Name

University

Course

Tutor

Date

房地产经济学论文代写 It is important for an overseas investor to assess a variety of factors before deciding on investing in the highly volatile market.

Real Estate Economics

1.0 Introduction

The objective of this report is to provide information concerning the rental volatility of commercial property markets across various sectors in the U.K. The intention of the report is to assist an overseas investment client willing to invest in the U.K commercial property market make investment decisions. 房地产经济学论文代写

Real property is defined as land or resources embodied in land, neither of which are physically moveable, and distinguishes the land from other factors of depression. Real property is distinguished by heterogeneity in which each property is unique, and this assists the creation of valuation. Other features of a real estate include a fixed vocation, price inelastic supply, transaction costs, liquidity, high unit value, price determination, long time holing, and information symmetry (Barras, 1994: 185).

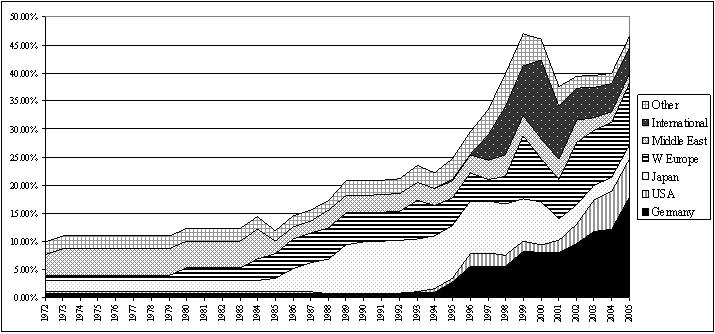

Fig: 1: Non-domestic ownership of the city of London

Source: Lizieri, C. 2010

译文:

房地产经济学

1.0 介绍

本报告的目的是提供有关英国各个行业商业地产市场租金波动的信息。该报告的目的是帮助愿意投资英国商业地产市场的海外投资客户做出投资决策。

不动产被定义为土地或包含在土地中的资源,两者均不可物理移动,并将土地与其他压抑因素区分开来。 不动产的特点是异质性,其中每个财产都是独一无二的,这有助于创建估值。 房地产的其他特征包括固定职业、价格无弹性供应、交易成本、流动性、高单位价值、价格确定、长期持有和信息对称(Barras,1994:185)。

图:1:伦敦市的非住宅所有权

资料来源:Lizieri, C. 2010

1.1. Aim and Scope

The purpose of this report is to first; explain why the commercial property markets in the U.K. display rental volatility, and second; explain why the amplitude of the volatility varies by property sector. The scope of the report is to discuss the U.K’s real estate market with a focus on office, retail, and industrial property. The report identifies factors that need to be considered while making investment decisions and gives recommendations to the overseas property investor. The following issues are covered:

- How cycles are generated

- Investment and development markets and the wider economy

- How volatility of rents vary by sector

- Why volatility of rents vary by sector

译文:

1.1. 目标和范围

本报告的目的是首先; 解释为什么英国的商业房地产市场显示租金波动,其次; 解释为什么波动幅度因房地产行业而异。 报告的范围是讨论英国的房地产市场,重点是写字楼、零售和工业地产。 该报告确定了在做出投资决策时需要考虑的因素,并向海外房地产投资者提出建议。 涵盖以下问题:

- 循环是如何产生的

- 投资和开发市场以及更广泛的经济

- 租金波动如何因行业而异

- 为什么租金波动因行业而异

1.2.Research Methodology

To provide a comprehensive report and give the most appropriate recommendation, data will be gathered from secondary sources and these include company website publications, class reference materials, and peer reviewed journals, which carry relevant information for this research. Case studies of commercial property investment firms like JLL, CBRE, DTZ, AtisReal, Knight Frank, and Colliers are included. 房地产经济学论文代写

1.3. Limitations of the report

The information presented here is done in consideration of the U.K. commercial property market in the sectors of office, retail, and industrial sectors. Therefore, the information may not necessarily apply to other nations’ markets or other sectors.

