Empirical Finance Spring II 2021 Assignment 2

实证金融作业代写 1.(10pts) The Carey company paid Dt = 1 of dividends this year. If its dividends are expected to grow at G = 1.03 per year,

Please double check your answers.

Q1. (40pts) Gordon growth model

- (10pts) The Carey company paid Dt= 1 of dividends this year. If its dividends are expected to grow at G = 1.03 per year, what is the dividends for the Carey company five years from now, that is, Dt+5?

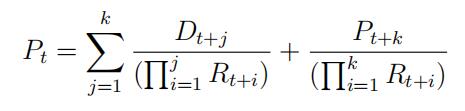

- (10pts) From our lecture slide, we can express price as

for some large k. The Gordon growth model assumes (i) Dt+1 = G × Dt and (ii)

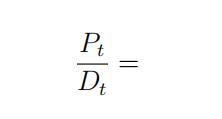

Rt = R. Express

according to the Gordon growth model.

- (10pts)The current price of Carey stock is $25 per If its current dividend is $1 per share and investors’ required rate of gross return is 1.1, what is the growth rate of dividends for Carey stock based on the Gordon growth model? 实证金融作业代写

- (10pts)A company with Dt = 1 and R = 1.2 grows at G = 1.06 for the first 5 years and drops to zero (meaning Gj = 1) thereafter (we use Gj to indicate its the new growth rate). What should its current price be according to the Gordon growth model?

Q2. (30pts) Portfolio choice 实证金融作业代写

Suppose that the S&P 500 index has mean of E(rM ) = 0.16 and standard deviation of

σ(rM ) = 0.10. The risk-free rate is rf = 0.08.

- (10pts)What is the expected return and standard deviation of a portfolio that is totally invested in the risk-free rate?实证金融作业代写

- (10pts) What is the expected return and standard deviation of a portfolio that has weight ω = 0.5 on the risk-free rate and 1 − ω = 0.5 in the S&P 500index?

- (10pts) What are the weights on a portfolio, ω for investing in the risk-free rateand 1 − ω for investing in the S&P 500 index, that produce a standard deviation that is 0.04? What is the expected return on that portfolio?

Q3. (20pts) Read Fama and French (2004) carefully and summarize the paper in one page (at least four paragraphs).

Q4. (80pts) Portfolio choice (coding exercise) 实证金融作业代写

Download “stocks.xlsx.” You will find 3 stock prices (labeled “market, A, B”) and 3 factors (labeled “riskfree, smb, hml”) in the range of 2011:M12 to 2021:M2.

- (20pts) Let the log return for stock i be ri,tat time t. Provide the sample mean and standard deviation for rM,t, rA,t, rB,t where 2012:M1 ≤ t ≤ 2021:M2. For convenience, “M” refers to “market.”实证金融作业代写

- (20pts) Estimate the CAPM equation and report the estimated β and R2from the regression. Here the estimation sample ranges from 2012:M1 to 2021:M2. Note that you are estimating the CAPM equation for A and B stocks separately (so, twice in total).

- Similarly estimate the Fama-French 3 factor model for A and B stocks. Here the estimation sample ranges from 2012:M1 to2021:M2.

(a)(20pts) Compare the estimates of βwith those from the CAPM equation.

(b)(20pts)Based on the coefficient estimates for “smb” and “hml” factors, discuss the characteristics of A and B stocks.

Q5. (30pts) Investment 实证金融作业代写

Suppose that the month t prices are PM = $3, 972.89, PA = $16.19, and PB = $521.66. You can spend up to $100,000 in stocks (M, A, B) after studying the historical price/return series (2012:M1-2021:M2). For this question, you may want to analyze their log return dynamics.

The minimum requirement is that you have to at least spend $10,000 on each stock. To helpyou understand the problem, suppose you buy 3 of M and 618 of A and 20 of B,

3 · PM = $11919

618 · PA = $10005 实证金融作业代写

20 · PB = $10433

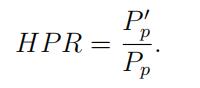

then the total cost of your portfolio is Pp = 3 · PM + 618 · PA + 20 · PB = $32357. Here, I am rounding up the decimal points for ease of illustration. Note that you can buy more asyou still have $67643 remaining. Now, suppose that the month t + 1 prices are PMj , PAj , and PBj , respectively. You are going to calculate the one-month holding period return of your portfolio

Ppj = 3 · PMj+ 618 · PAj+ 20 · PBj

where the holding period return is defined as

Explain how much you would buy each of M , A, and B. Your answer should be based on your analysis of HPR from the historical data. Thus, what only matters is HP R, that is, what’s your monthly return on investment, not about Pp or Ppj .实证金融作业代写

Note: I am asking you to use your imagination + data analysis skill you’ve learned so far in class.

其他代写:program代写 cs作业代写 app代写 Programming代写 homework代写 考试助攻 finance代写 代写CS finance代写 java代写 course代写 金融经济统计代写