The Production Side Of The Hershey Company

Name

Institution

The Production Side of The Hershey Company

经济学论文代写 Production Economic:Hershey is one of the largest chocolate manufacturing company in the world (The Hershey Company, n.d).

Production Economic

Hershey is one of the largest chocolate manufacturing company in the world (The Hershey Company, n.d). The company is producing in long-run where all factors of production are variable. Therefore, it does not experience diminishing marginal returns but rather experiences economies of scale where all input factors are variable. Assuming that Hershey is producing in short-run, the Cobb-Douglas production can be applied as described below.

In economics, the production function represents the relationship between the output and the combination of variable and fixed factors inputs like labor and capital used to obtain it (McGuigan, & Moyer, 1999). The production function is presented by;

Q=f(L,K)

Where:

Q is the amount of Hershey’s chocolate bars produced

L is the amount of input used in the process of producing Hershey’s chocolate bars, for instance, the number of hours of labour taken to produce Hershey’s chocolate bars in a given month.

K represents another input for production, say capital, for instance, the number of machine hours.

Mostly, K and L take any input for production.

Therefore, from the production function, the Cobb-Douglas production function is derived as Q(L, K) = A Lβ Kα where Q will represent Hershey’s chocolate bars, L represent the amount of labour needed, K represent the amount of capital used, A is the positive constant and β and α represent constants between 0 and 1.

Assuming that for Hershey has 500 total factor production of chocolate bars per month it uses 3 million units of capital and 700 hours of labour. The total cost will be:

If 1 unit of capital measured in hours cost $2 and 1 hour of labor cost $40 the total cost for the output will be $6028000 for that month. The amount of input can be varied to use 4000000 million units of capital and 700 hours of labour. Assume that output elasticity about labour is 0.4 and that of capital is 0.6.

Using the formula Q(L, K) = A Lβ Kα where β and α represent labour and capital respectively

Q(700, 6000000) = 500* 7000.4 *60000000.6

Q = 80,149,344 units of chocolate bar

译文:

生产经济 经济学论文代写

Hershey 是世界上最大的巧克力制造公司之一(The Hershey Company,n.d)。公司是长期生产的,所有生产要素都是可变的。因此,它不会经历边际收益递减,而是经历所有投入因素可变的规模经济。假设 Hershey 是短期生产,则可以按如下所述应用 Cobb-Douglas 生产。

在经济学中,生产函数表示产出与用于获得产出的可变和固定要素投入(如劳动力和资本)的组合之间的关系(McGuigan, & Moyer, 1999)。生产函数表示为:

Q=f(L,K)

where:

Q 是好时巧克力棒的产量

L 是在生产好时巧克力棒的过程中使用的投入量,例如,在给定的月份中生产好时巧克力棒所花费的劳动小时数。

K 代表生产的另一种投入,比如资本,例如机器小时数。

大多数情况下,K 和 L 接受任何生产投入。

因此,从生产函数推导出科布-道格拉斯生产函数为 Q(L, K) = A Lβ Kα 其中 Q 代表好时巧克力棒,L 代表所需劳动力,K 代表资本使用量, A 是正常数,β 和 α 代表 0 到 1 之间的常数。

假设 Hershey 每月有 500 种巧克力棒的全要素生产,它使用 300 万单位的资本和 700 小时的劳动。总费用为:

如果以小时为单位的 1 单位资本成本为 2 美元,而 1 小时的劳动力成本为 40 美元,则该月的总产出成本将为 6028000 美元。投入量可以变化,使用40000亿单位资本和700小时劳动。假设劳动的产出弹性为 0.4,资本的产出弹性为 0.6。

使用公式 Q(L, K) = A Lβ Kα 其中 β 和 α 分别代表劳动力和资本

Q(700, 6000000) = 500* 7000.4 *60000000.6

Q = 80,149,344 单位巧克力棒

The Marginal Product of Labor and Capital

For any given amount of labour in Hershey’s chocolate bar production, the ratio Q/K is the average change in the production for one unit of capital. The marginal product of change in input is the change in output as a result of additional units of input (Alvarez‐Cuadrado, Van Long, & Poschke, 2017). When production is changed when labour is fixed, and capital we changed from 3000000 to 4000000 units is given by

