Final Exam Review Questions

Treasury bonds代写 Central Bank has the following balance sheet (in millions of dollars).Assets LiquidityleveLiabilities and Equity

1.Central Bank has the following balance sheet (in millions ofdollars).Treasury bonds代写

|

Assets |

Liquidity

level |

Liabilities and Equity |

Run-off

factor |

|

| Cash | $ 20 Level 1 | Stable retail deposits | $190 | 3% |

Deposits at the Fed |

30 Level 1 | Less stable retail deposits | 70 | 10 |

| Treasury bonds

Qualifying marketable securities |

145 Level 1

50 Level 1 |

CDs maturing in 6 months

Unsecured wholesale funding from: |

100 | 0 |

GNMA bonds |

60 Level 2A | Stable small business deposits | 125 | 5 |

| Loans to AA- corporations | 540 Level 2A | Less stable small business deposits | 100 | 10 |

| Mortgages | 285 | Nonfinancial corporates | 450 | 75 |

Premises 35 Equity 130 Total $1,165 Total $1,165

Cash inflows over the next 30 days from the bank’s performing assets are $7.5 million. Calculate the LCR for Central Bank.

The liquidity coverage ratio for Central Bank is calculated as follows:

Level 1 assets = $20 + $30 + $145 + $50 = 245 Treasury bonds代写

Level 2 assets = ($60 + $540) x 0.85 = $510.00 Capped at 40% of Level 1 = $245 x 0.40 = 98

Stock of highly liquid assets $343

Cash outflows:

Stable retail deposits $190 x 0.03 = $5.70

Less stable retail deposits $70 x 0.10 = 7.00

CDs maturing in 6 months $100 x 0.00 = 0.00

Stable small business deposits $125 x 0.05 = 6.25 Less stable small business deposits $100 x 0.10 = 10.00 Non-financial corporates $450 x 0.75 = 337.50 Total cash outflows over next 30 days $366.45

Total cash inflows over next 30 days 7.50

Total net cash outflows over next 30 days $358.95

Liquidity coverage ratio =$343m/$358.95m = 95.56%. Treasury bonds代写

The bank is not in compliance with liquidity requirements based on the LCR.

1.An FI holds a 15-year

, $10 million par value bond that is priced at 104 with a yield to maturity of 7 percent. The bond has a duration of eight years and the FI plans to sell it after two months. The FI’s market analyst predicts that interest rates will be 8 percent at the time of the desired sale. Because most other analysts are predicting no change in rates, two- month forward contracts for 15-year bonds are available at 104. The FI would like to hedge against the expected change in interest rates with an appropriate position in a forward contract. What will this position be? Show that if rates rise 1 percent as forecast, the hedge will protect the FI from loss.

The expected change in the spot position is –8 x $10,400,000 x (0.01/1.07) = -$777,570. This would mean a price change from 104 to 96.2243 per $100 face value of bonds. By entering into a two-month forward contract to sell $10,000,000 of 15-year bonds at 104, the FI will have hedged its spot position. If rates rise by 1 percent, and the bond value falls by $777,570, the FI can close out its forward position by receiving 104 for bonds that are now worth 96.2243 per $100 face value. The profit on the forward position will offset the loss in the spot market.Treasury bonds代写

The actual transaction to close the forward contract may involve buying the bonds in the market at 96.2243 and selling the bonds to the counterparty at 104 under the terms of the forward contract. Note that if a futures contract were used, closing the hedge position would involve buying a futures contract through the exchange with the same maturity date and dollar amount as the initial opening hedge contract.

2.Contrast the position of being short with that of being long in futures contracts.

To be short in futures contracts means that you have agreed to sell the underlying asset at a future time, while being long means that you have agreed to buy the asset at a later time. In each case, the price and the time of the future transaction are agreed upon when the contracts are initially negotiated.

3.Suppose an FI purchases a Treasury bond futures contract at 95.

a.What is the FI’s obligation at the time the futures contract ispurchased?

