Real Estate Finance Exam

房地产金融考试代写 Cap rate is widely used to value commercial real estate properties, because it equals the expected return for real estate properties.

- There are a total of 200 points to be scored on the exam.

- You have 180 minutes to take the exam. Good luck!

- You need to return exam questions.

Part I (Total 50 Points) 房地产金融考试代写

True-False/Short-Answer Questions

Q1 (5 points) Discuss whether the following statement is true or false and provide a brief argument in support of your answer:

Cap rate is widely used to value commercial real estate properties, because it equals the expected return for real estate properties.

Q2 (5 points) Discuss whether the following statement is true or false and provide a brief argument in support of your answer:

The best investment strategy in real estate is to invest in senior debt, because it provides excess yield while the risk is low. 房地产金融考试代写

Q3 (5 points) Discuss whether the following statement is true or false and provide a brief explanation in support of your answer:

Suppose that the historical market risk premium rM – rf is 6% and the risk-free rate rf is 4%. Assume that β for mortgage is 1. Assuming CAPM holds for this mortgage. We may then conclude that the mortgage rate is 10%.

Q4 (5 points) Discuss whether the following statement is true or false and provide a brief explanation in support of your answer:

Suppose two hotels trade at the same cap rate. It implies that the expected growth rate of NOI for both properties are the same.

Q5 (10 points) Provide a short answer to this question

You own a piece of vacant land with a development rights for a hotel. Suddenly you learn that while the expectation concerning hotel prices next year remain the same, there is more uncertainty about where the exact value will be. What is likely to happen to your land value? 房地产金融考试代写

Q6 (10 points) Provide a short answer to this question

A few years ago, a borrower bought a property at $500M. He .financed the purchase with 80% LTV via an interest only mortgage with the rate of10%. That is, the loan balance is $400M in each year after paying interest of $40M. The current prop- erty value is only $350M, which is less than loan balance of $400M. The borrower declares default and hands over the property to the lender. The borrower’s main ar- gument for his decision is that the value of equity is $350M-$400M=-$50M, which is less than zero. Do you agree with the argument for the borrower’s decision?

Q7 (10 points) Provide a short answer to this question

You, the manager of a pension fund, just invested $100M in a real estate pri- vate equity distressed fund as the only limited partner (LP). For simplicity of your calculation, assume that the holding period of the investment is one year. The preferred (target) return for you, the LP, is 12%. The general partner (GP) con- tributes no capital. After reaching the target return of 12% for investors, LP and GP split the surplus in excess of $112M equally (50:50) until the GP captures 20% of the pro.fit, de.fined as the di.fference between the exit value (made in Year 1) and your investment $100M. How much does GP make if the realized exit value in Year 1 for the fund is $115M?

Part II (Total 50 Points)

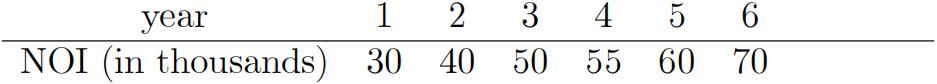

Consider two income producing properties: Building A and Building B. For both properties, the projected net operating incomes (NOIs) over the next six years are the same. The numbers are given by

For example, in Year 1 (one year from now), the NOI will be 30. Assume that the NOIs will be “stabilized” starting from Year 6 for both properties. By “stabilized” NOI, I mean that NOI is projected to grow at a constant rate g on average (Of course, cash flows are still risky). Today, you are considering whether you will buy either A, or B, or both, or neither. (You have a deep pocket. NPV is the only criterion you are using for purchase.). If you indeed buy today, you plan to exit by selling at the end of Year 6 (You will be collecting the NOI in Year 6 before selling). (Assume NOIs approximatecash flows very well and hence you may treat these two concepts synonymously for this exercise. That is, we will discount NOIs throughout this exercise.) 房地产金融考试代写

Suppose the market risk premium is rM -rf = 5%. The annual volatility of the stock market return CYM is 15%. For both properties, the return correlation with the market portfolio p is 0.4. The annual volatility of the returns for both properties CY is 30%.

Part A. (10 pts) To construct a sensible measure for going-in and going-out cap rates, you need to estimate the cost of capital. Let the risk-free rate rf be 2%. What is /3 forthe properties? What is the expected return (cost of capital) r for the properties? (The # are the same for both properties.)

Part B. (10 pts) Building A is expected to generate 70K in NOI starting from Year 6 and for all future years.

