文代写

2009 年,在全球严重衰退期间,英国首先采用了量化宽松政策(Chadha 和 Holly,2011 年,第 11 页)。始于 2008 年的全球危机因 2008 年 9 月美国雷曼兄弟倒闭而加剧,导致对世界经济的信心崩溃。结果,全球金融市场功能失调,信贷渠道受损。危机期间,世界 GDP 跌至二战以来的最低点。 Chadha 和 Holly(2011 年,第 11 页)称,2009 年第一季度英国 GDP 下降了 2.4%。

因此,英格兰银行的货币政策委员会(MPC)采取措施放松货币和支持支出。根据 Joyce 等人 (2011, p. 1) 的说法,到 2008 年最后一个季度,货币政策委员会已经将其贷款利率降低了 3 个百分点,随后在 2009 年初又进一步降低了 1.5 个百分点。到 2009 年 3 月上旬,MPC 贷款利率已降至 1.2%。但货币政策委员会认为,降低贷款利率可能无法有效实现2%的CPI通胀目标。因此,货币政策委员会发现有必要通过一项刺激国家支出的计划进一步放松货币条件(Joyce 等,2011,第 1 页)。

MPC 决定通过使用中央银行储备购买私人和公共金融资产来向经济注入资金,尽管这些购买主要集中在英国政府债券(GILTS)上。

购买少量私营部门资产旨在增加经济中的货币流通量,从而增加名义支出并有助于防止通胀率降至 2% 以下。最初,MPC 购买了价值 750 亿英镑的资产,到 2009 年 11 月,这一数字逐渐增加到 2000 亿英镑。在英国政府的指示下,MPC 采取了额外措施,旨在改善特定金融市场的表现。这些措施包括购买高质量的公司证券和商业票据(Rolland,2011 年,第 65 页)。

根据 Gibbard 和 Stevens(2011 年,第 105 页)的说法,货币政策措施有助于刺激英国 GDP 增长 1.5% 至 2%。当货币政策委员会通过向经济注入资金的计划时,人们担心通胀率会低于其 2% 的目标。但 MPC 2010 年的一份报告表明,在商品价格和税率上升的情况下,通货膨胀率飙升至 4.5%(Joyce 等,2011,第 1 页)。到 2011 年 11 月,通货膨胀率已达到 4.8%,使得 MPC 有必要进行干预以降低它。下图提供了英国首次实施量化宽松政策以来的趋势通胀率:

图 2:英国通胀率趋势

资料来源:Joyce, Tong & Woods(2011,第 41 页)

因此,很明显,量化宽松政策在提高英国的通胀率方面是有效的。

The case of the United States

The US suffered its worst economic crisis in 2008 since the 1930s. This crisis resulted from the burst of a housing bubble which affected depository institutions and other financial institutions involved with housing finance in the US. The real GDP was falling at an average annual rate of 6% with approximately 750,000 monthly job losses (Duncan, 2012, p. 78). Historical rise in delinquency rates on home mortgages during the period led financial firms involved in mortgage lending to suffer loss of access to liquidity and huge capital losses. This led to the collapse of one of the biggest money lenders, Lehman Brothers in 2008, leading to a financial panic that resulted in a decline in spending and a fall in prices of key assets. Consequently, the real economy of the US. And the world began to contract at an alarming rate resulting into deflation (Pozen, 2009, p. 157). 经济论文代写

The US federal bank took several extraordinary steps to rescue the situation. First, the federal bank reduced its lending rate from 5.25% to almost zero (Blinder & Zandi, 2010, p. 1). However, the economy still remained fragile and the Federal Reserve Bank found it prudent to adopt unconventional monetary policies to increase level of liquidity in the financial system. In March 2009, the Federal Bank engaged in massive quantitative easing through the purchase of $300 worth of treasury bonds. And Freddie Mac and Fannie Mae mortgage-backed securities at $175 billion in order to bring down interest rates in the long-term. The purchases were completed in a period of one year. According to Labonte (2012, p. 9), this move ended the great recession in the US economy and helped to spur recovery.