The FI is obligated to take delivery of a $100,000 face value 20-year Treasury bond at a price of $95,000 at some predetermined later date.Treasury bonds代写

b.If an FI purchases this contract, in what kind of hedge is itengaged?

This is a long hedge undertaken to protect the FI from falling interest rates.

c.Assume that the Treasury bond futures price falls to 94. What is the loss orgain?

The FI will lose $1,000 since the FI must pay $95,000 for bonds that have a market value of only $94,000.

d.Assume that the Treasury bond futures price rises to 97. Mark to market the

In this case the FI gains $2,000 since the FI pays only $95,000 for bonds that have a market value of $97,000.Treasury bonds代写

- Long Bank has assets that consist mostly of 30-year mortgages and liabilities that are short- term demand and time deposits. Will an interest rate futures contract the bank buys add to or subtract from the bank’srisk?

The purchase of an interest rate futures contract will add to the risk of the bank. If rates increase in the market, the value of the bank’s assets will decrease more than the value of the liabilities. In addition, the value of the futures contract also will decrease. Thus, the bank will suffer decreases in value both on and off the balance sheet. If the bank sells the futures contract, the increase in rates would results in the futures position producing a gain that would offset (at least partially) the loss in value on the balance sheet.Treasury bonds代写

- You have a $500 million long portfolio in Stock 1 that has a current price of $55 per share, the risk-free interest rate is 2% and there are no dividends. You have performed an analysis and found that for every dollar change in Stock 2 the price of Stock 1 rises by $1.02756. The size of each 3-month futures contract is 250. The current price of Stock 2 is $45 and at time T it is $43.9 per share. What are the number of contracts needed to implement this hedge?

Using formula 12.3, N = bVU/CF with the information above yields 1.02756($500M)/($45*250), or N = 45,669

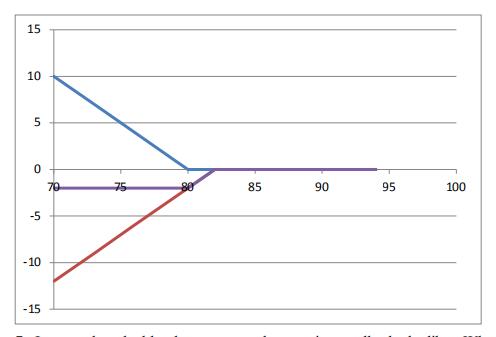

6.In a graph and table, demonstrate what a put bull spread looks like. What type of position would this provide a hedge for – i.e., long orshort?Treasury bonds代写

An example is below with assumed information. This position could be used to hedge a short position.

Price |

Purchased | Written Put | Net |

| at T | Put K=80 | K=82 | Profit |

| 80 | 82 | ||

| 70 | 10 | -12 | -2 |

| 73 | 7 | -9 | -2 |

| 76 | 4 | -6 | -2 |

| 79 | 1 | -3 | -2 |

| 80 | 0 | -2 | -2 |

| 82 | 0 | 0 | 0 |

85 |

0 | 0 | 0 |

| 88 | 0 | 0 | 0 |

| 91 | 0 | 0 | 0 |

| 94 | 0 | 0 | 0 |

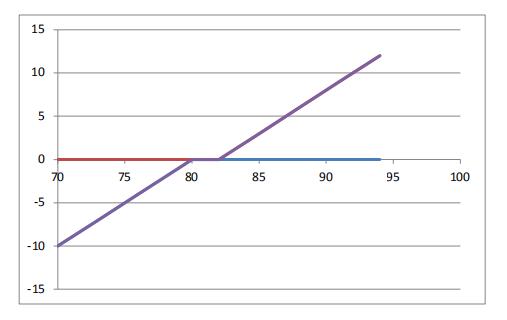

7.In a graph and table, demonstrate what a written collar looks like. What type of position would this provide a hedge for – i.e., long orshort?

