BUSN7031: MANAGEMENT ACCOUNTING – Practice Questions

管理会计代写 Please Note: These questions are practice questions. They are not meant to be necessarily indicative of the standard or difficulty of the exam

Please Note: These questions are practice questions. They are not meant to be necessarily indicative of the standard or difficulty of the exam

Practice Questions

1.

ABC has determined that the shipment setup costs should be accounted for at the batch-level of activities. ABC believes that the costs assigned to the shipment setup for the current period will be $440,000. ABC is estimating that there will be 400 shipments totalling 8,000 units during the current period. How much cost should be allocated to an order of 70 units that requires three shipments to deliver?

a. $3,850

b. $165

c. $1,100

d. $3,300

2. 管理会计代写

Which costing system will trace the most costs as direct costs?

a. Process costing

b. Job-order costing

c. Activity-based costing

d. Absorption costing

3.

Tom Company produces and sells 4,000 units per month of a certain small home appliance. Total costs per month are $600,000 of which $200,000 are variable and $400,000 are fixed. Idle capacity exits to cover a special sales order of 3,000 units per month. The lowest of these proposed prices that should be accepted by Tom Company for this order is:

a. $17 per unit

b. $73 per unit

c. $62 per unit

d. $21 per unit

4. 管理会计代写

How many units should be purchased if the desired ending inventory is 2,840 units, budgeted sales are 3,600 units and the beginning inventory is 1,700 units?

a. 2,460

b. 5,840

c. 4,740

d. 3,600

5.

A company’s static budget shows $80,000 of direct-material cost for the production of 16,000 units, but the actual direct-material cost was $83,000 for the production of 17,000 units. These data indicate:

a. an unfavourable sales-volume variance of $5,000

b. an unfavourable sales-volume variance of $3,000

c. a favourable flexible-budget variance of $3,000

d. an unfavourable flexible-budget variance of $2,000

6. 管理会计代写

The sum of the production-volume variance and the flexible-budget variance for fixed manufacturing overhead is equal to:

a. allocated fixed manufacturing overhead minus the spending variance

b. actual fixed manufacturing overhead minus the efficiency variance

c. the difference between actual and budgeted fixed manufacturing overhead

d. the difference between allocated and actual fixed manufacturing overhead

7.

Harvey Corporation manufactured 1500 chairs during June. The following variable overhead data pertain to June:

Budgeted variable overhead cost per unit $12.00

Actual variable manufacturing overhead cost $20 800

Flexible-budget amount for variable manufacturing overhead $18 000

Variable manufacturing overhead efficiency variance $360 unfavourable

What is the variable overhead flexible-budget variance?

a. $2800 unfavourable

b. $2800 favourable

c. $360 unfavourable

d. $1560 favourable

8.

