LUBS5006M

International Business Finance

Answer TWO questions

All questions carry equal marks

国际商业金融代写 1(A)The following spot exchange rates are currently being quoted by three different banks:Credit Suisse offers a spot rate of €0.00717-23/¥

Question 1

(A)

The following spot exchange rates are currently being quoted by three different banks:

Credit Suisse offers a spot rate of €0.00717-23/¥

Morgan Stanley offers a spot rate of €0.769-78/$

Deutsche Bank offers a spot rate of ¥99.9-100.5/$

Required:

(i)Calculate the implied cross exchange rate between the euro (€) and the yen (¥). (10%)

(ii)Demonstrate how an arbitrageur could make a profit from this situation and calculate the amount of the profit if 1m (millions) dollars ($) was arbitraged, showing all your workings. (20%) 国际商业金融代写

(iii)Now assume that you have ¥100m instead of $1m. Calculate the profit that can be made through triangular arbitrage, showing all your workings. (20%)

(B) The 3-month forward rate dollar($)/sterling(£) is currently $1.63/£. Based on your analysis of the exchange rate, you are quite confident that the spot exchange rate will be $1.61/£ in 3 months’ time. Assume you want to speculate on the $/£ spot rate by buying or selling £5m (millions) in the forward market.

Required:

a、Explain how you could speculate in the forward market and calculate your expected $ outcome from the speculation. (20%)

b、Calculate your speculative $ outcome if the spot exchange rate actually turns out to be $1.66/£. (20%)

c、Illustrate both speculative outcomes in a payoff diagram. (10%)

Question 2 国际商业金融代写

(A)

Assume today’s settlement price on ICE London € futures contract is £0.8474/€. You have a long position in one contract. Your margin account currently has a balance of £7,500. The maintenance bond is £5,000. The next three days’ settlement prices are:

Day 1 £0.8325/€

Day 2 £0.8297/€

Day 3 £0.8416/€

Required:

(i)Calculate the changes in the margin account from daily marking-to-market and the balance of the margin account after the third day. The contract size of one euro contract is €125,000. (20%)

(ii)Repeat question (i) but on the basis that you have a short position in the contract. (20%)

(B) 国际商业金融代写

Carvedpumpkins Inc is a US firm that wants to finance the purchase of a Yen (¥) denominated asset in Hokkaido and therefore wants to borrow ¥. The value of the asset is ¥275m (millions) and the duration of the borrowing is for 3 years.

Sushiforyou Ltd is a Japanese firm that needs to refinance a ¥ denominated obligation in foreign currency and, more specifically, wants to redenominate the ¥ interest payments generated by the existing obligation in dollars ($). The corresponding value of the bank loan is $2.5m at the current spot rate (¥110/$) with a 3 years remaining life.

Carvedpumpkins can currently borrow in $ at 4.4% and in ¥ at 6.5%. Sushiforyou is paying a 6.1% interest rate in the ¥ denominated obligation and can borrow in $ at 5%. A swap bank is offering a 3-year $ 4.4-4.7 swap quote and a 3-year ¥ 6.1-6.2 swap quote. Both quotes are against the flat $ Libor. The current $ Libor is 0.75%. Assume that the spot rate will not change for the duration of the contracts. 国际商业金融代写

Required:

(i) Identify the potential cost savings (in basis points) for the two firms if they decide to enter into currency rate swap contracts with the swap bank. Indicate what is the profit generated (in basis points) by the currency rate swap contracts to the swap bank. (20%)

(ii)Using the same data, calculate the cash flows generated by the swap contracts for the two firms and the swap bank for the 3 years. There is no exchange of the notional principal. The $ Libor increases by 0.25 basis points each year. (20%)

(iii) Explain briefly the potential motivations that may lie behind the decision by a firm to enter into a swap contract. (20%)

Note: Assume there are 360 days in a year.

