GLOBAL INVESTMENTS – FINAL IN-CLASS PROJECT – TUESDAY APRIL 23, 2019

GLOBAL INVESTMENTS代写 his is an INDIVIDUAL project, although you can share ideas with your neighbor the portfolio and written analysis is yours alone.

This is an INDIVIDUAL project, although you can share ideas with your neighbor the portfolio and written analysis is yours alone.

You are assigned the task of creating an investment strategy for a trust find. GLOBAL INVESTMENTS代写

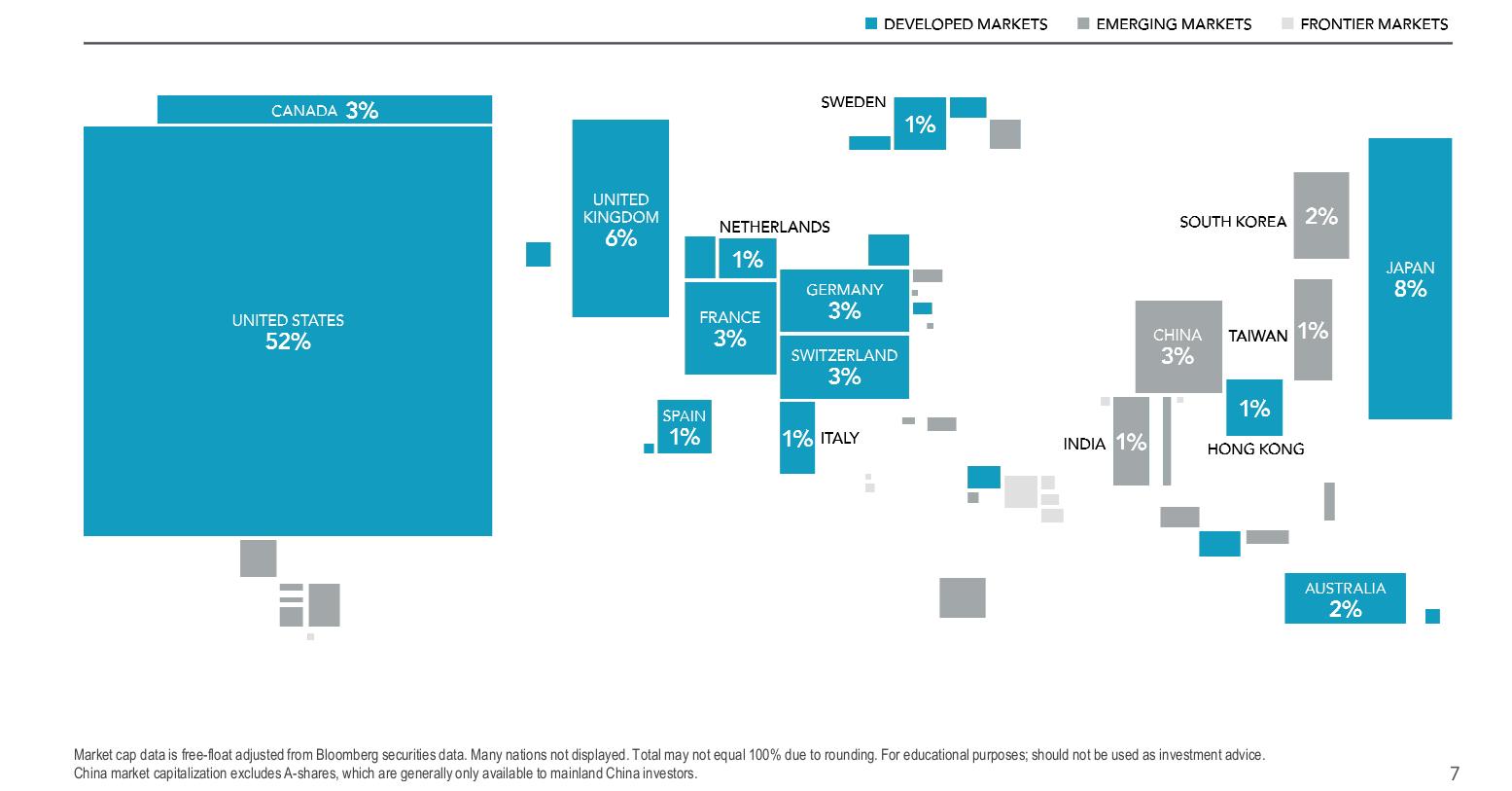

The CIO of the Fund has requested a global approach (this can include US allocations but cannot be greater than the global market capitalization from the chart below). You can place larger allocations than the 8% in Japan if you choose but US should not be greater than 52%. The accompanying spreadsheet will be used to make your manager/allocation decisions. The goal is to attain an 8% return while keeping overall portfolio risk (Standard Deviation) between 10 – 14%.

