ECON 701 MODULES 10 AND 11 EXERCISES

经济学练习代写 Exercise 1. Consider an economy with two consumers (Consumer 1 and Consumer 2) and two goods (good 1 and good 2).

Exercise 1.

Consider an economy with two consumers (Consumer 1 and Consumer 2) and two goods (good 1 and good 2).

(1) Find Consumer 1’s demands for good 1 and good 2 as functions of p1, that is, find x11 (p1) and x21 (p1).

(3) Find the slope of an indifference curve of Consumer 1 at a point (x11, x21). Call this Slope1(x11, x21).

(4) The slope of an indifference curve of Consumer 2 at a point (x12, x22) is given by Slope2(x12, x22) = −x22 /x12 . Convert the slope of Consumer 2’s indifference curve to be in terms of Consumer 1’s coordinates. That is, find Slope2(x11, x21).

(5) Find the equation of the contract curve in terms of Consumer 1’s coordinates.

(6) Confirm that the result of the First Fundamental Theorem of Welfare Economics holds for the equilibrium of this economy that you found in part (2).

Exercise 2. 经济学练习代写

Consider a situation in which a consumer consumes only two goods, good 1 and good 2, and takes prices as exogenously given. Suppose that the consumer is initially endowed with ω1 units of good 1 and ω2 units of good 2, and that the price of good 1 is p1 and the price of good 2 is p2. (The consumer can either buy or sell at these prices.)

Suppose that the consumer’s preferences are given by the utility function

u(x1, x2) = x1x2

where x1 is the amount of good 1 the consumer consumes and x2 the amount of good 2. Suppose also that ω1 = 2 and ω2 = 1 and normalise prices so that p2 = 1.

(1)

Write the budget constraint of this consumer and solve the budget constraint to give x2 as a function of x1.

(2) Substitute this function into the utility function to give utility as a function of x1. 经济学练习代写

(3) Find the value of x1 that maximises the consumer’s utility. You do this by differentiating the function you found in the previous part setting the derivative equal to zero and then solving the resulting equation to give x1 as a function of p1.

(4) Substitute the value you find for x1 into the function you found in part 1 to find the optimal value of x2 as a function of p1.

(5) Instead of the previous steps set up the utility maximisation problem with parameters p1, p2, ω1,and ω2. Give the Lagrangian for this problem and the first order conditions and solve the first order conditions to give x1 and x2 as functions of the parameters. Substitute the values given above for p2, ω1,and ω2 into these solutions. You should get the same answer as in the previous part.

(6) Graph the functions x1(p1) and x2(p1).

(7) Find the value of p1 that will make this consumer willing to consume her initial endowment.

(8) Suppose that p2 was 2, rather than 1. Repeat the analysis above for this case. Comment on the result.

(1)

Repeat the analysis of the previous exercise for this consumer, finding the demand functions x12(p1) and x22(p1).

(2) Find the market demand in the economy consisting of these two consumers by adding the individual demand functions. That is

X1(p1) = x11(p1) + x12(p1)

and

X2(p1) = x21(p1) + x22(p1).

(3) Find the value of p1 for which the market demand for good 1 is exactly equal to the total endowment of good 1.

(4) Confirm that at this price the market demand for good 2 is also equal to the total endowment of good 2.

(5) Why?

Exercise 4. 经济学练习代写

Consider a situation in which a consumer consumes only two goods, good 1 and good 2, and takes prices as exogenously given. Suppose that the consumer is initially endowed with ω1 units of good 1 and ω2 units of good 2, and that the price of good 1 is p1 and the price of good 2 is p2. (The consumer can either buy or sell at these prices.)

Suppose that the consumer’s preferences are given by the utility function

u(x1, x2) = max{x1, x2}

where x1 is the amount of good 1 the consumer consumes and x2 the amount of good 2. [If you have come across Leontief preferences in the past be careful. These are almost precisely the opposite. Leontief preferences are defined by u(x1, x2) = min{x1, x2}. You are asked to analyse Leontief preferences in Exercise 6.] Suppose also that ω1 = 2 and ω2 = 3. Again, we can choose one normalisation for the price vector and again we choose to let p2 = 1.

(1) 经济学练习代写

On a graph draw several indifference curves of this consumer.