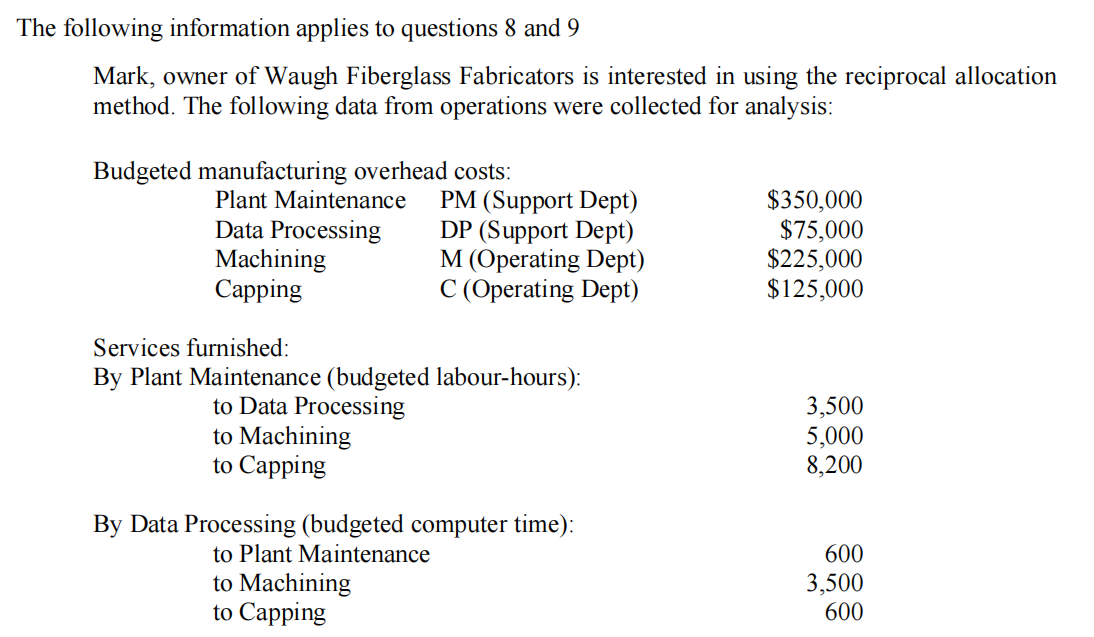

Which of the following linear equations represents the complete reciprocated cost of the Data Processing Department?

a. DP = $75,000 + (3,500/16,700) PM

b. DP = $75000 + (600/4,700) PM

c. DP = $75000 × (600/4,700) + $350,000 × (3,340/16,700)

d. DP = $350000 + (600/16,700) DP

9.

What is the complete reciprocated cost of the Plant Maintenance Department?

a. $365,000

b. $369,459

c. $375,773

d. $393,750 3

10. 管理会计代写

Pritchard Company manufactures a product that has a variable cost of $30 per unit. Fixed costs total $1,500,000, allocated on the basis of the number of units produced. Selling price is computed by adding 20% markup to full cost. How much should the selling price be per unit for 300,000 units?

a. $49

b. $43.75

c. $42

d. none of the above

11.

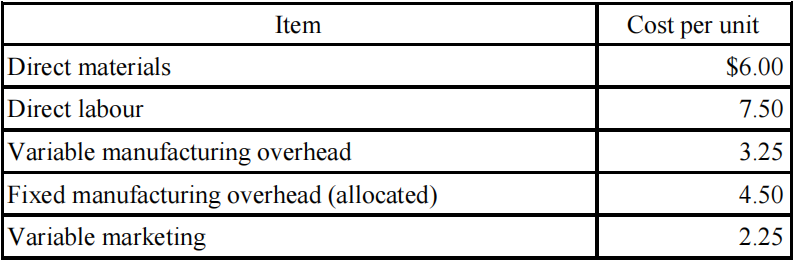

Julia’s Garden Supply is considering accepting a special order from a foreign firm for Be-gone, the main product it produces. This would be a one-time order, would not impact existing sales, and sufficient capacity exists to manufacture the goods. Existing cost information is as follows:

The fixed manufacturing costs will remain unchanged if the order is accepted or not. The foreign purchaser is willing to pay $22 for each unit and would like to purchase 5,000 units. Because the sales would not go through regular distribution channels, the variable marketing costs would not be incurred. However, a packing and shipping cost of $1.00 per unit would be incurred to get the units ready for overseas shipping. What is the potential profit or loss that Julia’s Garden Supply will make if it accepts the special order?

a. $6,250 loss

b. $12,500 loss

c. $16,250 income

d. $21,250 income

12. 管理会计代写

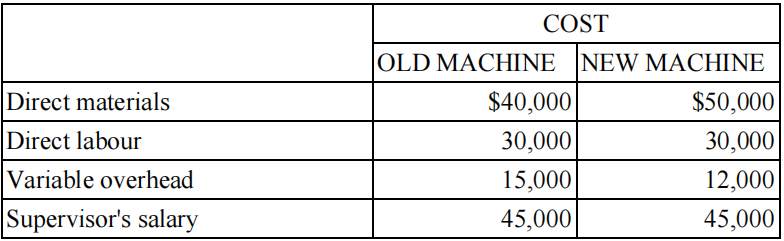

TRI-IT is looking at replacing a current machine with a newer model. The following information has been collected by the managers.