译文:

1.2.研究方法

为了提供全面的报告并给出最合适的建议,数据将从二手来源收集,其中包括公司网站出版物、课程参考资料和同行评审期刊,其中包含与本研究相关的信息。 包括 JLL、CBRE、DTZ、AtisReal、Knight Frank 和 Colliers 等商业地产投资公司的案例研究。

1.3. 报告的局限性

此处提供的信息是在考虑到英国办公、零售和工业部门的商业房地产市场的情况下完成的。 因此,这些信息不一定适用于其他国家的市场或其他部门。

1.4. K’s Commercial Property Market Overview

Substantial literature debate about nature and magnitude of risk associated with commercial property markets (Shaun, 2001: 2). Property market values fluctuate in irregular patterns in the U.K. A study into the nation’s macroeconomic factors provides a comprehensive explanation on the nature volatility of the commercial property. This is as a result of factors like changes in the country’s GDP, consumers’ expenditure, employment in the service sector, and industrial output which are all related to, and impact the demand for commercial real estate (Barras, 1994: 189). Unlike residential property which has an intrinsic reservation value and can still provide accommodation to the owner, the value of commercial property is determined by the value of future rents and therefore this value is likely to be affected by the business environment and economic situation (Zhu, 2004: 1).

译文:

1.4. K’S 商业地产市场概览

关于与商业房地产市场相关的风险的性质和程度的大量文献辩论(Shaun,2001:2)。 英国的房地产市场价值以不规律的模式波动。一项对国家宏观经济因素的研究为商业地产的性质波动提供了全面的解释。 这是由于国家 GDP、消费者支出、服务业就业和工业产出等因素的变化,这些因素都与商业房地产的需求相关并影响着商业房地产的需求(Barras,1994:189)。 与具有内在保留价值且仍可为业主提供住宿的住宅物业不同,商业物业的价值取决于未来租金的价值,因此该价值很可能受到商业环境和经济形势的影响(朱, 2004 年:1)。

According to Lizieri, et al. (1998: 339), a market that is subdivided into distinct regimes which exhibit different behaviors cannot have its performance measured through linear models.

Real estate markets fall into this categorization because they are considered to be cyclical in nature (Brown, 2000: 4). The structure of the U.K real estate market is characterized by boom and bust phases of market behavior. During a downturn, the property values may fall sharply and with less volatility than when they rise in an upturn (Lizieri et al., 1998: 339). 房地产经济学论文代写

The yield for the U.K real estate market stopped increasing in the summer 2009. Moreover, investors have become more active although selective depending upon the quality of stock and income security, fewer supply transactions, and equity driven transactions. Any investors willing to invest in the U.K should be aware of the property debt, government debt, and the household sector debt. When the U.K. government borrows over 10 percent GDP, the tax increases and spending reduces. Eventually, the interest rates begin to rise and it is predicted that the disposable income after tax and debt-servicing will fall in the years 2010 to 2011.

译文:

根据 Lizieri 等人的说法。 (1998: 339),一个细分为不同制度并表现出不同行为的市场不能通过线性模型来衡量其表现。

房地产市场属于这一类别,因为它们被认为具有周期性(Brown,2000:4)。英国房地产市场的结构特点是市场行为的繁荣和萧条阶段。在经济低迷时期,财产价值可能会急剧下降,而且波动性比上升时期上升时更小(Lizieri et al., 1998: 339)。

英国房地产市场的收益率在 2009 年夏季停止增长。此外,投资者变得更加活跃,尽管取决于股票和收入安全的质量、供应交易减少和股权驱动交易的选择。任何愿意在英国投资的投资者都应该了解房地产债务、政府债务和家庭部门债务。当英国政府借款超过 GDP 的 10% 时,税收增加,支出减少。最终,利率开始上升,预计 2010 年至 2011 年税后和偿债后的可支配收入将下降。

2.0. Commercial property markets in the U.K. and rental volatility

Commercial property markets in the U.K display rental volatility and this is influenced by macroeconomic issues. In the office markets, major cycles in rent occurred in the early 1970s and late 1980s. The amplitude of fluctuation also varies from one part of country to another. Nevertheless, the real office rents in London have not remarkably changed over the 1970-2007 period. A major factor is the strength of the user market, because the use or potential use of the property determines both the property and investment value.

译文:

2.0. 英国的商业房地产市场和租金波动 房地产经济学论文代写

英国的商业房地产市场显示租金波动,这受到宏观经济问题的影响。 在写字楼市场,租金的主要周期发生在 1970 年代初和 80 年代末。 波动幅度也因国家而异。 尽管如此,伦敦的实际写字楼租金在 1970-2007 年期间并没有显着变化。 一个主要因素是用户市场的强度,因为物业的用途或潜在用途决定了物业和投资价值。

Therefore the level of demand and supply determines the rental value.

