ECON 4261: Final

Part I: Test (25 points)

经济考试助攻代写 1.What is the meaning of the term “heteroskedasticity”? □ The conditional variance of the dependent variable is not constant.

1.

What is the meaning of the term “heteroskedasticity”?

□ The conditional variance of the dependent variable is not constant.

□ The conditional variance of the errors is not constant.

□ The conditional mean of the error term is not equal to zero.

□ The conditional variance of the error term is equal to σ².

2. 经济考试助攻代写

Generalized Least Squares

If the following assumption is violated:

□ A1: Linearity; □ A2: Strict Exogeneity; □ A2W: Weak Exogeneity;

□ A3: Rank X = K; □ A4: Spherical Errors

then, the GLS estimator may be preferred to the OLS estimator because it is:

□ unbiased while OLS is not unbiased.

□ consistent while OLS is not consistent.

□ effiffifficient amongst Linear Unbiased Estimator (BLUE) while OLS is not the BLUE.

3. 经济考试助攻代写

Instrumental Variables Estimator

If the following assumption is violated:

□ A1: Linearity; □ A2: Strict Exogeneity; □ A2W: Weak Exogeneity;

□ A3: Rank X = K; □ A4: Spherical Errors

then, we look for instruments, denoted by z, for the endogenous variable x2, that are:

1) Valid, that is,___________,

2) Good (i.e. not weak) instruments for x₂ in the sense that___________. Then, the IV estimator is preferred to the OLS estimator because it is:

□ unbiased while OLS is not unbiased.

□ consistent while OLS is not consistent.

□ effiffifficient amongst Linear Unbiased Estimator (BLUE) while OLS is not the BLUE.

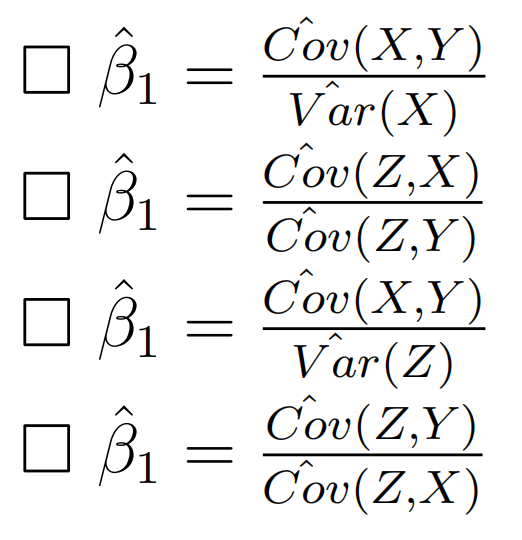

4.

When there is a single instrument and a single (endogenous) regressor, the IV estimator for the slope can be calculated as follows:

5.

Consider the IV model with a constant and two variables x₁ and x₂. The variable x₂ is endogenous. You have access to data for three valid instruments for x₂. The model is

□ over-identifified.

□ exactly identifified.

□ not/under identifified.

6. 经济考试助攻代写

The Method of Maximum Likelihood estimation consists in choosing param-eters estimates

□ that maximize the likelihood that the unobserved errors are normally dis-tributed.

□ that maximize the likelihood that βˆ converges to β as N → ∞.

□ that maximize the likelihood that the data was drawn from the assumed distribution.

Part II: Exercises (75 points)

1. 经济考试助攻代写

Exercise on model specifification (20 points)

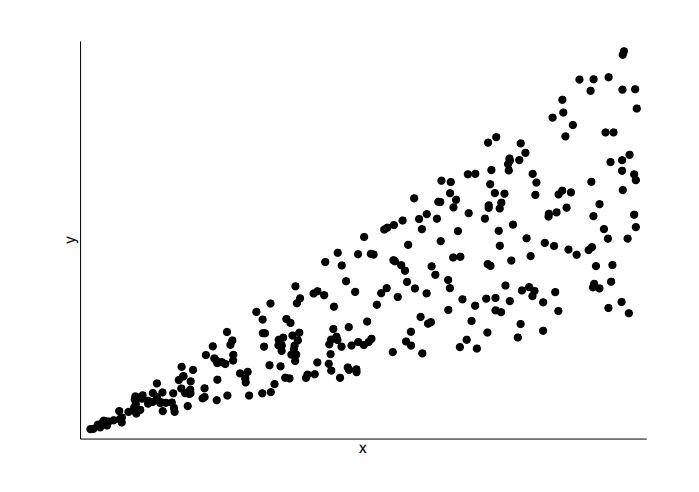

Consider that you have this data for the variables x and y:

(a) Do you expect A1 to hold? Which econometric model do you expect to better fifit the data? Explain. Hint: How many regressors do we have? Do you think the model should have a constant?

(b) Do you expect A2 to hold? Explain.

(c) Do you expect A4 to hold? Explain. Which is the name that we give to the pattern observed in the above graph?

(d) Give a brief example where two variables x and y may exhibit this pattern. Explain.

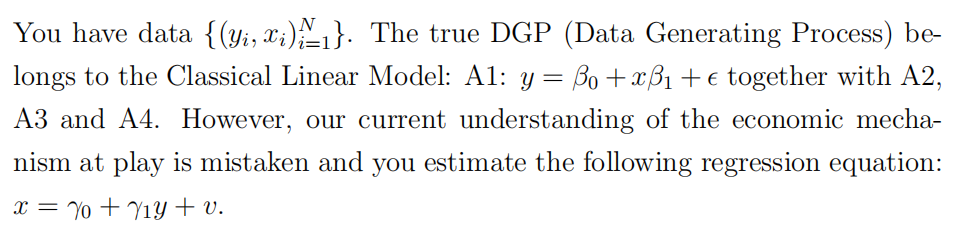

2.