Which of the costs are relevant in the decision as to whether the new machine should be acquired?

a. Direct materials only

b. Direct materials, variable overhead, and direct labour

c. Direct materials and variable overhead

d. Direct materials, variable overhead, direct labour, and supervisor’s salary

13.

Which one of the following is a feature of a good balanced scorecard?

a. Uses only objective measurements

b. Has unlimited number of measurement included

c. Uses only financial measures for evaluation

d. Articulates a sequence of cause-and-effect relationships

14.

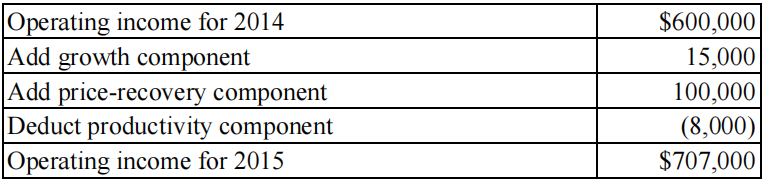

An analysis of Ragan Inc.’s operating income for the last two years showed the following

a. A downsizing strategy

b. A product differentiation strategy

c. A cost leadership strategy

d. A reengineering strategy

15.

A measure of the change in operating income attributable solely to changes in dollar amounts of inputs and outputs from one period to the next is a component known as the:

a. growth component.

b. productivity component.

c. revenue component.

d. price-recovery component.

16. 管理会计代写

Manufacturing cycle efficiency is an example of a balanced-scorecard measure of the:

a. internal business process perspective.

b. customer perspective.

c. learning and growth perspective.

d. financial perspective.

17.

Which of the following is not a nonfinancial performance measure for customer satisfaction?

a. number of defective units shipped to customers as a percentage of the total units of product shipped

b. number of customer complaints

c. on-time delivery

d. number of defects for each product line

18. 管理会计代写

Which capital budgeting technique(s) measure all expected future cash inflows and outflows as if they occurred at a single point in time?

a. Net present value.

b. Internal rate-of-return.

c. Payback period.

d. Both a and b are correct. 5

19.

Geyer Company uses a standard cost system. For the month of April, total overhead is budgeted at $80,000 based on the production volume of 20,000 direct labour hours. At standard, each unit of finished product requires 2 direct labour hours. The following data are available for the April production activity:

Equivalent units of product 9,500

Direct labour hours worked 19,500

Actual total overhead incurred $79,500

What amount should Geyer credit to the manufacturing overhead allocated account for the month of April?

20. 管理会计代写

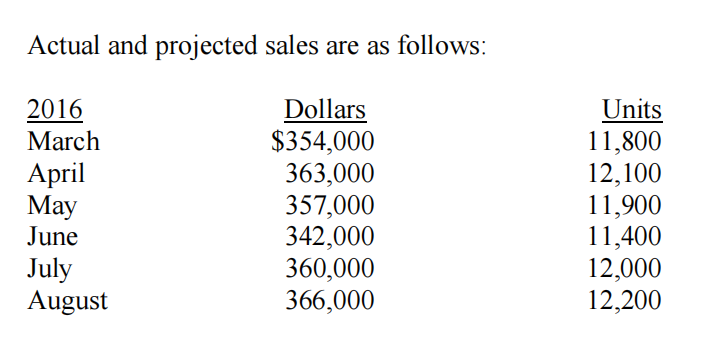

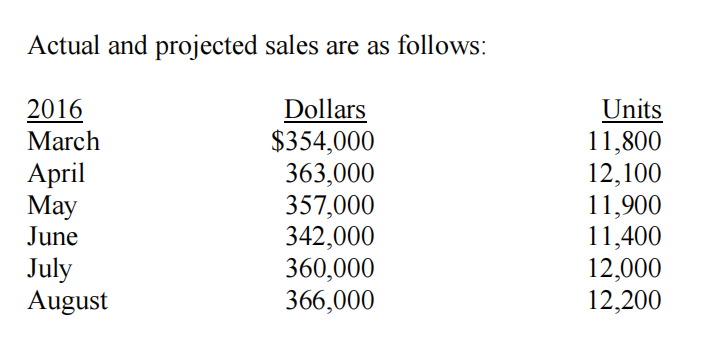

What are Tomlinson Retail’s budgeted cash collections during May 2016, based on the following assumptions?