The factors affecting rent include the changes in the productivity of capital, cost of production changes, and the market for the goods and services that are being produced in that property. The rental offers are also affected by the length of lease, occupation obligations, and the recent rent review period. 房地产经济学论文代写

Property market fluctuations that were experienced especially in the 1980s are linked to macroeconomic factors and the ability is the development sector to be able to meet the changes in demand is the property. The cyclical effect of the business cycle drives the demand side of the market for the property users. However, lags in the development process and inflexibility of the built stock result in the supply being unable to immediately respond to the changes in demand. Moreover, the slow adjustment in the supply can result to an erratic swing in erratic swings in the rental cycle.

译文:

因此,需求和供应水平决定了租金价值。

影响租金的因素包括资本生产率的变化、生产成本的变化以及在该财产中生产的商品和服务的市场。 租金报价还受到租赁期限、占用义务和最近的租金审查期的影响。

特别是在 1980 年代经历的房地产市场波动与宏观经济因素有关,开发部门能够满足需求变化的能力是房地产。 商业周期的周期性效应推动了物业用户市场的需求侧。 然而,开发过程的滞后和建筑库存的不灵活导致供应无法立即响应需求的变化。 此外,供应的缓慢调整可能导致租赁周期中不稳定的波动。

Development of Cycle

Interactions occur between the property market and macroeconomics. A building boom can be generated by the interaction of the building cycle, the credit cycle and the overall long cycle of development in the property market. In a strong economic upturn, and where there is relatively a shortage of space, demand of space goes up and this increases the rent value. In turn, the yield reduces as the capital value increases. 房地产经济学论文代写

Consequently, the profitability of development rises as new buildings are started. In the process, if credit expansion occurs, the interest rates fall and this reinforces economic growth as banks begin to finance any speculative developments. However, the building boom is always underway but there is always little new supply in the market because of time lags. In macroeconomics, this stage is marked with a rise of inflation and interest rates rise to control the inflation. Afterwards, the macro cycle moves into a downswing and the new space supply reaches the market as the demand levels off such that the value of rent and capital falls.

译文:

发展周期

房地产市场和宏观经济之间发生相互作用。建筑周期、信贷周期和房地产市场整体长周期的相互作用可以产生建筑热潮。在经济强劲好转且空间相对短缺的情况下,空间需求上升,这会增加租金价值。反过来,收益率随着资本价值的增加而减少。

因此,随着新建筑的开工,开发的盈利能力上升。在此过程中,如果发生信贷扩张,利率会下降,这会加强经济增长,因为银行开始为任何投机性发展提供资金。然而,建筑热潮总是在进行中,但由于时间滞后,市场上的新供应总是很少。在宏观经济学中,这个阶段的标志是通胀上升和利率上升以控制通胀。之后,随着需求趋于平稳,租金和资本的价值下降,宏观周期进入下行趋势,新的空间供应进入市场。

Amplitude of the volatility varies by property sector

The rental volatility of commercial property markets vary from one sector to the other. Rental value varies by selection, quality, and the use sub-market. This section studies the office, retail and industrial as sub-markets that showcase variation in rent values.

译文:

波动幅度因房地产行业而异

商业物业市场的租金波动因一个部门而异。 租金价值因选择、质量和使用子市场而异。 本节研究作为展示租金价值变化的子市场的写字楼、零售和工业。

I.Office

Office markets are not simply by-product of space demand from the producer services firms but are and investment asset and a store of value (Dunse and Jones, 2002: 159). Office markets assist in determining demand, and expose cities to volatility in the global market scenes; for instance, occurrences of offices in the international financial centers where supply, space, investment and financial markets are locked together through financial specialization in economic activity, financial ownership of space, and provision of equity and debt for investment and development. 房地产经济学论文代写

In office markets, there is usually a limited supply of space and the space does not seem to be impacted by the anticipated rent (Lizieri et al., 1998: 341). Instead, periods of intense building activity camouflaged by periods of inactivity are observed. Furthermore, construction begins the lag real increase in rent. When there are fluctuations in demand and these fluctuations are allied to short term inelasticity inn supply, rental fluctuations are produced in form of pronounced building cycle. 房地产经济学论文代写

The building cycle results to extreme swings in capital and rent values (Dunse & Jones, 2002: 159). The cyclicality of office markets is usually cited as one that indicates irrational behavior by lenders and developers. A developing work body therefore seeks to combine the real options models and game theory in order to explain the behavior of the economic agents in the development process.

The global credit crisis significantly impacted the office markets especially in London, Dublin, and Madrid. Rents fell since the year 2007, and this followed the dramatic increases that occurred the previous years (Lizieri, 2010). Nevertheless, some markets have started showing rental increases, for instance, the West End, city, and Docklands.