(2) Draw, on the same graph draw the budget sets when p1 = 0.5, when p1 = 1, and when p1 = 2,

(3) Find the value(s) of (x1, x2) that maximises the consumer’s utility, for each of these budget sets. You don’t need to do any differentiation to do this. Simply thinking clearly should tell you the answer.

(4) Generalise the previous answer to give the optimal values of x1 and x2 as functions of p1.

(5) Graph the functions x1(p1) and x2(p1).

(6) Argue that there is no value of p1 that will make the consumer willing to consume her initial endowment, and that thus, in the one consumer economy there is no equilibrium.

Exercise 5. 经济学练习代写

Consider again the preferences given in the previous exercise. We shall now illustrate the convexifying effect of having many consumers.

(1) Suppose that there are two consumers identical to the consumer described in Exercise 1, that is they have the same preferences and the same initial endowment. Graph the aggregate demand functions

X1(p1) = x11(p1) + x12(p1)

and

X2(p1) = x21(p1) + x22(p1)

taking particular care at the value p1 = 1.

(2) Is there a competitive equilibrium for this economy? Why?

(3) How many identical consumers of this type are needed in order that the economy should have an equilibrium?

Exercise 6. 经济学练习代写

Consider a situation in which a consumer consumes only two goods, good 1 and good 2, and takes prices as exogenously given. Suppose that the consumer is initially endowed with ω1 units of good 1 and ω2 units of good 2, and that the price of good 1 is p1 and the price of good 2 is p2. (The consumer can either buy or sell at these prices.)

Suppose that the consumer’s preferences are given by the utility function

u(x1, x2) = min{x1, x2}

where x1 is the amount of good 1 the consumer consumes and x2 the amount of good 2. Think a little about what this utility function means. If the consumer has 3 units of good 1 and 7 units of good 2 then her utility is 3. If she has 3 units of good 1 and 17 units of good 2 then her utility is still 3.

Increasing the amount of the good she has more of does not increase her utility. If she has 4 units of good 1 and 7 units of good 2 then her utility is 4. Increasing the amount of the good she has less of does increase her utility.

(1) 经济学练习代写

On a graph draw several indifference curves of this consumer.

(2) Now assume that p2 = 1 and ω = (1, 2). Draw, on the same graph draw the budget sets when p1 = 0.5, when p1 = 1, and when p1 = 2,

(3) Find the value(s) of (x1, x2) that maximises the consumer’s utility, for each of these budget sets. You don’t need to do any differentiation to do this. Simply thinking clearly should tell you the answer.

(4) Generalise the previous answer to give the optimal values of x1 and x2 as functions of p1.

(5) Again generalise your answer by dropping the assumptions that p2 = 1 and that ω = (1, 2) to give the optimal values of x1 and x2 as functions of p1, p2, ω1, and ω2.

Exercise 7.

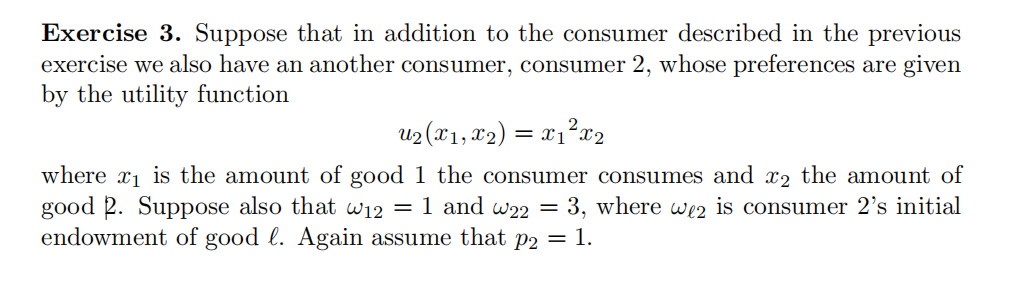

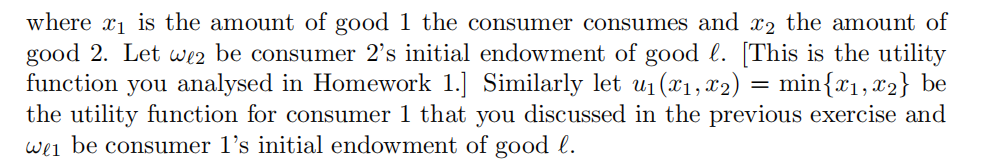

Suppose that in addition to the consumer described in Exercise 6 we also have an another consumer, consumer 2, whose preferences are given by the utility function

u2(x1, x2) = x1x2

(1) Repeat the analysis of the previous exercise for consumer 2,finding the demand functions x12(p1, p2, ω12, ω22) and x22(p1, p2, ω12, ω22).

