PRACTICE QUIZ QUESTIONS

CASH FLOW

现金流代写 1.Which of the following activities increases cash flows from investing activities? a. A decrease in accounts receivable

1.Which of the following activities increases cash flows from investing activities?

a. A decrease in accounts receivable

b. Taking out a long-term loan from a bank

c. Depreciation expense

d. Selling a building

2.Which of the following activities decreases cash flows from financing activities in the cash flow statement?

a. Depreciation expense

b. Paying off a long-term loan from a bank

c. Buying a building

d. An increase in accounts receivable

3. 现金流代写

Which of the following activities increases cash flows from operating activities in the cash flow statement?

a. A decrease in accrued expenses payable

b. A decrease in accounts receivable

c. Depreciation expense

d. Selling a building

e. Two of the above – b and c

4.Which of the following activities decreases cash flows from operating activities in the cash flow statement?

a. A decrease in accrued expenses payable

b. A decrease in accounts receivable

c. Depreciation expense

d. Two of the above

5.The statement of cash flows explains changes in a firm’s:

a. Cash in the bank

b. Cash and cash equivalents

c. Cash, cash equivalents, and accounts receivable

d. Working capital

6. 现金流代写

In a statement of cash flows, interest paid to creditors is classified as a cash flow from:

a. Operating activities

b. Trading activities

c. Financing activities

d. Investing activities2

7.According to the slides we covered in class, companies that are in the “mature” stage of development tend to have positive cash flows from operations

a. True

b. False

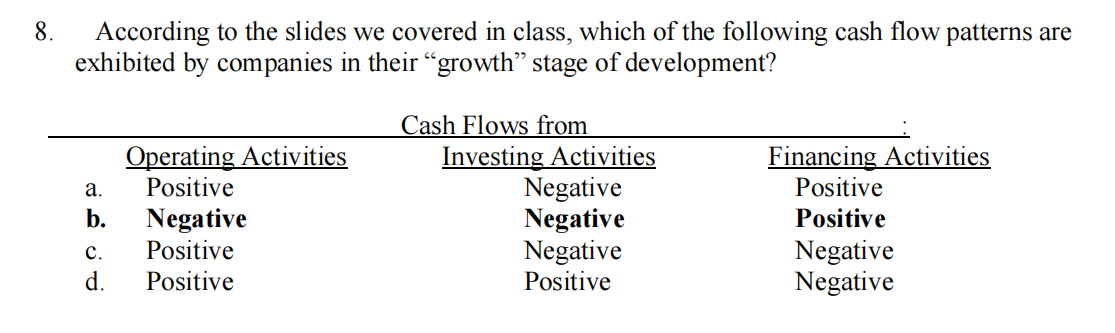

9.

Bradley Company has an accrual basis net income of $90,000 and the following items related to its operating accounts:

Depreciation expense $19,000

Accounts receivable increase 6,000

Inventory decrease 7,000

Accounts payable decrease 4,000

How much is Bradley’s net cash flow from operating activities?

a. $ 87,000

b. $101,000

c. $ 62,000

d. $106,000 = $90,000 + $19,000 – $6,000 + $7,000 – $4,000

10.Chioda Corporation had the following data for 2018:

Net cash flows from operating activities $1,844,000

Current liabilities at January 1, 2018 $2,400,000

Current liabilities at December 31, 2018 $3,200,000

Manta’s operating-cash-flow-to-current-liabilities ratio for 2018 is:

a. 0.56

b. 0.66

c. 0.48

d. 0.42

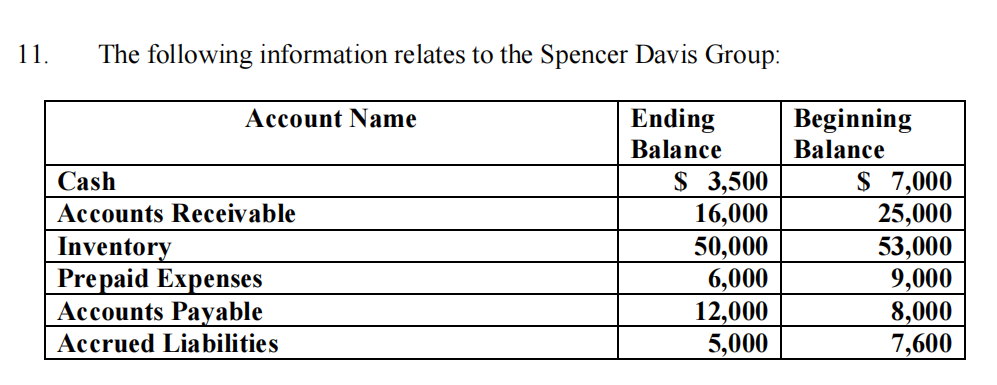

In addition, the company reported net income of $21,000, depreciation expense of $8,600 and a dividend of $3,500. Cash Flows from Operations under the indirect method for this period must have been:

a. $42,500

b. $49,500

c. $37,400

d. $46,000

12.

Miller Company reports a $30,000 increase in inventory and a $10,000 increase in accounts payable during the year. Cost of Goods Sold for the year was $300,000. The cash payments made to suppliers were:

a. $300,000

b. $260,000

c. $320,000 = 300,000 + 30,000 – 10,000

d. $290,000

13.Dodd Inc. had cash sales of $250,000 and credit sales of $500,000. The accounts receivable balance increased $10,000 during the year. How much cash did Dodd receive from its customers during the year?

a. $740,000 = 250,000 + 500,000 – 10,000

b. $760,000

c. $540,000

d. $560,000

14.The beginning balance of Prepaid Interest was $1,800 and the ending balance was $2,600. The Interest Expense account for the year was $8,600. How much cash was paid for interest?

a. $8,300

b. $9,400 = 8,600 + (2,600-1,800)

c. $8,100

d. $8,600

15. 现金流代写

A firm’s cash flow from investing activities includes:

a. Cash received from the sale of a plant asset

b. Cash paid as dividends

c. Cash received from the rendering of services to customers

d. Cash paid to retire bonds payable

16.Which of the following is a cash equivalent for purposes of preparing a statement of cash flows?

a. Accounts receivable

b. Investment in subsidiary company common stock

c. Inventory

d. Investment in a money market fund

17.A firm’s net cash flow from operating activities includes:5

a. Cash received from sale of equipment

b. Cash received from issuance of common stock

c. Cash received from sale of merchandise

d. Cash received as payment of loan from a borrower

18. 现金流代写

To the closest hundredth, which of the following amounts is Ranger’s operating-cash-flow-to-current-liabilities ratio?

a. 2.66

b. 2.50

c. 2.35

d. 3.06

19.To the closest hundredth, which of the following amounts is Ranger’s operating-cash-flow-to-capital-expenditures ratio?

a. 2.66

b. 2.50

c. 2.35

d. 3.06

20.For the current year, Mendez Company’s net cash flow from operating activities is $60,000; its beginning total liabilities were $100,000, and its ending total liabilities were $200,000. The company’s operating-cash-flow-to-total-liabilities ratio for the year is:

a. 0.40

b. 0.30

c. 0.20

d. 0.10

e. None of the above

更多代写:jupyter notebook代写 Statistics统计学网课代考 英国course work课程代写 Argumentative Essay代写 Book Summary代写 时尚管理专业代写