Exercises – Lecture 08

1. 投资证券代写

Onshore Bank has $20 million in assets, with risk-weighted assets of $10 million. CET1 capital is $500,000, additional Tier I capital is $50,000, and Tier II capital is $400,000. How will each of the following transactions affect the value of the CET1, Tier I, and total capital ratios? What will the new value of each ratio be?

a. The bank repurchases $100,000 of common stock with cash.

b. The bank issues $2 million of CDs and uses the proceeds to issue category 1 mortgage loans.

c. The bank receives $500,000 in deposits and invests them in T-bills.

d. The bank issues $800,000 in common stock and lends it to help finance a new shopping mall.

e. The bank issues $1 million in nonqualifying perpetual preferred stock and purchases general obligation municipal bonds.

f. Homeowners pay back $4 million of category 1 mortgages, and the bank uses the proceeds to build new ATMs.

2. 投资证券代写

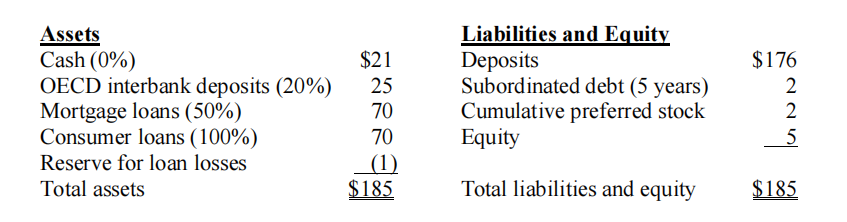

Third Bank has the following balance sheet (in millions), with the risk weights in parentheses.

The cumulative preferred stock is qualifying and perpetual. In addition, the bank has $30 million in performance-related standby letters of credit (SLCs) to a public corporation, $40 million in two-year forward FX contracts that are currently in the money by $1 million, and $300 million in six-year interest rate swaps that are currently out of the money by $2 million. Credit conversion factors follow:

Performance-related standby LCs 50%

1- to 5-year foreign exchange contracts 5%

1- to 5-year interest rate swaps 0.5%

5- to 10-year interest rate swaps 1.5%

a. What are the risk-weighted on-balance-sheet assets of the bank as defined under the Basel Accord?

b. To be adequately capitalized, what are the CET1, Tier I, and total capital required for both off-and on-balance-sheet assets?

c. Disregarding the capital conservation buffer, does the bank have enough capital to meet the Basel requirements? If not, what minimum CET1, additional Tier 1, or total capital does it need to meet the requirement?

d. Does the bank have enough capital to meet the Basel requirements, including the capital conservation buffer requirement? If not, what minimum CET1, additional Tier 1, or total capital does it need to meet the requirement?

3.

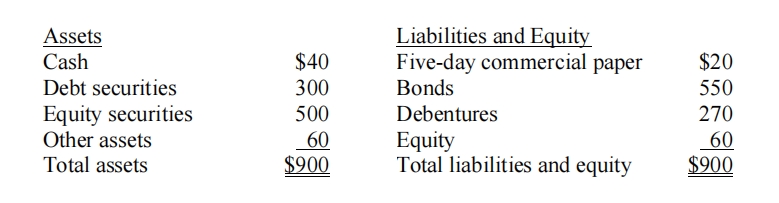

A securities firm has the following balance sheet (in millions):

The debt securities have a coupon rate of 6 percent, 20 years remaining until maturity, and trade at a yield of 8 percent. The equity securities have a market value equal to book value, and the other assets represent building and equipment which was recently appraised at $80 million. The company has 1 million shares of stock outstanding and its price is $62 per share. Is this company in compliance with SEC Rule 15C 3-1?

更多代写:cs多伦多大学代考 proctorio作弊 英国宏观经济学网课代上 法律essay代写 代做Assignment 动力学课业代写