(i) Sales

a. Each month’s sales are billed on the last day of month.

b. Customers are allowed a 3% discount if payment is made within ten days after the billing date.

c. Sixty percent of the billings are collected within the discount period, 25% are collected by the end of the month, 9% are collected by the end of the second month, and 6% prove to be uncollectible.

(ii) Purchases

a. Fifty-four percent of all purchases of merchandise as well as selling, general, and administrative (SGA) expenses are paid in the month purchased and the remainder in the following month.

b. Each month’s units of ending inventory is equal to 130% of the next month’s units of sales.

c. The cost of each unit of merchandise inventory is $20.

d. Total SGA expenses are equal to 15% of the current month’s sales and include $2,000 of depreciation.

21. 管理会计代写

The Mancuso Company uses a flexible budget and standard costs to aid planning and control. At a 60,000-direct-labour-hour level, budgeted variable manufacturing overhead is $30,000 and budgeted direct labour is $480,000.

The following are some results for August:

Variable manufacturing overhead flexible budget variance $10,500 U

Variable manufacturing overhead efficiency variance $9,500 U

Actual direct-labour costs incurred $574,000

Materials price variance (based on goods purchased) $16,000 F

Materials efficiency variance $9,000 U

Fixed manufacturing overhead incurred $50,000

Fixed manufacturing overhead budget variance $2,000 U

The standard cost per pound of direct materials is $1.50. The standard allowance is one pound of direct materials for each unit of finished product. Ninety thousand units of product were made during August. There was no beginning or ending work-in-process. In July, the materials efficiency variance was $1,000, favourable, and the purchase price of materials was greater than the standard cost by $0.20 per pound. In August, the actual purchase price of materials was $0.10 per pound less than the standard cost. 管理会计代写

In July, labour troubles caused an immense slowdown in the pace of production. There had been an unfavourable direct-labour efficiency variance of $60,000; there was no labour-price variance. These troubles had persisted in August. Some workers quit. Their replacements had to be hired at higher rates, which had to be extended to all workers. The actual average wage rate in August exceeded the standard average wage rate by $0.20 per hour.

Calculate the following for August:

a. Total pounds of direct materials purchased during August.

b. Total number of pounds of excess material usage.

c. Variable manufacturing overhead spending variance.

d. Total number of actual hours of input.

e. Total number of standard hours allowed for the finished units produced.