∆Q = f(700, 3000000+1000000) – f(700,3000000)

Therefore, ∆Q/ 1000000= f(700, 3000000+1000000) – f(700,3000000) /1000000

Taking the limit of the infinitesimal change in capital or taking the limit as ∆L goes to zero we get ∂Q/∂K’ where any change in the capital will lower per-unit returns. At ∂Q/∂K’, there will be no increase in the chocolate bar as capital increases and hence referred to them as the marginal product of capital. The company makes a profit when the Marginal Revenue equals the marginal cost of production.

译文:

劳动和资本的边际产品

对于 Hershey 巧克力棒生产中任何给定的劳动量,Q/K 比率是单位资本生产的平均变化。投入变化的边际产品是由于增加单位投入而导致的产出变化(Alvarez-Cuadrado、Van Long 和 Poschke,2017 年)。当劳动力固定时生产发生变化,我们从 3000000 单位变化到 4000000 单位的资本由下式给出

∆Q = f(700, 3000000+1000000) – f(700,3000000)

因此,∆Q/ 1000000= f(700, 3000000+1000000) – f(700,3000000) /1000000

取资本的无限小变化的极限,或取 ΔL 变为零时的极限,我们得到 ∂Q/∂K’,其中资本的任何变化都会降低单位回报。在 ∂Q/∂K’ 处,巧克力棒不会随着资本的增加而增加,因此将其称为资本的边际产品。当边际收入等于生产的边际成本时,公司盈利。

Cost Analysis

Cost analysis is the measure of the cost-output relationship (Gavagnin, Sánchez, Martínez, Rodríguez, & Muñoz, 2017). Therefore, management is interested in determining the cost incurred in employing the inputs and how they can be utilized to for better returns.

The total cost of production of chocolate bars is determined by

Total cost = Fixed costs + Variable costs

In this case, variable costs are labour, distribution, electricity and more and fixed cost are like rents. Total revenue is calculated by subtracting total costs from the total sales less other expenses. That is

Total revenue = total cost of sales – expenses

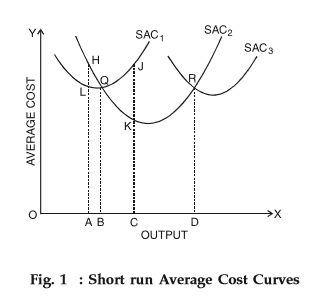

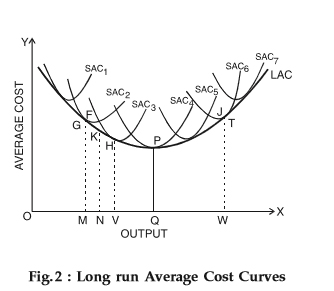

Hershey is producing at long-run. Therefore, it is experiencing a U-shaped long average cost curve. In short-run, the company had fixed and variable inputs. The long-run curve is tangential to the short-run curves after all the fixed inputs become variable as shown below.

译文:

成本分析 经济学论文代写

成本分析是对成本-产出关系的衡量(Gavagnin、Sánchez、Martínez、Rodríguez 和 Muñoz,2017 年)。 因此,管理层感兴趣的是确定使用投入所产生的成本以及如何利用投入来获得更好的回报。

巧克力棒的总生产成本由下式决定

总成本 = 固定成本 + 可变成本

在这种情况下,可变成本是劳动力、配电、电力等,而固定成本就像租金。 总收入的计算方法是从总销售额减去其他费用中减去总成本。 那是

总收入 = 总销售成本 – 费用

好时正在长期生产。 因此,它正在经历一条 U 形长平均成本曲线。 短期来看,公司有固定投入和可变投入。 在所有固定投入变为可变之后,长期曲线与短期曲线相切,如下所示。

Short-run cost curves 1, 2, and three marks years of variation in the total average cost of the Hershey company.