The exercise is to build a recommended portfolio for the CIO. You can use ETF’s Mutual Funds, Individual Stocks, REIT Funds, or any other asset class to build you portfolio/recommendation. You can combine various ETF’s to arrive at an allocation to a particular asset class (there spreadsheet tab titled ETF Allocation will provide some insight. This is a long-only exercise so avoid levered ETFs’.

You will write a 1-2 page 1.15 point recommendation that describes your approach/strategy and (1) why you are making that overall asset allocation recommendation and (2) why you selected the ETF’s, mutual funds etc you did. There are 10 allocations on the spreadsheet you will use all of them. You can research data from any site you deem appropriate. You will need to assess an ETF’s exposure to US vs non-US and compile that in arriving at your recommendation, see US-Non US tab on spreadsheet. GLOBAL INVESTMENTS代写

The data you use for your analysis MUST be consistent. For example if you are using ETF’s try to use all periods ending March 31, 2019 and MUST be three years of monthly data. You will need to create a historical view of your managers so the numbers in the spreadsheet need to be accurate and the same periods to build your individual portfolio. There are explanations in the spreadsheet.

You will need to: GLOBAL INVESTMENTS代写

- Secure return or monthly pricing data OR use the return and risk data provided by the fund you are using for your investment choices and input that data into the spreadsheet

- Review the Return and Risknumbers for consistency and reasonableness

- Calculate the excess return from the benchmark to build the correlation matrix.

- Install the data analysis function in excel.

a.File

b.Options

c.Add-ins

d.Analysis ToolPak

e.GO

f.Check the Analysis TookPack then OK.

g.The tab will appear in the Data tab “Data Analysis”

5.Highlight the excess return click Data Analysis, Correlation to run the correlation numbers

6.Then you have the three data points for the analysis to pull into the Eff. Frontier Tab.GLOBAL INVESTMENTS代写

The final component is determining your allocations of capital to your investment decision to meet the CIO’s objectives. You must identify the asset classes in the spreadsheet to adhere to the Investment Policy Objectives. The constraints that apply to the investment allocation are below:

The policy allows for asset allocation target range (constraints) for investments as follows:

Minimum – Maximum Allocations

- Equities: 25% – 55% (including sector, country funds, active, index investments, growth, value styles)

- Fixed Income

15% – 30% (including corporate, sovereign, US treasuries, high yield max. allocation is 5%, EMD.

- Alternative Investments

25% – 45% (including global commodities, hedge fund, private equity, REITS)

When you are completed you will send me an email with the written analysis and spreadsheet.

Some thoughts approaches for portfolio construction: GLOBAL INVESTMENTS代写

- Determine the Funds (Managers)

a.Based on the investment strategies and assets managed

b.Using Ishares, Powershares, Morningstar, Spiders, Mutual Fund complexes such as Fidelity, Vanguard etc. list of investment options.

2.Apply the constraints

a.The efficient frontier spreadsheet under correlations identifies asset class by color coding, green- equities; orange – fixed income; blue – alternatives.

b.If you deem a sector/country/hedge fund or other investment to be in a different asset class identify in the spreadsheet with your submission.GLOBAL INVESTMENTS代写

3.Meet the Risk/Return objective

a.Applying the asset constraints from the project to each asset class meet the overall investment objective or 8 – 10% return and risk below 10 – 14% for your submission.

Grading for Global Investments final project

Submission is via email to me following class, including the overall analysis and thoughts along with the optimization spreadsheet.

The quality and content of the introductory memo regarding the pros/cons of international investing.GLOBAL INVESTMENTS代写

- Manager selection process including your thoughts on manager selection (EFT, Mutual Fund, or REITS).

- Proposal must meet risk/return objectives of the CIO as outlined in the assignment.

- Identify portfolio in spreadsheet as your allocation choice. This will drive the risk/return calculations to arrive at the total strategy expected risk/return.

- The Investment allocations must adhere to the policy constraints (minimum/maximum) when making your recommendation.

其他代写:algorithm代写 analysis代写 app代写 assembly代写 assignment代写 C++代写 C/C++代写 code代写 course代写 dataset代写 finance代写 java代写 java代写 web代写 北美作业代写 编程代写 考试助攻 北美作业代写 program代写