(2) Find the market demand in the economy consisting of these two consumers by adding the individual demand functions. That is

X1(p1, p2, ω11, ω21, ω12, ω22) = x11(p1, p2, ω11, ω21) + x12(p1, p2, ω12, ω22)

and

X2(p1, p2, ω11, ω21, ω12, ω22) = x21(p1, p2, ω11, ω21) + x22(p1, p2, ω12, ω22).

(3) Suppose that ω11 = 0, ω21 = 1, ω12 = 1, and ω22 = 0. Also normalise prices so that p2 = 1. Find the value of p1 for which the market demand for good 1 is exactly equal to the total endowment of good 1.

(4) Confirm that at this price the the market demand for good 2 is also equal to the total endowment of good 2.

(5) What is the utility of consumer 1 in this equilibrium?

Exercise 8. 经济学练习代写

Suppose that everything is as in Exercise 7 except that now the initial endowments are ω11 = 0, ω21 = 2, ω12 = 1, and ω22 = 0. That is consumer 1’s endowment of good 2 has increased from 1 to 2.

(1) Find the equilibrium in this case.

(2) What is the utility of consumer 1 in this equilibrium?

(3) Compare this with the utility found in the previous exercise and explain why we get this apparently paradoxical result.

(4) Explain why it should be possible to come up with an even stronger paradox, that is why we might expect to find examples in which the weak inequality you observed in the previous part could be strong. [You might do this by drawing the appropriate Edgeworth box.]

Exercise 9. 经济学练习代写

Suppose that everything is as in Exercises 7 and 8 except that now the initial endowments are ω11 = 0, ω21 = 0.25, ω12 = 1, and ω22 = 0.

(1) Is there an equilibrium in this case? [Hint: There is. One of the prices is zero.]

(2) Let the initial endowments be ω11 = 0, ω21 = a, ω12 = 1, and ω22 = 0. Graph the equilibrium value of p1 (normalising p2 to be 1) and x11 the equilibrium consumption of good 1 by consumer 1 as functions (or correspondences) of a.

Exercise 10.

Consider an economy with two consumers and two goods.

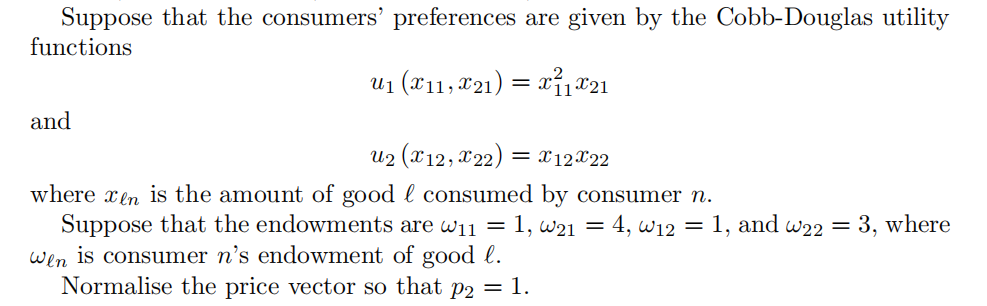

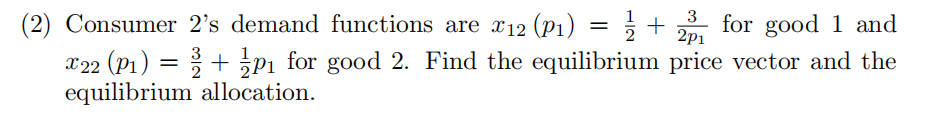

Suppose that Consumer 1’s preferences are given by the Cobb-Douglas utility function

u1(x11, x21) = x11x21

where x11 is the amount of good 1 that Consumer 1 consumes and x21 the amount of good 2 that Consumer 1 consumes. Suppose that Consumer 1 is endowed with 5 units of good 1 and 1 unit of good 2.

