Practice Final 2017

April 24, 2017

宏观经济学代考 Explain whether demand υtor supply shocks st get amplified as people become less rational and more behavioral or m goes down.

1 Problem 1 宏观经济学代考

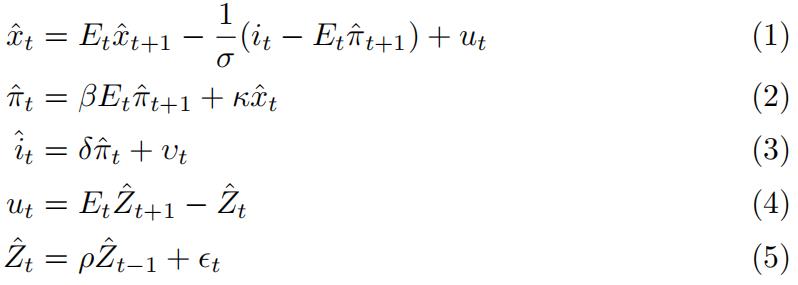

In the New Keynesian model linear system of equations has the following form:

where xˆt is the output gap between actual output and flexible prices output, πˆt is inflation level, ˆit is the interest rate, Zˆt is a technology growth shock. Ex- ogenous shocks υt and st are niid (normal identically independently distributed) variables.

1.Assume that δ > 1 and find the solution for output gap in terms of stand υt.

2.Explain why New Keynesian model amplifies demand shocks υtand sta- bilizes supply shocks st.

2 Problem 宏观经济学代考

2: A Behavioral New Keynesian Model (by Gabaix 2016)

Expected interest rate in macroeconomics is equal to the nominal interest rate divided by expected inflation. More precisely, Rt = Et it or Rˆt = ˆit − Etπˆt+1.

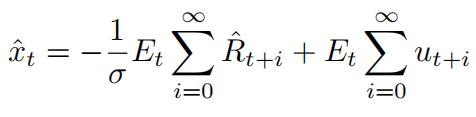

1.Iterate forward Euler equation toobtain

(6)

(6)

Notice that according to this model expected shock after 300 years ut+300 has the same effect on output gap as expected shock to ut+1 in one year. Is this realistic?

Of course not! Euler equation thus overestimates the effect of the future on the present. 宏观经济学代考

2.To fix this problem Xavier Gabaix offered the following behavioral ap- proach: agents have kind of blurry look to the future, and whenever the system has expected future variable, the way agents actually behaves is by replacing this future variable Etxˆt+i with miEtxˆt+i. This allows all agents to think that far in the future system will be at its steady state on average and their forecasting power declines over Solve the be- havioral system by replacing all Etxˆt+i by miEtxˆt+i in the following New Keynesian system:

xˆt = Etxˆt+1 − σ (it − Etπˆt+1) + ut (7)

πˆt = βEtπˆt+1 + κxˆt (8)

ˆit = δπˆt + υt (9)

ut = EtZˆt+1 − Zˆt (10)

Zˆt = ρZˆt−1 + st (11)

Focus on the unique equilibrium.

3.Explain whether demand υtor supply shocks st get amplified as people become less rational and more behavioral or m goes down.

3 Problem 宏观经济学代考

3: Financial Frictions and Hetero- geneity

There are two types of agents: patient households with discount β and impatient households with discount γ such that γ < β. Both types of agents have linear preferences over consumption.

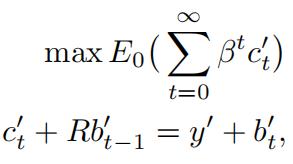

For patient households optimization problem is the following:

(12) (13)

where they consume c‘t and receive interest rate R on their assets bt−1. We can express consumption as a function of other variables in the budget constraint and plug it in the utility to obtain the expression below:

Impatient households maximize their discounted flow of consumption subject to the budget constraint where they produce output y and borrow bt units of final goods, consume ct units of final output, and pay back their debts Rbt−1. 宏观经济学代考

ct + Rbt−1 = y + bt (15)

Transversality conditions says that

![]()

1.Let’sassume that impatient household borrows in the first period and then pays back constant amount of money from the next period and What is the optimal solution?

2.Suppose that impatient household can borrow in the first and second pe- riod and repay his debt thereafter (consume constant amount of final output)

3.What do you think is the optimal solution that will satisfy transversality condition?

更多代写:留学生经济专业作业代写 Gre代考 留学生会计代写 留学生Summary摘要代写 留学生管理学论文代写范文 代修英国网课机构