Numerical Methods in Finance: Problem Set 1

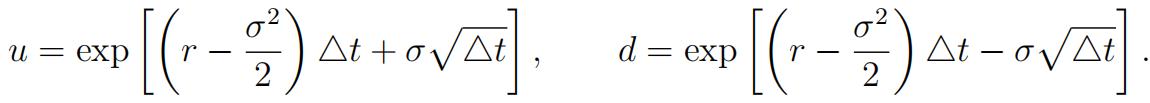

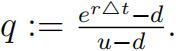

数值方法代写 where r is the riskfree rate, σ is the stock volatility and Δt = Tis the calender time represented by each period in the model.

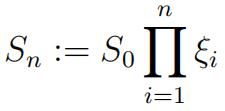

For question 1 to 3, we consider a lattice model where the stock price process is modelled as

with ξi’s being some i.i.d. random variables. For an N -period model to match the first two moments of the risk-neutral stock price dynamics under Black-Scholes model over a time horizon of T , we require

(1)

(1)

where r is the riskfree rate, σ is the stock volatility and Δt = Tis the calender time represented by each period in the model.

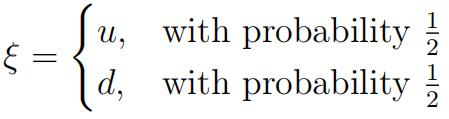

1.Inthe Jarrow-Rudd model, it is assumed that 数值方法代写

with d < 1 < u.

(a)Derivethe expressions of u and d.

(b)Theactual parameters used in the Jarrow-Rudd model are

Justify the above choices by comparing them against your answers in part (a) up to the Δt term.

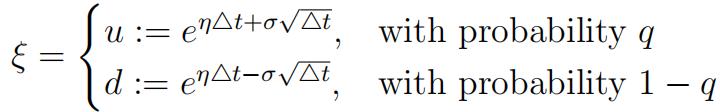

2.Inthe modified Cox-Ross-Rubinstein model, it is assumed that 数值方法代写

for a given parameter η ≥ 0. The risk-neutral probability of an up-move is set to be

Show that the above choices of u, d, q are consistent with the required conditions in (1) up to a certain order of Ot. Does your answer depend on the value of η?

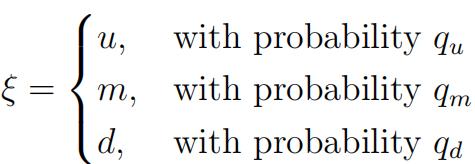

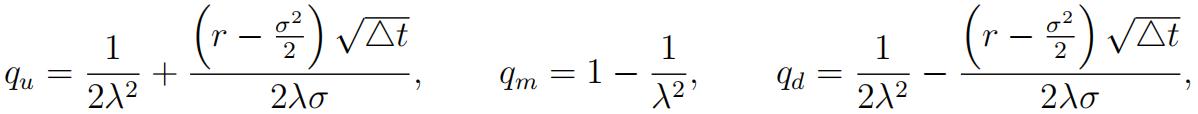

3.Atrinomial tree is constructed if the discrete random variable takes three possible outcomes:

where d < m < u and qu + qm + qd = 1. One possible tree parameters specification is the Kamrad-Ritchken model:

![]()

and

with λ 1 being a given parameter. Show that the above choices of parameters are consistent with (1) up to a certain order of t. Does your answer depend on the value of λ? What happens if λ = 1?

4.Revise the proof of Proposition 1.6 inTopic 1!

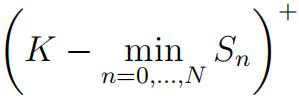

5.Supposewe want to price a fixed strike lookback put option which payoff is given by

using an N -period trinomial tree model (as defined in question 3). Assume further that the tree is symmetric such that ud = 1 and m = 1.

(a)Writedown the expression of sn which represents all possible stock price values at time n under the N -period trinomial tree model. State the range of n and k clearly.

(b)Definea suitable auxiliary variable to solve this pricing With brief justifications, construct a grid for this auxiliary variable. 数值方法代写

(c)Identifyhow the time n + 1 value of your auxiliary variable is linked to its time n value aswell as the time n stock price level Sn. Hence, derive the forward shooting grid functiondescribing how the location index associated with the auxiliary variable in the trinomial tree evolves in each time time.

(d)Writedown the complete algorithm which solves for the time-zero value of the fixed strike lookback put option under the trinomial tree model. Define all the variables you use clearly.

6.Barrieroption is a derivative instrument which payoff is contingent on whether the underlying stock has reached a particular barrier level or not.

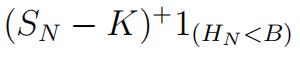

For example, an up-and-out barrier call option ceases to exist whenever the stock price ever reaches the barrier level B (where B > S0) throughout the option’s lifecycle. Its payoff is given by

where Hn := maxi=0,1,…,n Si represents the running maximum of the stock price up to time n. We now want to price this up-and-out barrier option using a standard binomial tree.

(a)TakeIn := 1(Hn<B) as an auxiliary Express In in terms of In−1 and Sn.

(b)LetV n be the fair option value at time n when the current stock price is Sn = sn =S0un−kdk and the current value of the auxiliary variable is In = i. Using (a), write downthe forward shooting grid function describing how the index i evolves in each time step.

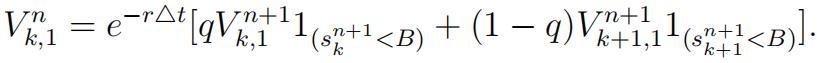

(c)What are the values ofV n k,0 for each k and n? Hence show that

7.Ina similar setup as in question 5, consider a down-and-in barrier put option which payoff is given by 数值方法代写

(K − SN )+1(L ≤B)

where Ln := mini=0,1,…,n Si represents the running minimum of the stock price up to time n. Assume that B < S0.

(a)Take In:= 1(Ln≤B) as an auxiliary variable. Express In in terms of In−1 and Sn. 数值方法代写

(b)LetV n be the fair option value at time n when the current stock price is Sn = sn =S0un−kdk and the current value of the auxiliary variable is In = i. Using (a), write down the forward shooting gird function describing how the index i evolves in each time step.

(c)Writedown the complete algorithm which solves for time-zero value of the down-and-in barrier put option.

(d)Writedown explicitly the recursive equation for V n . Does it depend on V n˜at all for any n˜ and k˜? Explain your results.

更多代写:金融Midterm代考 Gmat代考 金融学Fin代考 金融类paper代写 金融工程论文代写 留学生毕业论文怎么写