Suppose that Consumer 2’s preferences are given by the Leontief utility function

u2(x12, x22) = min{x12, x22}

where x12 is the amount of good 1 that Consumer 2 consumes and x22 the amount of good 2 that Consumer 2 consumes. Suppose that Consumer 2 is endowed with 1 units of good 1 and 5 units of good 2.

Normalise the price vector so that p2 = 1. 经济学练习代写

(1) Find the contract curve. [Hint: Think before you start calculating!]

(2) Find the equilibrium price and the equilibrium allocation.

(3) Represent this economy in an Edgeworth Box diagram. Clearly mark the initial endowment, the equilibrium allocation, and the equilibrium price vector. Also draw the contract curve and clearly label it.

(4) On the same diagram draw the indifference curves through the initial endowment for the two consumers, labelling clearly which is which.

(5) Mark clearly the set of Pareto optimal allocations that make each consumer at least as well off as the were at the initial endowment.

A Comment on Exercise 10 经济学练习代写

Suppose that we have an economy like that in Exercise 13, but that, instead of two consumers there are four, two like Consumer 1, who we shall call Consumers 1 and 3, and two like Consumer 2, who we shall call Consumers 2 and 4. A little thought should convince you that the equilibrium price will be the same and that the equilibrium allocation will just be the replication of the equilibrium allocation of the two consumer economy.

Recall that, in the original economy, the allocation ((√ 5, √ 5),(6 − √ 5, 6 − √ 5)) was Pareto optimal. Again it should be clear that the replication of this allocation remains Pareto optimal in the four consumer economy.

However I claim that a coalition of Consumers 1, 2, and 3 could share their initial endowment to make all of them better off.

The idea is that we could rearrange the endowments of Consumers 1 and 2 to give them the allocation ((√ 5, √ 5),(6 − √ 5, 6 − √ 5)) and have Consumer 3 with her initial allocation (5, 1).

Now we leave Consumer 2 with (6− √ 5, 6− √ 5) but have Consumers 1 and 3 each get half of their total previous consumption putting them both on the midpoint of the line between (5, 1), their initial endowment, and (√ 5, √ 5), which, since their indifference curve is strictly convex they would both strictly prefer to either (5, 1) or (√ 5, √ 5).

We could then take a little bit from each of them and give it to Consumer 2, making them all strictly better off than they had been at the replication of ((√ 5, √ 5),(6 − √ 5, 6 − √ 5)).

For concreteness let us give a numerical answer. The total endowment of Consumers 1, 2, and 3 is 经济学练习代写

2 × (5, 1) + (1, 5) = (11, 7).

We want Consumer 2 to receive a bit more than

(6 − √ 5, 6 − √ 5) ≈ (3.764, 3.764)

so lets try (3.8, 3.8), which will give Consumer 2 a utility of 3.8 which is greater than u2(6 − √ 5, 6 − √ 5).

That leaves (11 − 3.8, 7 − 3.8) = (7.2, 3.2) left for Consumers 1 and 3, which we split equally between them, giving each (3.6, 1.6) and each a utility of 3.6 × 1.6 = 5.76, which is greater than the utility of 5 that they receive from (√ 5, √ 5).

This illustrates an interesting fact. Recall that the core of the economy consists of all allocations such that no coalition of consumers can make all its members better off by redistributing the initial endowment of just the members of the group. What we’ve seen is that if we replicate the economy some points that were in the core of the original economy are no longer in the core of the replicated economy. In fact, for any allocation that is not an equilibrium allocation there is some number k of replications of the economy such that if the economy is replicated k times then that allocation is not in the core of the economy. Loosely we say that as the economy becomes large the core of the economy shrinks to the set of competitive allocations.

Exercise 11. 经济学练习代写

Prove the Theorem 2 from Module 11.2. [This is essentially the same as the proof of the First Welfare Theorem, but for all coalitions, not just the grand coalition N. You do need to be careful that we are not assuming local nonsatiation and the definition of blocking (by coalition N) is stronger than the notion of Pareto improving (and so the requirement that the allocation not be blocked by coalition N is weaker than the requirement that the allocation be Pareto efficient.]

Exercise 12.

Give a definition of a coalition weakly blocking a feasible allocation that is more similar to the way we have defined Pareto improving, and a corresponding notion of the strict core. Show that if every consumer’s preferences are locally nonsatiated then the strict core and the core coincide.

更多代写:Scheme代写 ielts代考 英国GRE代考替考 Essay代写教育学 Reflection代写 能源经济代写