Exercise on Reverse causality (30 points)

(a) Relate the parameters and error term of the true model to the param-eters and error term of the regression equation.

(b) Argue that y is endogenous in the regression equation.

(c) Give a brief example where two variables y and x may be causing changes in each other.

Variable x is:

Variable y is:

Changes in variable x cause changes in variable y because:

Changes in variable y cause changes in variable x because:

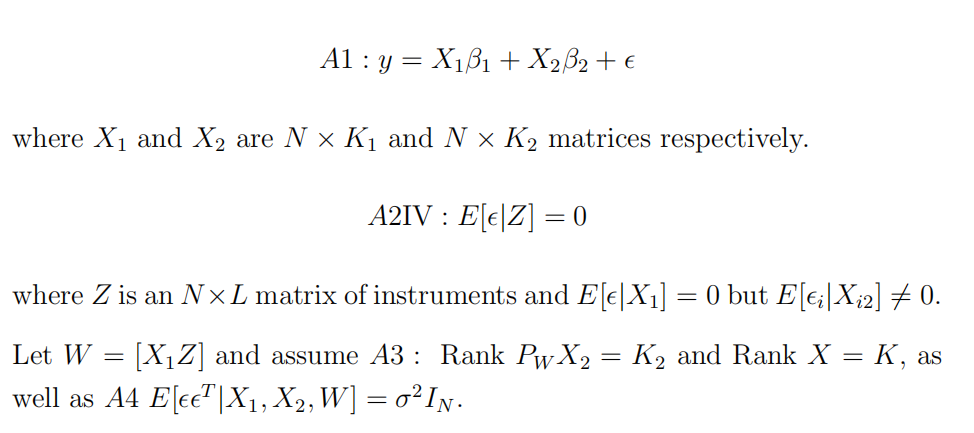

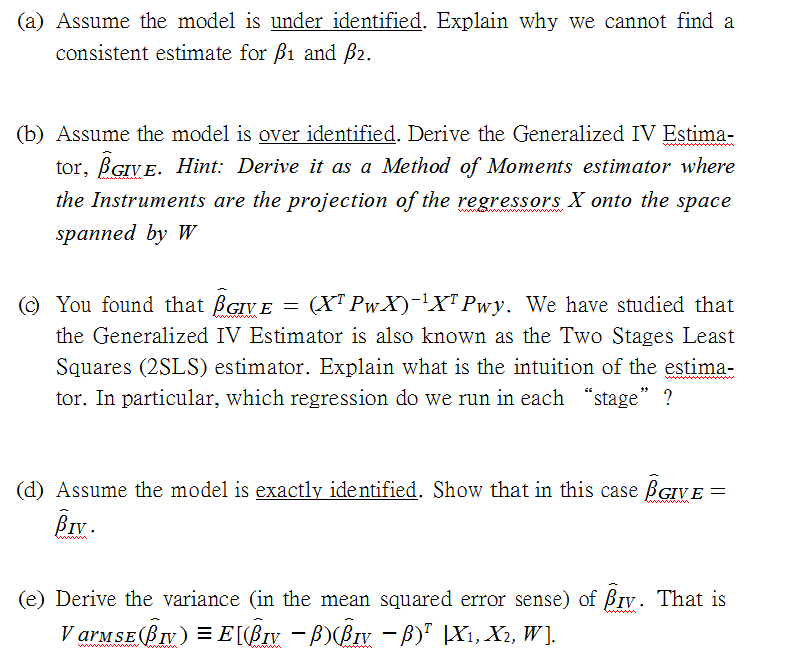

3. 经济考试助攻代写

Exercise on Instrumental Variables (15 points)

Consider the following IV model:

(f) Explain how having strong/good instruments (highly correlated with the endogenous variable) affffects the standard errors of the IV parameter estimates.

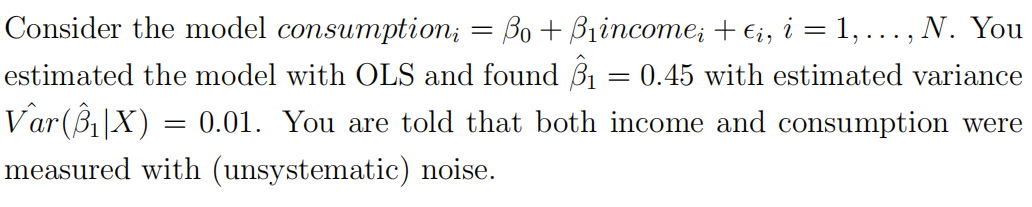

4. 经济考试助攻代写

Inference and measurement error (10 points)

i) In which direction is the OLS estimator for β₁ biased? Hint: What do you think is the sign of β₁?

The name of this bias is_________.

ii) Biased estimates may be useful. Your understanding of economics and budgets constraints tells you that the marginal propensity to consume out of income is smaller than 1. Use your biased parameter estimate of β₁ to argue where an unbiased estimate should lie.

其他代写:homework代写 Exercise代写 加拿大代写 北美代写 北美作业代写 essay代写 assignment代写 analysis代写 code代写 assembly代写 英国代写 作业代写 CS代写 Data Analysis代写 data代写 澳大利亚代写 app代写 algorithm代写 作业加急