译文:

美国的情况

美国在 2008 年遭遇了自 1930 年代以来最严重的经济危机。这场危机的起因是房地产泡沫的破灭,它影响了美国的存款机构和其他涉及住房融资的金融机构。实际 GDP 以年均 6% 的速度下降,每月约有 750,000 人失业(Duncan,2012 年,第 78 页)。在此期间,住房抵押贷款拖欠率的历史上升导致参与抵押贷款的金融公司无法获得流动性和巨额资本损失。这导致最大的放债人之一雷曼兄弟在 2008 年倒闭,引发金融恐慌,导致支出下降和关键资产价格下跌。因此,美国和世界的实体经济开始以惊人的速度收缩,导致通货紧缩(Pozen,2009,第 157 页)。

美国联邦银行采取了几项非同寻常的措施来挽救局势。首先,联邦银行将其贷款利率从 5.25% 降至几乎为零(Blinder 和 Zandi,2010 年,第 1 页)。然而,经济仍然脆弱,美联储认为采取非常规货币政策以提高金融体系的流动性水平是明智之举。 2009 年 3 月,联邦银行通过购买价值 300 美元的国债以及 1750 亿美元的房地美和房利美抵押贷款支持证券进行大规模量化宽松,以长期降低利率。购买在一年内完成。据 Labonte (2012, p. 9) 称,此举结束了美国经济的大衰退,并有助于刺激复苏。

However, unemployment levels remained low.

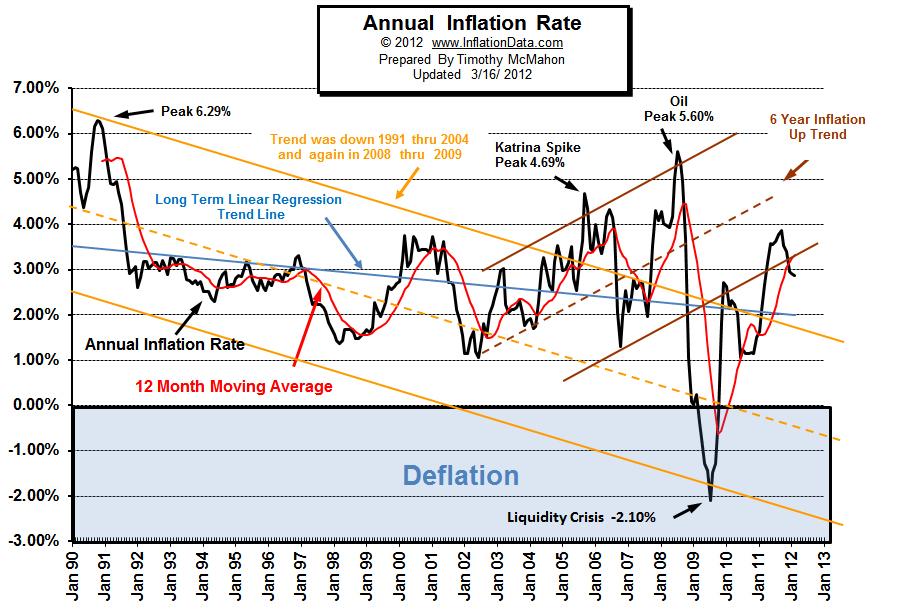

The Federal Reserve Bank therefore took steps to stimulate economic growth through a second round of purchasing additional treasury bonds worth $600 billion in March 2010. These purchases were completed in a period of six months (Engelen et al, 2011, p. 229). The Federal Reserve Bank report produced in 2011 showed that the with additional fiscal measures, the QE policy helped to raise real GDP by 15% to $1.8 trillion and created almost 10 million jobs, reducing the unemployment rate by approximately 6½ percentage points lower. Importantly, inflation rate has increased from -1% in 2009 to almost 4% in 2012, as shown in the diagram below.

