ECON 3H03 – INTERNATIONAL MONETARY ECONOMICS

MIDTERM EXAM

国际货币经济学代写 Consider a U.S. investor with $1,000. Assume that the U.S. interest rate is 5%, the European interest rate is 4%,

Instructions: You have 50 minutes to work on the exam (from 11:30 am to 12:20 pm). This midterm is individual and closed-book. For the multiple choice questions, choose the option that best answers/completes the question/enunciate, and clearly mark your answer.

PART I – MULTIPLE CHOICE QUESTIONS (5 points each question)

Use the following scenario to answer questions 1-2.

SCENARIO: FORWARD EXCHANGE RATE

Consider a U.S. investor with $1,000. Assume that the U.S. interest rate is 5%, the European interest rate is 4%, and the (one-year) forward exchange rate is $0.924

1. 国际货币经济学代写

(Scenario: Forward Exchange Rate) If the spot rate is $1.20, then the dollar denominated (riskless) return on Euro deposits using a forward cover is:

A) $1350.65

B) $808.50

C) $800.80

D) $1363.64

2. 国际货币经济学代写

(Scenario: Forward Exchange Rate) At approximately what exchange rate will the returns between the United States and Europe be equalized?

A) $1.0719

B) $1.0927

C) $0.9329

D) $0.9152

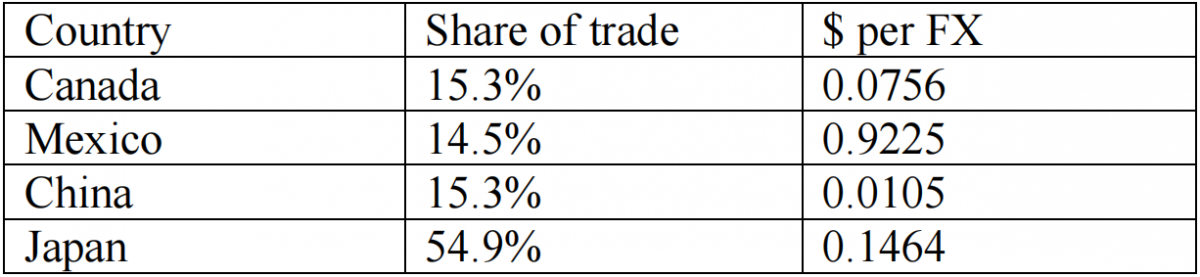

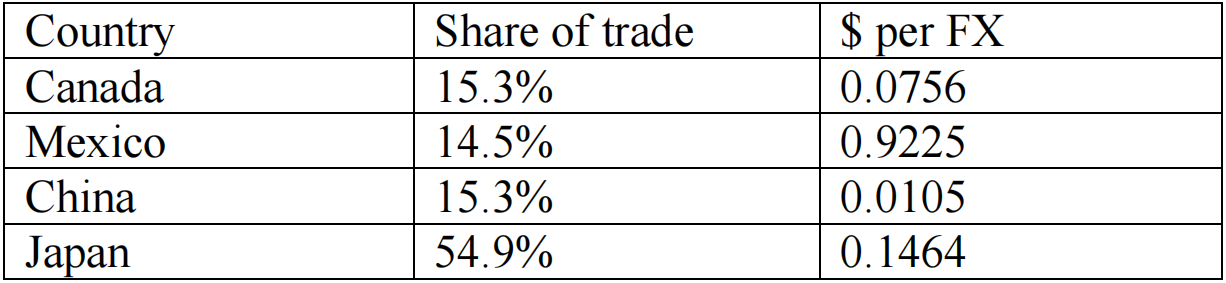

3.

Based on the table above, the effective (multi-lateral) exchange rate for the United States is:

A) $0.9225

B) $4.8195

C) $0.2273

D) $4.3993

4. 国际货币经济学代写

Which of the following statements is true?

A) Euro nominal exchange rate is price of Euros in units of dollars;

Euro real exchange rate is one U.S. basket in units of Euro baskets

B) Euro nominal exchange rate is price of Euros in units of dollars;

Euro real exchange rate is one Euro basket in units of U.S. baskets

C) Euro nominal exchange rate is price of dollars in units of Euros;

Euro real exchange rate is one U.S. basket in units of Euro baskets

D) Euro nominal exchange rate is price of dollars in units of Euros;

Euro real exchange rate is one Euro basket in units of U.S. baskets

5.

Which of the following are required for real interest parity?

