Black Hills State University

School of Business and Natural Science

Exam III (Part 2) – Spring 2019

投资代考 You are a manager of Third Capital mutual fund. You can only invest in 2 stocks and 1 T-bill because of restrictions in your company.

BADM-411: Investments 投资代考

- You are a manager of Third Capital mutual fund. You can only invest in 2 stocks and 1 T-bill because of restrictions in your company. Risk-free rate is 5%. You have information about two stocks’ expected return, standard deviation and covariance among these two stocks, and found the tangency portfolio using these information. Expected return of the tangency portfolio is 7.16 and its standard deviation is 10.15%. The weight of each stock in the tangency portfolio is as follows: (15 points)

| Stock | Weight |

| A投资代考 | 56.8% |

| B | 43.2% |

| Total | 100% |

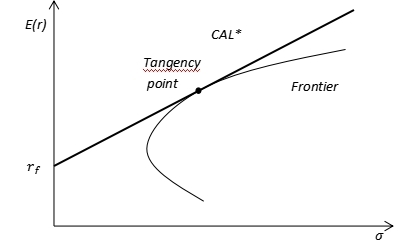

a.Now, you would like to create the preferred portfolio formed from a risky (tangency) portfolio and a T-bill, and you must yield an expected return of 5.29%. What is the proportion invested in the T-bill and the tangency portfolio? What is standard deviation of your preferred portfolio you can achieve? (Hint: consider the following CAL graph) (8 points)

b.For the standard deviation of your preferred portfolio that you obtained from part (a), what is the overall asset allocation of the T-bill and each of the two stocks? (7 points)投资代考

2.Karen Kay, a portfolio manager at Collins Asset Management,

is using the capital asset pricing model for making recommendations to her clients. Her research department has developed the information shown in the following exhibit. (15 points)

| Security | Expected Return | Standard

Deviation |

Beta |

| A | 12% | 15% | 0.8 |

| B | 16% | 9% | 1.4 |

| Market Return | 13% | 10%投资代考 | |

| Risk-Free Rate | 5% |

a.With regard to Securities A and B only, which security has the smaller total risk? (2 points)

b.With regard to Securities A and B only, which security has the smaller systematic risk? (2 points)

c.Compute the Jensen Alpha for Securities A and B. (5 points)投资代考

d.Identify and justifywhich of the 2 stocks would be more appropriate for Karen who would like to make her very first investment in the financial market. (6 points)

e.Draw the Security Market Line (SML), labeling each axis, rf, and the slope of the SML. Indicate where securities A and B are located on the graph. (6 pts)

3.Suppose that you SHORT FIVEMay 2016 Gold futures contracts at the opening price of $1,119.40/oz on May 4, 2019. 投资代考

You close out your position on May 8, 2019 at a price of $1,110.50/oz. The initial margin and the maintenance margin requirements are $4,400 per contract and $4,000 per contract, respectively. Contract size is 100 troy ounces per contract. Assume that you deposit the initial margin in cash for the FIVE contracts sold and did not withdraw the excess on any given day. (15 pts)

a.Complete the table below given the following daily settlement prices. (9 points)

| Day | Settlement

Price ($/oz) |

Beginning

Balance |

Total Daily

Profit / Loss |

Margin Call

Deposits |

Ending

Balance |

| May 4, 2019 | $1,120.20 | ||||

| May 5, 2019 | $1,118.80 | 投资代考 | |||

| May 6, 2019 | $1,135.00 | ||||

| May 7, 2019 | $1,130.00 | 投资代考 | |||

| May 8, 2019 |

b.What is your total profit (loss) on the contracts you sold? (2 points)投资代考

c.What is your percentage return based on the amount put up as margin? (2 points)

d.If, on May 8, 2016, you chose to deliver the gold, what would you receive and what would you be delivering? State clearly the transactions and the dollar amount involved. (2 points)

4.Consider a European call and a European put on a stock that pays no dividends. Both options have a strike price of $525 and expire 1 year from now. 投资代考

Assume the call costs $10 and the put costs $30. The risk-free rate is 5% per year. (15 points)

a.What is the price of the stock? (7.5 points)

b.What is the price of a futures contract on the stock with a maturity of 1 year? (7.5 points)

其他代写:代写CS C++代写 java代写 r代写 matlab代写 web代写 app代写 作业代写 考试助攻 金融经济统计代写 物理代写 数学代写