When the cost curves are joined, the long-run curve will be derived. However, for maximum profit, Hershey chooses between the three short-run to determine the most profitable combination of output and average cost. Thus, the firm opted to produce at SAC1 as it gives a lower cost of production. The company can continue varying the level of production at short-run hence have a series of curves which makes up the long-run curve.

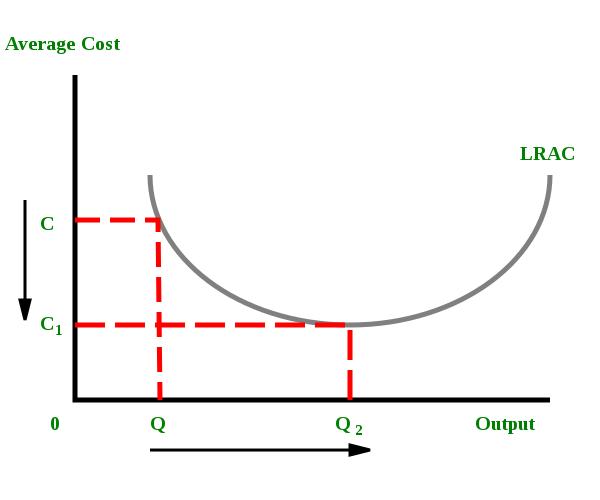

At long-run, Hershey has economies of scale. The U-shaped curve depends on the returns to scale. Therefore, Hershey company has U-shaped return to scale because it has expanded on its production and diversified. Return to scale increase as the company expands. Also, the U-shape is as a result of the inverse relationship between a return to scale and long-run average costs. In this regard, the company would have to fall long-run average costs and rising economies of scale because of economies of scale. On the other hand, it would have a rising LRAC and lower economies of scale because it has diseconomies of scale.

译文:

短期成本曲线 1、2 和 3 年标志着好时公司总平均成本的变化。

当成本曲线被连接时,将导出长期曲线。然而,为了获得最大利润,好时在三个短期之间进行选择,以确定产量和平均成本的最有利可图的组合。因此,该公司选择在 SAC1 进行生产,因为这样可以降低生产成本。公司可以在短期内继续改变生产水平,因此有一系列曲线构成了长期曲线。

从长远来看,好时具有规模经济。 U 形曲线取决于规模报酬。因此,Hershey 公司的规模收益呈 U 型,因为它扩大了生产和多元化。随着公司的扩张,规模回报增加。此外,U 形是规模报酬与长期平均成本之间反比关系的结果。在这方面,由于规模经济,公司将不得不降低长期平均成本和不断上升的规模经济。另一方面,由于存在规模不经济,它的 LRAC 会上升,规模经济会降低。

Application of Cost Theory

The Hershey Company apply long-term cost theory. At this level, the company determines long-term planning decisions which are based on the fact that all its inputs are variable and there are no restrictions to production decisions. The issue of cost measurement is determined using the total cost of producing chocolate bars. Since the company does not have fixed costs, these costs are added as part of the cost of production. Finally, the company need to consider capital asset value and decide how they are going to be treated during accounting.

Additionally, in making cost decisions, the company will need to control other variables that might be contributing to cost. For instance, employee absenteeism, production runs, management efficiency and others contribute significantly to the overall costs. Therefore, Hershey company management can deflate or detrend cost data to reflect changes in cost data, use multiple regression analysis, and engage in economies of scope as control variables of output costs.

译文:

成本理论的应用 经济学论文代写

好时公司应用长期成本理论。在这个层面上,公司根据所有投入都是可变的并且对生产决策没有限制这一事实来确定长期规划决策。成本测量问题是使用生产巧克力棒的总成本来确定的。由于公司没有固定成本,这些成本被添加为生产成本的一部分。最后,公司需要考虑资本资产价值并决定在会计期间如何处理它们。

此外,在做出成本决策时,公司将需要控制可能影响成本的其他变量。例如,员工缺勤、生产运行、管理效率和其他因素对总体成本的影响很大。因此,好时公司管理层可以缩小或去趋势成本数据以反映成本数据的变化,使用多元回归分析,并从事范围经济作为产出成本的控制变量。

Besides, Hershey needs to control its costs through statistical estimation methods.