That is, g = 0 for Building A. What is the going-out cap rate at the end of Year 6? What is corresponding sale price at the end of Year 6 (not including NOI in Year 6) for Building A? If the current purchase price is $1,000K, what is the internal rate of return for this investment? What is the implied going-in cap rate cA for Building A, using the purchase price $1,000K?

Part C. (10 pts) Now compute the highest price that you are willing to pay (under yourassumptions about the discount rate, cash flow growth rates and projected NOIs). Call this value VA, which also measures the “true” value of the property. Then, calculate the net present value of your transaction by taking the difference between VA, the value that you think the property is worth, and the price $1,000K you are paying for the property. Will you buy Building A? Why or why not? 房地产金融考试代写

Part D. (10 pts) Suppose that BuildingB has a higher economic depreciation schedule than Building A does.

Assume that its NOI from Year 6 and onward will be stabilized with a growth rate -2% (note that g is negative 2%). Then, what is the going-out cap rate and the corresponding property value at the end of Year 6 (not including NOI in Year 6) for Building B? Will you still purchase Building B today for $1,000K? Why or why not? If not, what is the highest price you are willing to pay (as usual, under all the assumptions you have made)? Call this value VB. What is the implied going-in cap rate cB at purchase price VB?

Part E. (10 pts) Suppose that the risk-free rate is 3%, not 2%, as we have assumed so far. (Keep the market risk premium to be rM – rf = 5%.) Nothing else changes. Recalculate the “true” property values VA and VB for Building A and Building B.Whichproperty suffers a greater loss in dollar amount due to a higher interest rate? Provide a brief explanation.

Part III (Total 55 Points) 房地产金融考试代写

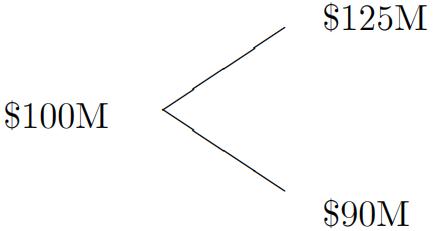

Consider a property. It will either go up 25% in Year 1 or decrease 10% in Year 1 (NOIs are included in the property values). The probability of going up is 60% and the probability of going down is 40%. The current property in Year 0 is trading at $100M. The risk-free rate is 4%. The property value (including the NOIs) evolves as follows:

For illustrational purposes, we have assumed that the world can only take two pos- sible outcomes in Year 1 (“up” or “down”). While this assumption appears restrictive and unrealistic, we can relax this assumption by repeating the tree many times and use Black-Scholes as you see in the class.

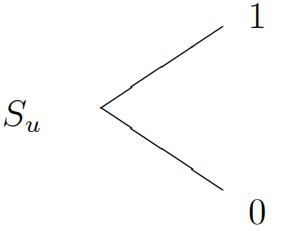

For calculational simplicity, we will use Su to denote today’s value for security U that pays investors a dollar in Year 1 if and only if the property does well (“up” state). The following tree depicts the payoff for this security.

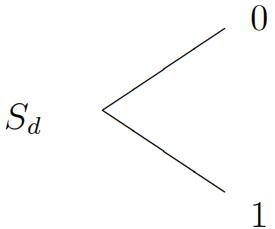

Similarly, we use Sd to denote the current value for security D that pays investors a dollar in Year 1 if and only if the property depreciates (“down” state). Namely,

Q1 (10 points) Assumning no arbitrage, use the property values and the risk free to find values of Su and Sd implied by no arbitrage.

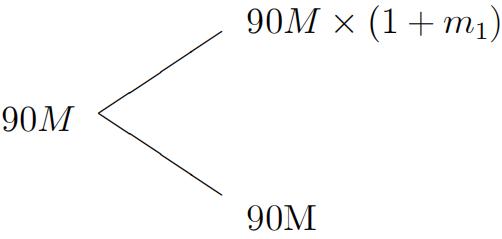

Q2 (10 points) Now suppose that you are taking out a mortgage with an LTV 90%. When the bank fails to collect the mortgage, the bank will foreclose your property and sell your property for $90M. Let m1 denote the corresponding mortgage rate. That is, the payoff of the mortgage is given below:

Calculate the fair (e.g. equilibrium implied by no arbitrage) mortgage rate m1.

Q3 (5 points) Calculate the expected return on equity rE and the expected return on the mortgage.

