Comparison

Comparison代写 Return on Assets and Return on Equity of MAC are higher than that of AT&T.Debt ratio of AT&T is higher than that of MCD.

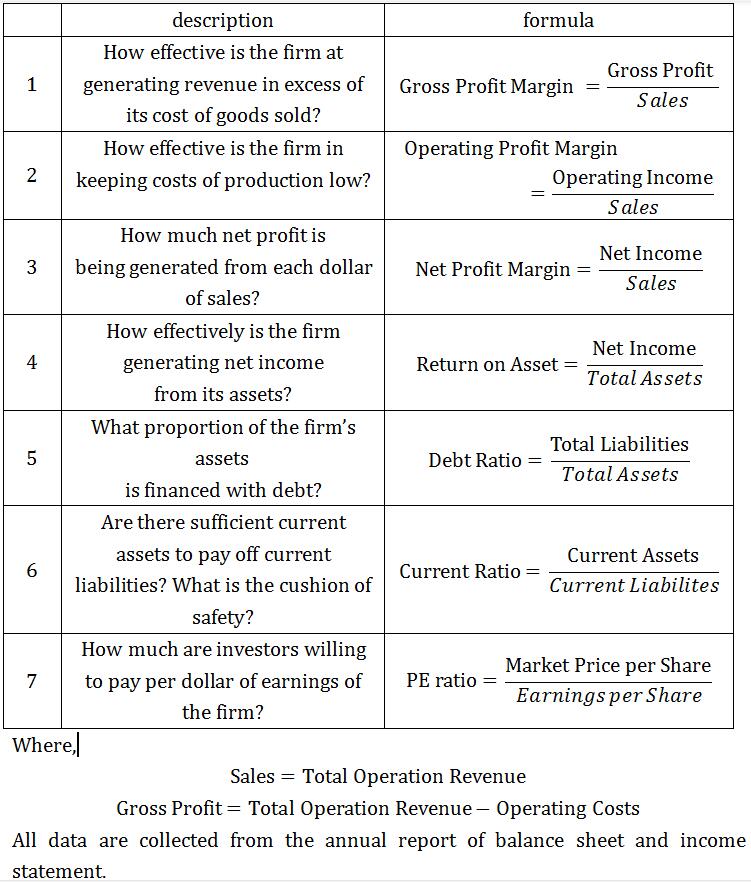

1.Definition of indicators:

2. Comparation

- Observation period: 2011~2013

1. Profitable Ratios :

-

- the Gross Profit Margins of AT&T (AT&T INC) are larger than that of MCD (McDonald’s Corporation), we can infer that AT&T is more effective at generating revenue in excess of its cost of goods.

- The Operating Profit Margin and Net Profit Marginof AT&T are less than that of MCD, we can infer that MCD is more effective in keeping its costs of production low, and the net profit generated from each dollar of sales of MCD is higher than that of AT&T.Comparison代写

- Return on Assets and Return on Equity of MAC are higher than that of AT&T. that means the net income of MCD generated from its assets are higher than that of AT&T. and net income of MAC generated from its equity are higher than of AT&T too.

AT&T, which is a communication holding company, must have higher expenses on research and development and operating assets impairment. MCD is a food service company, it doesn’t need too much expenses on research and development. So, the Gross Profit Margin of AT&T are higher while the Net income Margin are lower than that of MCD. The result is consistent with the common sense.Comparison代写

2. liquidity ratio

-

- Current ratio of AT&T is less than that of MCD, so MCD has more sufficient current assets with high liquidity to pay off current liabilities. MCD is less likely to have problem to meet its short-term financial obligations.

3. Debt ratio

-

- Debt ratio of AT&T is higher than that of MCD. The proportion of AT&T’s assets financed with debt is higher than that of MCD, which means, AT&T’s proportion of debt is higher than that of MCD.

4. Market Value ratio

-

- PE ratio of each company come lower than the number in year 2011. And in Year 2013 the PE ratio of MCD is higher than that of AT&T, which means investors willing to pay more on each dollar of earnings of MCD than AT&T.Comparison代写

Q: Is company on the right track?

A: Both companies are on the right track.

Q: Which of the two competitors is stronger?

A: From the aspect of PE ratio, I will think MCD is stronger than AT&T.

更多其他: 考试助攻 assignment代写 Data Analysis代写 数据分析代写 金融代写 代写作业 作业代写