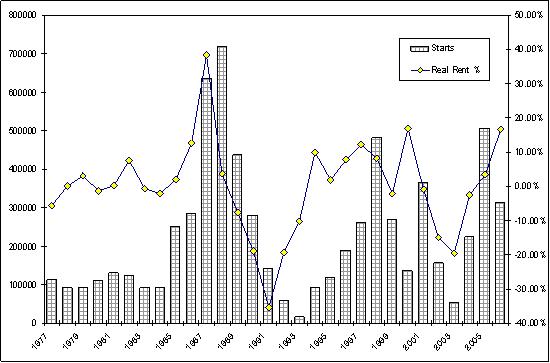

Fig 2: Office construction and real rents.

Source: Lizieri, 2010.

译文:

I.办公室

写字楼市场不仅仅是生产性服务公司空间需求的副产品,而且是投资资产和价值储存(邓斯和琼斯,2002:159)。写字楼市场有助于确定需求,并使城市面临全球市场格局的波动;例如,在国际金融中心设立办事处,通过经济活动的金融专业化、空间的金融所有权以及为投资和发展提供股权和债务,供应、空间、投资和金融市场被锁定在一起。

在写字楼市场,空间供应通常有限,而且空间似乎不受预期租金的影响(Lizieri 等,1998:341)。取而代之的是,观察到被不活动时期掩盖的强烈建筑活动时期。此外,建设开始滞后于租金的实际增长。当需求波动且这些波动与短期无弹性的旅馆供应相关时,租金波动就会以明显的建造周期的形式产生。

建筑周期导致资本和租金价值的极端波动(Dunse & Jones,2002:159)。写字楼市场的周期性通常被认为表明贷方和开发商的非理性行为。因此,发展中的工作主体寻求结合实物期权模型和博弈论,以解释经济主体在发展过程中的行为。

全球信贷危机严重影响了写字楼市场,尤其是在伦敦、都柏林和马德里。租金自 2007 年以来下降,这是继前几年发生的急剧上涨之后(Lizieri,2010)。尽管如此,一些市场已经开始出现租金上涨,例如西区、城市和码头区。

图 2:写字楼建设和实际租金。

资料来源:利齐耶里,2010 年。

II.Retail

Retail markets are driven by the expenditure of consumers, while the consumers’ expenditure is impacted by personal disposable income (Lizieri, 2010). Macroeconomic variables such as GDP, unemployment, and interest rates in turn affect the disposable income. Permanent income also affects the revenue derived from retail markets. Retail centers feature chain stores, department stores, and other high-end retailers. In the U.K, key destinations for retail markets include London, Manchester, Leeds, and Glasgow in which there are opportunities for further development of shopping centers. 房地产经济学论文代写

The retail rental cycle consists of various stages in which stage one features stable rent and high up turning consumer spending. Stage 2 or the growth phase characterizes rise of rents and a strong consumer spending as well as retailer demand. Stage 3 features the stabilization of rents as consumption growth slows down. Stage 4 features the readjustment phase in which rents become stable or begin to decline. Moreover, consumer spending also slows down or starts declining. The retail sector is well explained thorough the central place theory.

译文:

II.零售

零售市场由消费者的支出驱动,而消费者的支出受个人可支配收入的影响(Lizieri,2010)。 GDP、失业率和利率等宏观经济变量反过来影响可支配收入。永久收入也会影响来自零售市场的收入。零售中心以连锁店、百货公司和其他高端零售商为特色。在英国,零售市场的主要目的地包括伦敦、曼彻斯特、利兹和格拉斯哥,其中有进一步发展购物中心的机会。

零售租赁周期由多个阶段组成,其中第一阶段的特点是租金稳定,消费支出上升。第二阶段或增长阶段的特点是租金上涨、消费者支出强劲以及零售商需求。第三阶段的特点是随着消费增长放缓,租金趋于稳定。第四阶段是调整阶段,租金趋于稳定或开始下降。此外,消费者支出也放缓或开始下降。零售业通过中心地理论得到了很好的解释。

III.Industrial Markets

The industrial space is most occupied by warehousing in developed economies because manufacturing has declined. As a result, older manufacturing units seem unattractive as the configuration of space does not meet the occupier requirements. The current occupier considers the transport and distribution network in choosing the industrial location. This aspect is well illustrated in the industrial location theory 房地产经济学论文代写

In the U.K industrial sector, consumer confidence is falling and this directly impacts retail sales, which trickles down to distribution and logistic activity. However, ample construction has increased supply and this has made the market more competitive. There are also variations in performances across Europe and this reflects cyclical differences and differences in the supply. If well investigated, some of the cities in key locations can have long term structural advantages for logistics or warehousing, especially those near the transport hubs.