22. 管理会计代写

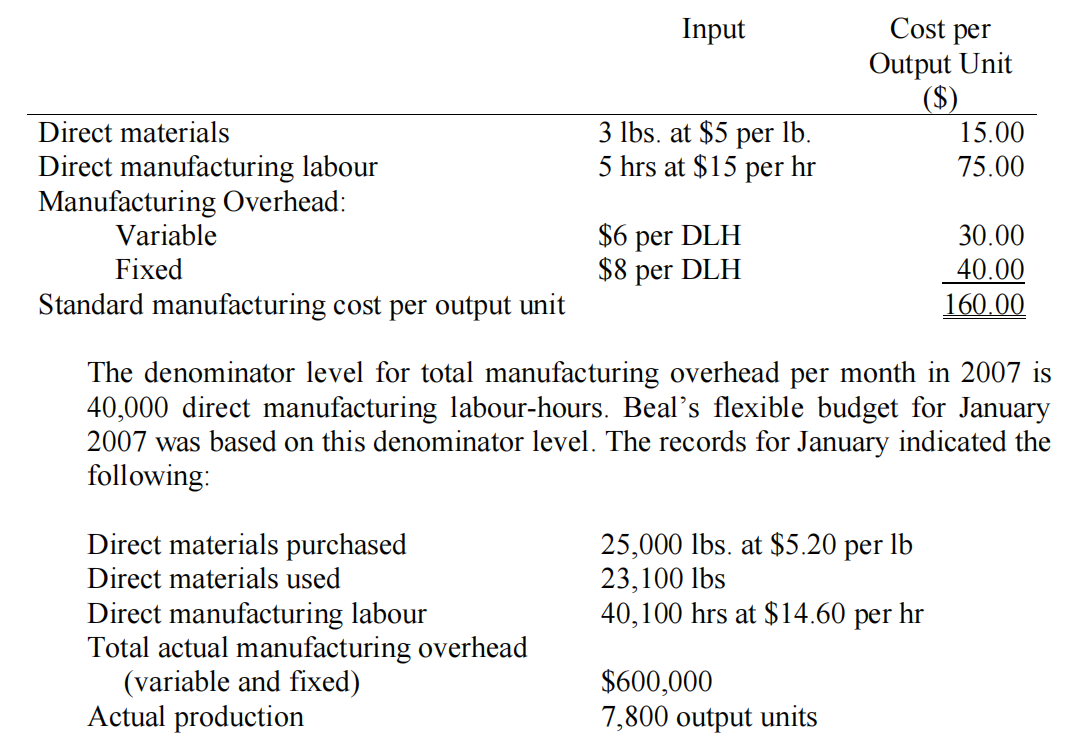

Beal Manufacturing Company’s costing system has two direct-cost categories: direct materials and direct manufacturing labour. Manufacturing overhead (both variable and fixed) is allocated to products on the basis of standard direct manufacturing labour-hours (DLH). At the beginning of 2015, Beal adopted the following standards for its manufacturing costs:

Required:

For the month of January 2015, compute the following variances, indicating whether each is favourable (F) or unfavourable (U):

a. Direct materials price variance, based on purchases

b. Direct materials efficiency variance

c. Direct manufacturing labour price variance

d. Direct manufacturing labour efficiency variance

e. Variable manufacturing overhead efficiency variance

f. Production-volume variance

g. Total manufacturing overhead spending variance

23. 管理会计代写

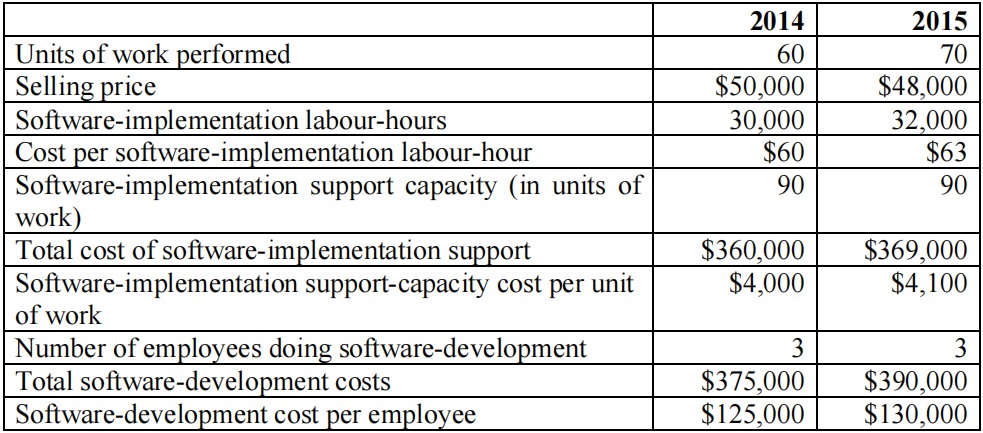

MIS Corporation is a small information-systems consulting firm that specialises in helping companies implement sales-management software. The market for BIS’s products is very competitive. To compete, BIS must deliver quality service at a low cost. BIS bills clients in terms of unites of work performed, which depends on the size and complexity of the sales-management system. BIS presents the following data for 2014 and 2015:

Software-implementation labour-hour costs are variable costs. software-implementation support costs for each year depend on the software-implementation capacity (defined in terms of units of work) that BIS chooses to maintain each year. It does not very with the actual units of work performed that year. At the start of each year, management uses its discretion to determine the number of software- development employees. The software-development staff and costs have no direct relationship with the number of units of work performed.