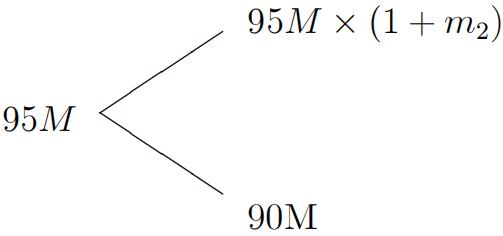

Q4 (10 points) Now suppose that you still take out a mortgage but with an LTV 95%. When the bank fails to collect the mortgage, the bank will foreclose your property and sell your property for $90M. Let m2 denote the corresponding mortgage rate. That is, the payoff of the mortgage is given below:

Calculate the fair (equilibrium) mortgage rate m2.

Q5 (10 points) Recalculate the expected return on the mortgage (when LTV is 95%). Compare it with the expected return on the mortgage when LTV is 90%. Which one is bigger and why?

Q6 (10 points) Now suppose that you are taking out a mortgage with an LTV 95% but you put an additional personal guarantee of $2M. When the bank fails to col- lect the mortgage, the bank will foreclose your property and sell your property for

$90M and obtain your $2M personal guarantee. Let m3 denote the corresponding mortgage rate. Calculate the fair (equilibrium) mortgage rate m3 for this loan. Compare it with the one you computed in Q4 for the mortgage with LTV=95% but with no personal guarantee. Which one is bigger and why?

Part IV (Total 20 Points)

You consider purchasing an office property now (Year 0). You estimate that the next year’s NOI (Year 1) is $5M. Suppose that the market risk premium rM – rf is 4%. Let the long term risk-free rate rf be 4%. (The yield curve is flat.) Suppose /3 = 1.5 if the property is unlevered. (You use the office industry REITs beta to estimate the riskiness of this office building.) Suppose that the property NOI is expected to grow each yearby 5% (g = 5%). So the expected NOI in Year 1 is $5M, the expected NOI in Year 2 is$5M X (1 + g) and so on.

Q1 (5 points) Use CAPM to compute the cost of capital (the expected return) r for this property. What is the cap rate for this property?

Q2 (5 points) If using all equity to purchase the asset and holding the asset indefi- nitely, what is the value of this property as of Year 0?

Q3 (10 points) You do not want to buy the asset with all equity for reasons such as diversification or shortage of equity funds. You take out a 20-year fully amortizing (constant payment) fixed rate mortgage with a mortgage balance $100M at an annual mortgage interest rate 10%. (To save your time, assume you only need to pay mortgage once a year and ignore the monthly compounding) What is the annual mortgage payment? How much of the first mortgage payment goes to repayment of the principal?

Part V (Total 25 Points) 房地产金融考试代写

You are financing the acquisition of San Francisco Properties (SFP). For the simplicity of your analysis, assume away all tax complications. (That is, you can assume that before-tax cash flows are equal to after-tax cash flows.) To start off as the baseline analysis, you have estimated that the cash flows generated by SFP is $40M in perpetuity in expectation (so g = 0), starting in Year 1 (one year from today). You have also estimated the annual cost of capital for SFP, if fully funded by equity, to be 8%.

You have raised the following two types of debt: senior debt and mezzanine debt. In addition, you have also found a partner who contributed $60M and in exchange received 60% equity stake. Call this portion outside equity. Your equity position is also referredto as inside equity. Inside and outside equity have same seniority (any equity cashflows are split in function of equity contribution) The senior debt is an interest-only 20-year mortgage with a principal of $250M at a mortgage rate 4%. The mezzanine debt is an interest-only 20-year mortgage with a principal of $150M at mortgage rate 6%. 房地产金融考试代写

Note that the total amount of funds raised by the two forms of debt is $400M ($150M+$250M) in total. For this problem, you can assume that the strict absolute priority rule is enforced. That is, the senior creditor has to be paid first before the mezzanine investor ever gets paid a penny.

Q1 (5 points) What is the value of the property without leverage? How much your own equity do you need to contribute?

Q2 (5 points) What is the debt service coverage ratio (DSCR) for the senior debt? What is the debt service coverage ratio for the mezzanine debt in Year 1 (that is DSCR of a combined senior and mezzanine debt)?

Q3 (5 points) After having done the benchmark case analysis, you decide to do a sensitivity analysis. Suppose the realized cash flow in Year 1 is $25M. How this cashflow is distributed between senior debt, mezzanine debt, outside equity, and your claim?

Q4 (10 points) Draw the capital structure box to illustrate the seniority of the claims, including all claims in the capital structure box. Use the convention where senior claims sit on top. Also Draw the payoff diagram in Year 1 for each claim (se- nior/junior debt, inside and outside equity) as a function of cash flow in Year 1. Label all axes and highlight the slope of each segment for each claim on the graph.