Figure 3: US annual inflation rate

Source: Labonte (2012)

Therefore, as in the case of the UK, the QE policy has helped to raise inflation rate in US.

From the above case studies, there are various reasons which explain the difference in the effectiveness of the QE policy on controlling inflation rates in Japan, the UK and the US. First, unlike in the UK and the US cases, QE was applied on a dysfunctional banking system in Japan, with an impaired credit channel. According to Lenza et al (2010 p. 14), this was caused by the fact that BoJ and failed to act early enough, making consumers and businesses to lose confidence in the banking system. 经济论文代写

The BoJ had reduced lending rate to 0.5% by 1995 but did not apply the QE policy until March 2001. In the UK for instance, MPC reduced the lending rate to 0.5% in 2009 and began the programme of directly injecting money into the economy the same month (Lenza et al, 2010 p. 14). Thus, the QE policy in Japan could not stimulate spending and raise inflation rate as effectively as it did in the UK and in the US. Secondly, as noted earlier, the BoJ purchased financial assets principally from banks. Thus, there was no direct effect of the policy on spending. This makes it clear that Japan would have effectively raised inflation rates if it had applied the QE policy in a similar manner as the UK and the US and if its banking system was functional.

译文:

然而,失业率仍然很低。

因此,联邦储备银行于 2010 年 3 月通过第二轮额外购买价值 6000 亿美元的国债采取措施刺激经济增长。这些购买在六个月内完成(Engelen 等,2011,第 229 页)。美联储 2011 年发布的报告显示,通过额外的财政措施,量化宽松政策有助于将实际 GDP 提高 15% 至 1.8 万亿美元,并创造了近 1000 万个就业岗位,将失业率降低了约 6.5 个百分点。重要的是,通货膨胀率从 2009 年的 -1% 上升到 2012 年的近 4%,如下图所示。

图 3:美国年通胀率

资料来源:Labonte (2012)

因此,与英国的情况一样,量化宽松政策有助于提高美国的通胀率。

从上述案例来看,日本、英国和美国量化宽松政策在控制通胀率方面的效果存在差异的原因是多方面的。首先,与英国和美国的案例不同,量化宽松适用于日本银行系统功能失调、信贷渠道受损的情况。根据 Lenza 等人 (2010 p. 14) 的说法,这是因为日本央行未能及早采取行动,导致消费者和企业对银行系统失去信心。

日本央行在 1995 年将贷款利率降至 0.5%,但直到 2001 年 3 月才实施量化宽松政策。例如,在英国,货币政策委员会在 2009 年将贷款利率降至 0.5%,并开始了直接向经济注入资金的计划。同月(Lenza 等人,2010 年第 14 页)。因此,日本的量化宽松政策无法像英国和美国那样有效地刺激支出和提高通胀率。其次,如前所述,日本央行主要从银行购买金融资产。因此,该政策对支出没有直接影响。这清楚地表明,如果日本以与英国和美国类似的方式实施量化宽松政策,并且其银行体系运转正常,那么日本本可以有效地提高通胀率。

Conclusion

Therefore, drawing from the cases of Japan, UK and the US, we can conclude that QE is an effective monetary policy tool in raising the inflation rate. This policy, which is based on the Keynesian monetary model, can be applied to raise the inflation rate when conventional policy tools are ineffective to achieve this goal. However, there are external factors that may limit the effectiveness of the policy in raising the inflation rate.

As noted in the above cases, the banking system and the credit channel in an economy need to be stable for this policy to work. Further, the effectiveness of the policy is affected by the consumer confidence in an economy. Finally, for the process of QE to be effective in increasing the inflation rate, it should operate in a variety of channels, with only a few involving commercial banks. Otherwise, it may be ineffective when the central bank purchases assets only from banks. Since the banks may hoard the money in order to increase their capital reserves.