Required:

1.Is BIS’s strategy one of product differentiation or cost leadership? Explain briefly.

2.Calculate the growth, price-recovery, and productivity components that explain the change in operating income from 2014 to 2015.

3.Comment on your answer in requirement 2. What do these components indicate?

24. 管理会计代写

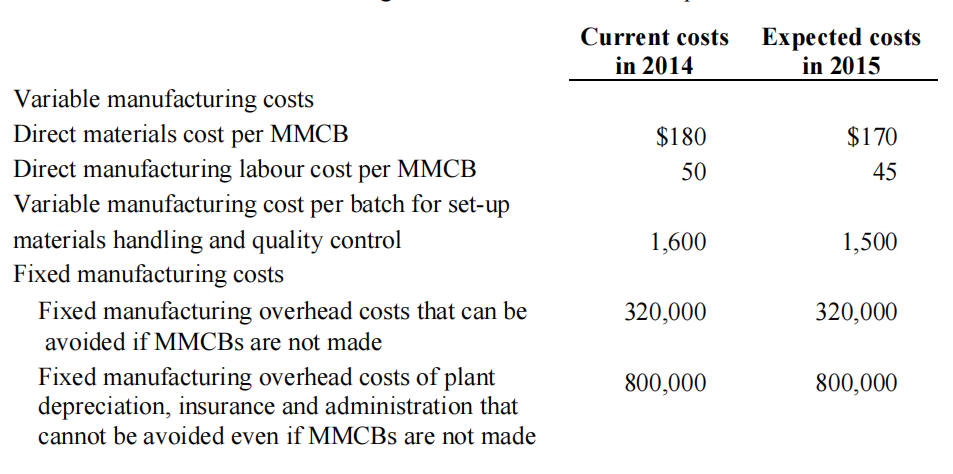

Mobile Tech manufactures mobile modems. It manufactures its own mobile modem circuit boards (MMCBs), an important part of the mobile modem. It reports the following cost information about the costs of making MMCBs in 2014 and the expected costs in 2015:

Mobile Tech manufactured 8,000 MMCBs in 2014 in 40 batches of 200 each. In 2015, Mobile Tech anticipates needing 10,000 MMCBs. The MMCBs would be produced in 80 batches of 125 each.

Cellparts Ltd has approached Mobile Tech about supplying MMCBs to Mobile Tech in 2015 at $300 per MMCB on whatever delivery schedule Mobile Tech wants.

Required

a. Calculate the total expected manufacturing cost per unit of making MMCBs in 2015.

b. Suppose the capacity currently used to make MMCBs will become idle if Mobile Tech purchases MMCBs from Cellparts. On the basis of financial considerations alone, should Mobile Tech make MMCBs or buy them from Cellparts? Show your calculations.

c. Now suppose that if Mobile Tech purchases MMCBs from Cellparts, its best alternative use of the capacity currently used for MMCBs is to make and sell special circuit boards (CB3s) to Chan Ltd. Mobile Tech estimates the following incremental revenues and costs from CB3s:

Total expected incremental future revenues $2,000,000

Total expected incremental future costs $2,150,000

On the basis of financial considerations alone, should Mobile Tech make MMCBs or buy them from Cellparts? Show your calculations.

其他代写: finance代写 homework代写 英国代写 北美作业代写 algorithm代写 analysis代写 app代写 assembly代写 C/C++代写 code代写 CS代写 cs作业代写 Data Analysis代写 essay代写 Exercise代写