Hershey is at long-run operations and hence it can make long-term cost estimation using time-series data. The type of data assumes that input costs, technology, and finished products are unchanged. The estimation is essential as the company gain much control over the cost of production and can be able to make rational cost decision on production, input prices, production technology and output.

Further, Hershey is a multinational company that has benefited from size economies of scale. It operates in a large market for chocolate bars and is continuing to grow. The company can operate on minimum unit costs and massive sales. The company has linked with distributors who take up the responsibility of marketing and connecting with the retailers and end users to achieve increased economies of scale. Also, it has diversified to other products and differentiation of similar products. As such, below is the presentation of the Hershey long-run average cost due to economies of scale. From the graph, the company experience economies of scale at Q2 where it produces high output at lower prices of C1.

Moreover, Hershey has the advantage of having economies of scope.

The company provides more than ten different products which are produced using the same inputs. Chocolate bars, cakes, and milkshakes can use the same technologies, labour, management and more to produce. The use of inputs across different products reduce the overall cost of production thus economies of scope.

Since Hershey is producing a mixture of products, it is difficult to determine its break-even point. Break-even point shows the relationship between sales revenues, costs of sales, and net profit at specific output levels. At the break-even point, the company does not either make profit or loss. Therefore, to determine the break-even point for Hershey, one will have to consider a single product or a constant mix of different products.

译文:

此外,好时需要通过统计估算方法来控制其成本。 经济学论文代写

Hershey 处于长期运营状态,因此它可以使用时间序列数据进行长期成本估算。数据类型假设投入成本、技术和成品不变。估算是必不可少的,因为公司对生产成本有很大的控制权,能够对生产、投入价格、生产技术和产量做出合理的成本决策。

此外,好时是一家受益于规模经济的跨国公司。它在一个巨大的巧克力棒市场上运营,并且还在继续增长。公司可以以最低的单位成本和大量的销售额运营。该公司已与承担营销责任的分销商建立联系,并与零售商和最终用户建立联系,以实现更大的规模经济。此外,它已经多元化到其他产品和同类产品的差异化。因此,以下是由于规模经济而导致的好时长期平均成本的介绍。从图中可以看出,该公司在第二季度实现了规模经济,以较低的 C1 价格生产高产量。

此外,好时还拥有范围经济的优势。

该公司提供十多种使用相同投入生产的不同产品。巧克力棒、蛋糕和奶昔可以使用相同的技术、劳动力、管理等进行生产。在不同产品之间使用投入降低了生产的总体成本,从而降低了范围经济。

由于好时生产混合产品,因此很难确定其盈亏平衡点。盈亏平衡点显示特定产出水平下的销售收入、销售成本和净利润之间的关系。在盈亏平衡点,公司既不盈利也不亏损。因此,要确定好时的盈亏平衡点,必须考虑单一产品或不同产品的恒定组合。

References 经济学论文代写

Alvarez‐Cuadrado, F., Van Long, N., & Poschke, M. (2017). Capital–labor substitution, structural change, and growth. Theoretical Economics, 12(3), 1229-1266.

Gavagnin, G., Sánchez, D., Martínez, G. S., Rodríguez, J. M., & Muñoz, A. (2017). Cost analysis of solar thermal power generators based on parabolic dish and micro gas turbine: Manufacturing, transportation and installation. Applied energy, 194, 108-122.

McGuigan, J. R., & Moyer, R. C. (1999). Managerial economics: applications, strategy, and tactics. South Western Educational Publishing.

The Hershey Company. (n.d). About. Retrieved from https://www.thehersheycompany.com/en_us/home.html

其他代写:essay代写 algorithm代写 assignment代写 analysis代写 code代写 app代写 assembly代写 CS代写 homework代写 Exercise代写 C++代写 C/C++代写 course代写 Data Analysis代写 data代写

合作平台:essay代写 论文代写 写手招聘 英国留学生代写