Question 3 国际商业金融代写

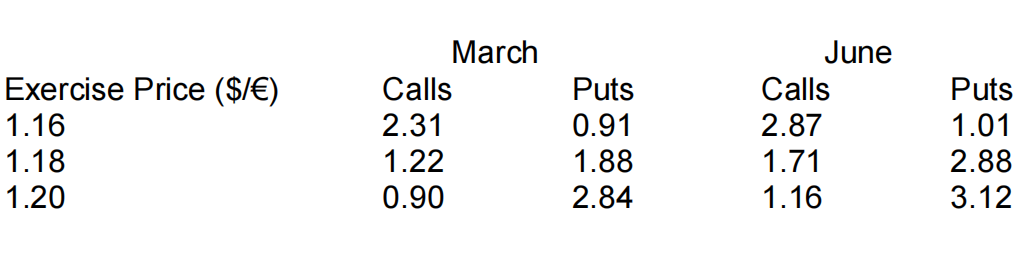

It is the beginning of January and a Finnish company has to pay dollars ($) 10.62m in 6 months time to a US supplier. Traded option prices (contract size euros (€) 75,000) are currently as follows:

Option premiums are quoted in dollar cents per € and are payable up front. They are American-style options. Assume that the current spot exchange rate is $1.14/€.

When answering the questions below, where appropriate, refer to the information above.

Required:

a、Calculate how many option contracts the company should enter into to hedge the transaction assuming the company chooses the option(s) with an exercise price of $1.18/€. (15%)

b、State whether the company should enter into a call or put option and whether it should use March or June contracts. Explain the reasons for your choice. (15%)

c、Calculate the cost, to the nearest $, of the premium payable to obtain a number of contracts which is sufficient to hedge the transaction at an exercise price of $1.18/€. (15%)

d、Based on an exercise price of $1.18/€, illustrate the impact of an option hedge assuming spot rates in 6 months time of (1) $1.13/€ or (2) $1.22/€. (35%)

e、Show the payoff diagram of the option contract subscribed by the Finnish company. Annotate the diagram clearly to reveal the logic of the hedge represented. (20%)

Note: Assume there are 360 days in a year.

Question 4 国际商业金融代写

On the 1st of April, Speedyrecovery Inc, a middle size U.S. company operating in the health care sector, sold the commercial rights for the development and sale of its key product, a new generation valve for artificial hearts still in the developing phase, to Novartis of Switzerland for Swiss francs (CHF) 4.5m (millions), payable CHF2m at the end of September and the remaining CHF2.5m at the end of the year. The price was calculated by applying to the original valuation of $5m of the trademark rights on March the then current exchange rate of CHF0.90/$.

By the time the order was received and booked on April, the CHF had strengthened to CHF0.87/$, so the sale was in fact worth $5,172,413.79. Therefore, Speedyrecovery had already gained another $172,413.79 from favourable exchange rate movements. Nevertheless, Speedyrecovery’s Director of Finance now wondered if the company should hedge against a reversal of the recent trend of the Swiss franc. Speedyrecovery estimates its cost of equity capital to be 10.5% per annum. As a relatively small firm, Speedyrecovery is unable to raise funds with long term U.S. debt (current U.S. T-bills yield 2.4% per annum).

Required:

a)Speedyrecovery could use a forward market hedge to manage its foreign currency exposure. The 6-month forward exchange quote is CHF0.86/$ and the 9-month forward exchange quote is CHF0.84/$. Both contracts expire at the end of the month. Calculate what would be the outcome of this approach for Speedyrecovery at the end of December. (25%) 国际商业金融代写

b).Speedyrecovery could use a money market hedge to manage its foreign currency exposure. Speedyrecovery could borrow Swiss francs from the Zurich branch of Citibank at 9%. Calculate what would be the outcome of this approach for Speedyrecovery at the end of December. (25%)

c).Speedyrecovery could hedge its foreign currency exposure with foreign currency options written on the Swiss franc. September put options are available at a strike price of CHF0.87/$ for a premium of 3% of the CHF value of the option, and December put options are available at a strike price of CHF0.86/$ for a premium of 2.2% of the CHF value of the option. September call options are available at a strike price of CHF0.87/$ for a premium of 3.2% of the CHF value of the option, and December call options are available at a strike price of CHF0.86/$ for a premium of 2.8% of the CHF value of the option. All currency options maturity date is at the end of the month and these are over-the-counter option contracts. Calculate what would be the outcome of this approach for Speedyrecovery at the end of the December. (35%)7

d).Compare and briefly comment on the implications of the different outcomes for Speedyrecovery of the approaches in a), b) and c) at the end of December. (15%)

Note: Assume there are 360 days in a year.

其他代写:finance代写 homework代写 北美作业代写 英国代写 Exercise代写 algorithm代写 analysis代写 app代写 assembly代写 C/C++代写 code代写 CS代写 cs作业代写 Data Analysis代写 essay代写

合作平台:essay代写 论文代写 写手招聘 英国留学生代写