译文:

III.工业市场

由于制造业下降,工业空间在发达经济体中被仓储占据最多。因此,由于空间配置不符合占用者的要求,旧的制造单元似乎没有吸引力。目前的租户在选择工业区位时会考虑运输和分销网络。这方面在工业区位理论中得到了很好的说明

在英国工业部门,消费者信心正在下降,这直接影响到零售销售,进而影响到分销和物流活动。然而,充足的建设增加了供应,这使得市场更具竞争力。整个欧洲的表现也存在差异,这反映了供应的周期性差异和差异。如果调查得当,一些关键位置的城市在物流或仓储方面具有长期的结构优势,尤其是那些靠近交通枢纽的城市。

3.0. Recommendation 房地产经济学论文代写

Investing in the real estate commercial market is a risky venture in which risk concerns uncertain outcomes. The measures of risk should reflect the investor’s expectations rather than focus on what has happened in the past. The following suggestions are recommended for the overseas investor: 房地产经济学论文代写

The investor should consider a long term holding into the U.K. market. The investor should also seek property rights because property rights have a long time scale and therefore like assets with both and income flow over time and potential for capital gains in the future (Keogh, 1994). The property rights must be clearly defined in a legal document (Keogh, 1994). Another aspect to consider by the investor is the management. With strategic management, the investor knows how to deal with the volatile situations in business environment.

译文:

3.0. 推荐 房地产经济学论文代写

投资于房地产商业市场是一项风险投资,其中风险涉及不确定的结果。 风险度量应反映投资者的预期,而不是关注过去发生的事情。 向海外投资者推荐以下建议:

投资者应考虑长期持有英国市场。 投资者还应该寻求产权,因为产权具有很长的时间尺度,因此就像资产一样,收入随着时间的推移而流动,并且在未来有资本收益的潜力(Keogh,1994)。 财产权必须在法律文件中明确定义(Keogh,1994)。 投资者要考虑的另一个方面是管理层。 通过战略管理,投资者知道如何应对商业环境中的动荡局势。

4.0. Conclusion 房地产经济学论文代写

Fluctuations in GDP, alterations of consumer expenditure, changes in service sector employment and industrial output impact the demand for commercial real estate. It is important for an overseas investor to assess a variety of factors before deciding on investing in the highly volatile market. The issues to be considered include the property debt, the household sector debt, and the government debt.

译文:

4.0. 结论 房地产经济学论文代写

GDP的波动、消费支出的变化、服务业就业和工业产出的变化都会影响对商业地产的需求。 海外投资者在决定投资于高度波动的市场之前评估各种因素非常重要。 需要考虑的问题包括财产债务、家庭部门债务和政府债务。

List of references 房地产经济学论文代写

Barras, R. 1994. “Property and the economic cycle,” Journal of Property Research, 11(3), 183-197.

Brown, G.R. 2000. Duration and risk. Retrieved November 15, 2010, from http://business.fullerton.edu/finance/journal/papers/pdf/past/vol20n03/04.337_356.pdf

Davies, P., & Zhu, H. 2004. Bank lending and commercial property cycles: some cross country evidence,” Available http://www.areuea.org/conferences/papers/47/427.pdf.

Dunse, N. & Jones, C. 2002. The existence of office submarkets in cities. Journal of Property Research, 19(2), 159-182

Keogh, G. 1994. “Use and Investment Markets in British Real Estate, Journal of Property Valuation and Investment, 12 (4), 58-72.

Lizieri, C. 2010. Global cities, office markets and capital flows. Available at http://www.lboro.ac.uk/gawc/rb/rb362.html

Lizier, C., Satchbell, S., Worzala, E and Dacco, R. (1998).Real interest regimes and real estate performance: a comparison of U.K and U.S market., Journal of Real Estate Research, 16(3): 339-355. Available http://business.fullerton.edu/finance/journal/papers/pdf/past/vol16n03/v16p339.pdf.

Shaun, A. & Soosung, H. 2001. A measure of fundamental volatility in the commercial property market, p. 1-29. Available from http://www.landecon.cam.ac.uk/sab36/fundvol.pdf.

其他代写:代写CS C++代写 java代写 matlab代写 web代写 app代写 作业代写 物理代写 数学代写 考试助攻 paper代写 英国代写 论文代写 金融经济统计代写