译文:

结论 经济论文代写

因此,结合日本、英国和美国的案例,我们可以得出结论,量化宽松是提高通胀率的有效货币政策工具。这一基于凯恩斯主义货币模型的政策可用于在常规政策工具无法实现这一目标时提高通胀率。然而,有一些外部因素可能会限制该政策在提高通胀率方面的有效性。

正如上述案例所指出的,经济体中的银行系统和信贷渠道需要稳定才能使该政策发挥作用。此外,政策的有效性受到消费者对经济的信心的影响。最后,量化宽松进程要想有效提高通胀率,应该多渠道运作,只有少数几个渠道涉及商业银行。否则,中央银行只从银行购买资产可能是无效的,因为银行可能会囤积货币以增加资本储备。

References

Blake, A & Kirsanova, T 2011, ‘Inflation conservatism and monetary-fiscal policy Interactions,’ International Journal of Central Banking, Vol. 7, Iss. 2, pp. 41-83.

Blinder, A S & Zandi, M 2010, How the Great Recession was brought to an end, Accessed 21 March 2011 from, http://www.economy.com/mark-zandi/documents/End-of-Great-Recession.pdf

BoE 2011, Quantitative easing explained: putting more money into our economy to boost spending, Accessed 21 March 2011 from, http://www.bankofengland.co.uk/monetarypolicy/Documents/pdf/qe-pamphlet.pdf

Chadha, J & Holly, S 2011, Interest Rates, Prices and Liquidity: Lessons from the Financial Crisis, Cambridge University Press, New York.

Duncan, R 2012, The New Depression: The Breakdown of the Paper Money, John Wiley & Sons, Economy, Hoboken.

Engelen, E, Ertuk, I, Froud, J, Johal, S, Leaver, A & Williams, K 2011, After the Great Complacence: Financial Crisis and the Politics of Reform, Oxford University Press.

Gibbard, P & Stevens, I 2011, ‘Corporate debt and financial balance sheet adjustment: A comparison of the United States, the United Kingdom, France and Germany,’ Annals of Finance, Vol. 7, Iss. 1, pp 95-118. 经济论文代写

Hamouda, O F 2009, Money, Investment and Consumption: Keynes’s Macroeconomics Rethought, Edward Elgar Publishing, West Sussex.

International Monetary (2006), Fund, Japan – Selected Issues, International Monetary Fund, New York

Joyce, M A S, Lasaosa, A, Stevens, I & Tong M 2011, ‘The Financial Market Impact of Quantitative Easing in the United Kingdom’, International Journal of Central Banking, Vol. 7 No. 3, pp. 113-161.

Joyce, M, Tong, M & Woods, R 2011, ‘The United Kingdom’s quantitative easing policy: Design, operation and impact,’ Quarterly Bulletin 2011 Q3, Accessed 21 March 2011 from http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/qb110301.pdf

Koo, R 2011, ‘QE Failed to Spur Bank Lending in Japan,’ Accessed 21 March 2011 from http://articles.businessinsider.com/2011-08-24/markets/29995529_1_boj-bank-lending-japanese-policymakers

Labonte, M 2012, ‘Monetary Policy and the Federal Reserve: Current Policy and Conditions,’ Accessed 21 March 2011 from http://www.fas.org/sgp/crs/misc/RL30354.pdf

Lenza, M, Pill, H & Reichlin, L 2010, ‘Orthodox and Heterodox monetary policies,’ Economic Policy, April 2010.

Meier, A 2009, Panacea, Curse, or Nonevent? Unconventional Monetary Policy in the United Kingdom, International Monetary Fund, New York.

Pozen, R 2009, Too Big to Save How to Fix the U.S. Financial System, John Wiley & Sons, New York.

Rolland, G 2011, Market Players: A Guide to the Institutions in Today’s Financial Markets, John Wiley and Sons, London.

Ugai, H 2006, ‘Effects of the Quantitative Easing Policy: A Survey of Empirical Analyses’, Bank of Japan Working Paper Series, No.06-E-10.