A) covered interest parity and uncovered interest parity

B) purchasing power parity and covered interest parity

C) purchasing power parity and uncovered interest parity

D) purchasing power parity, covered interest parity, and uncovered interest parity

6. 国际货币经济学代写

Using monetary theory, one can show that the price level (index) in an economy is equal to:

A) the inflation rate minus the interest rate.

B) the average change in the level of trade over the past 5 quarters.

C) the ratio of the real supply of money to the demand for real balances.

D) the ratio of the nominal supply of money to the demand for real balances.

7.

If the U.S. interest rate is 9% per year and the U.K. interest rate is 4% per year, which of the following statements is true?

A) The pound will depreciate 9% in 1 year.

B) The dollar will depreciate 5% in 1 year.

C) The pound will depreciate 5% in 1 year.

D) The dollar will appreciate 4% in 1 year.3

8. 国际货币经济学代写

A U.S. basket that costs $100 would cost € 140 in the United Kingdom. What is the United Kingdom nominal exchange rate implied by absolute PPP?

A) €71

B) €00

C) €40

D) none of the above

9.

Suppose there is a permanent increase in European money growth rate. Using the general monetary model, in the long run:

A) Euro nominal interest rate will decrease; U.S. exchange rate will depreciate

B) Euro nominal interest rate will increase; U.S. exchange rate will depreciate

C) Euro nominal interest rate will decrease; U.S. exchange rate will appreciate

D) Euro nominal interest rate will increase; U.S. exchange rate will appreciate

Use the following scenario to answer questions 10-11.

SCENARIO: MONETARY APPROACH IN THE LONG-RUN

For the next year, the U.S. Fed is predicted to keep U.S. monetary growth at 3% and the Bank of England is predicted to keep U.K. monetary growth at 2%. U.S. real income grows at 2% and the U.K. real income grows at 2%.

10. 国际货币经济学代写

(Scenario: Monetary Approach in the Long-run) What is the expected rate of nominal depreciation for the U.S. (versus the United Kingdom)?

A) 1%.

B) 3%

C) 2%

D) 4%.

11.

(Scenario: Monetary Approach in the Long-run) Suppose that the U.S. wants to fix its exchange rate versus the United Kingdom. Then the U.S. money supply should grow at

A) 0%

B) 2%

C) 4%.

D) 1%

12. 国际货币经济学代写

According to the result known as trilemma, it is impossible to achieve the following three policy goals:

A) fiscal policy autonomy, international capital mobility, floating exchange rate

B) monetary policy autonomy, international capital mobility, floating exchange rate

C) fiscal policy autonomy, international capital mobility, fixed exchange rate

D) none of the above

PART II – PROBLEM (40 points in total)

Use the U.S. money market and FX diagrams to answer the following questions about the relationship between the British pound (£) and the U.S. dollar ($). The exchange rate is in U.S. dollars per British pound, E$/£. We want to consider how a change in the U.S. real income affects interest rates and exchange rates. On all graphs, label the initial equilibrium point A.

a) [5 points] 国际货币经济学代写

Illustrate how a temporary increase in the U.S. real income affects the U.S. money market and FX market. Label your short-run equilibrium point B and your long-run equilibrium point C.

b) [3 points]

Using your diagram from (a), state how each of the following variables changes in the short run (increase/decrease/no change relative to their initial values at point A): U.S. interest rate, British interest rate, E$/£, expected E$/£, and the U.S. price level.

c) [2 points] 国际货币经济学代写

Using your diagram from (a), state how each of the following variables changes in the long run (increase/decrease/no change relative to their initial values at point A): U.S. interest rate, British interest rate, E$/£, expected E$/£, and the U.S. price level.

d) [15 points]

Using a new set of graphs, illustrate how a permanent increase in the U.S. real income affects the U.S. money market and FX market. Label your short-run equilibrium point B and your long-run equilibrium point C.

e) [15 points]

For the case of the permanent increase in U.S. real income, using charts with time on the horizontal axis, illustrate how each of the following variables changes over time: US nominal money supply, US price level, US real money balances, US nominal interest rate, and the nominal exchange rate (E$/£).

Answers to the Problem (you may use both sides, please be clear!!)

其他代写: 英国代写 Data Analysis代写 essay代写 Exercise代写 finance代写 homework代写 北美作业代写 algorithm代写 analysis代写 app代写 assembly代写 C/C++代写 code代写 CS代写 cs作业代写

合作平台:essay代写 论文代写 写手招聘 英国留学生代写