MSFI 435 – Empirical Finance Fall 2017

An Example of Individual Project

实证金融项目代写 One crucial decision on the IPO process is how to value the company—which price to set for the stock being offered.

(Important: This assignment is to be implemented on an individual basis. No sharing of material—including data, results, inferences and write-ups—may take place among members of a group nor across different groups.)

(About the significance level: For all the tests of significance in this assignment, please assume a 5% significance level.)

Examining Underpricing in IPOs 实证金融项目代写

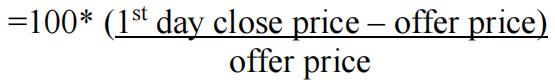

An IPO refers to the moment a company goes public. This moment is marked by issuance of public equity, so the IPO is also the first moment the company raises equity in a stock market. More often than not, when a company goes public, the first trading day carries positive (and large) returns. More specifically, we examine the return on the IPO stock on its very first day of trading, as

Take the example of Chipotle. When the company went public in 2006, the offer price was$22, but the trading price closed at $44 at the end of the first day of trading. Thus, for Chipotle, the 1st day return was an amazing 100*(44-22)/22=100%! 实证金融项目代写

This is not an uncommon outcome. In fact, Jay Ritter found that, among 7,600 companies that went public between 1975 and 2005 in U.S., the average company rose in price 17% in the first trading day following the issuance. That might be a surprise, after all a companyseems to be leaving money at the table when the price rises so much in the first day—since it could be charging more for the shares being offered. But, if the company could have been charging more for the shares, we say the IPO was underpriced.

Underpricing seems to be so pervasive that an IPO is considered successful when it has underpricing.

When Alibaba went public, its IPO was considered a big success. The offer price for Alibaba was $68 and it closed at $93.89 at the end of the first trading day, so its first-day return was 38%.

Our task in the assignment is to understand why underpricing takes place. Before we establish our hypotheses, though, we need to discuss how the offer price of an IPO is established. 实证金融项目代写

One crucial decision on the IPO process is how to value the company—which price to set for the stock being offered. Since the pre-IPO company is not yet public, there is no stock price to observe. The offer price is established by the investment banks that are hired by the company as advisors on the IPO process. These investment banks are known as underwriters. What underwriters do is that they first analyze the company value,establishing a range for the offering price of the firm. In the case of Chipotle, this range was initially set between $15.50 and $17.50 per share.

Then, the underwriters go on a road show: they meet with many prospective investors in order to get their reactions about the possible offering prices. Finally, on the days preceding the beginning of the trading, the underwriters decide on an offering price—which could be inside or outside that initial range. For Chipotle, the offering price was set above the initial range, at $22 per share. Alibaba also set the offering price higher compared to the initial range: The first price range was set between $60 and $66, then updated to between $66 and $68, and finally the offer price was set at $68.

Now we are ready to discuss the hypotheses for why underpricing might happen.

Partial Adjustment Hypothesis 实证金融项目代写

One possible explanation came to be known as the partial adjustment hypothesis. Benveniste and Spindt (1989) noticed that during the road show the underwriters collect information about the demand for upcoming IPO. If demand is high, underwriters will set a higher offer price; however, if investors know that revealing strong demand—that is, good news about the IPO—will result in a higher offer price, they will decline of doing so, unless they are offered something in return. Underpricing could be such reward. In other words, underpricing is used as a way to entice investors to reveal their information about the true value of the firm. 实证金融项目代写

The partial adjustment hypothesis thus predicts the occurrence of underpricing, especially for the IPOs that gathered positive information from investors during the road show. This is the hypothesis we will test here. We obtain a proxy for whether the road show led to the collection of positive news—the adjustment in the price from the range established pre-road show to the final offering price. Notice that the cases on Chipotle and Alibaba fit this story: the final offer price, $22 and $68, were above the initial ranges of $15.50-$17.50 and $60-$66, and both faced a lot of underpricing.

Information Asymmetry 实证金融项目代写

One stream of reasoning about IPOs advocates that “underpricing is positively related to the degree of asymmetric information” (see page 1807 on Ritter and Welch, 2002). If there is information asymmetry between informed investors and retail investors (informed investors such as hedge funds would know more about the true value of the firm), or between the company and investors (the company would know more about itself than investors), some investors will be afraid of getting involved in the IPO for fear of a winner’s curse, since they would be able to buy shares only when the informed agents don’t, in which case the company is not worth much. Thus, underpricing is necessary to entice these investors to participate. 实证金融项目代写

Let’s take on this story. The problem is to find proxies for information asymmetry. I propose a simple one, firm size, the assumption being that there is more informationoutthere for bigger. So, we can test the hypothesis that underpricing is negatively correlatedwith the proxy for information asymmetry (firm size). In fact, the null is that information asymmetry is not related to underpricing, and the alternative hypothesis is that higher levels of information asymmetry comes with higher levels of underpricing.

The idea is to run a regression explaining first day of returns of an IPO. The control variables are proxies for change in offer price (DELTA_OFFER) and for information asymmetry (log of total assets). You should also add a control variable for an underwriter’s market power,

RETi=β0 + β1 DELTA_OFFERi + β2 LTAi+ β3MARKET_POWERi+ εi,

Data on IPOs appear in the following dataset…and the definition of the variables are as shown here…

更多代写:jupyter notebook代写 Statistics统计学代考 Report代写价格 report写作 Research Paper作业代写 美国艺术论文代写