This position may be useful to hedge a short position

Price |

Written | Purchased Call | Net |

| at T | Put K=80 | K = 82 | Profit |

| 80 | 82 | ||

| 70 | -10 | 0 | -10 |

| 73 | -7 | 0 | -7 |

| 76 | -4 | 0 | -4 |

| 79 | -1 | 0 | -1 |

| 80 | 0 | 0 | 0 |

82 |

0 | 0 | 0 |

| 85 | 0 | 3 | 3 |

| 88 | 0 | 6 | 6 |

| 91 | 0 | 9 | 9 |

| 94 | 0 | 12 | 12 |

Suppose you are a lender that has made a loan commitment to a borrower. The value of the commitment is $500,000 made today for a 90-day rate lock at 4.5%. Suppose that 45 days into the lock of the commitment, the value falls to $450,000. The volatility of commitments is 30%, or .3. 5-year Treasuries, a benchmark for the risk-free rate have a coupon of 1.5%.Treasury bonds代写

8.Provide a conceptual description of the components of the loan commitment.

The loan commitment is comprised of two parts, a bond-like set of cash flows where price changes are inversely related to changes in interest rates and an embedded written put option that allows the borrower close the loan or not.

- From a financial instrument perspective, how should the borrower be thinking about this loancommitment?Treasury bonds代写

From the borrower’s perspective they have the right to fallout of the pipeline without penalty and in that regard it as if they have a free put option. They can “put” or close the commitment at the contracted note rate. In this case they would likely exercise their close option.

10.From the lender’s perspective what risk do they face and what estimate can be placed on this risk using the information above.

Make sure in taking time into account it is on an annualized basis.Treasury bonds代写

They have written a put option to the borrower at no cost. You can use formula 13.2 for the delta of the put option. Using the inputs above and assuming time to expiration T is 45/365, yields a value of -.824. NOTE – I will provide the delta so you do not need to calculate it using Black-Scholes. This would suggest that the option to the borrower is deep in the money for the borrower to exercise the option to close the loan. Note that this occurs because rates have moved up causing the price of the commitment to go down.

Higher rates incent the borrower to close.

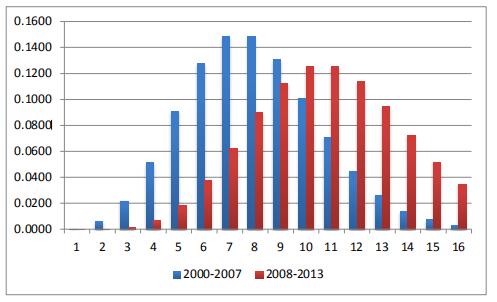

- Between 2000-2007, your bank observed 49 operational events. From 2008-2013, the bank grew considerably and as a result, your bank has seen the number of operational risk events climb to 150. How might you compare the relative operational risk from the 2000-2007 period to the 2008-2013period?Treasury bonds代写

Between 2000-2007 there were 49 events in 7 years, or 7 events per year. For the period 2008-2013 there were 50 events in 5 years, or 10 per year. Using this information we could demonstrate that operational risk was greater in the 2008-2013 period by using a Poisson distribution. The distributions would look as follows:

- What is the probability of observing 5 operational risk events in a single year for the 2000-2007period?

12.77% with k = 5 and l = 7

As the head of your model validation group, you are presented with a model that is being used to approve customers for a new “Platinum” credit card oriented toward the highest credit quality customers. You have established a model deployment KS threshold of 35. The overall KS of the model has been tested at 42 against the development sample and 36 on an out-of-sample basis according to the model development group. The model validation group presents results showing the model has a KS of 36 out-of-sample and 32 at around where the credit policy cutoff for approval would be set.Treasury bonds代写

13.Should you approve the model for deployment ornot?Treasury bonds代写

The threshold for determining whether to roll out the model or not should be based on the model validation team’s results and not the model development group. In addition, the model tolerance should be based on a sample not used to develop the model. Additional information on how the model performs across key cohorts should be provided before making a decision. Strictly on the basis of the information provided above, the scorecard should not be approved given the 32 KS at where the model will be used most heavily.Treasury bonds代写

- Suppose additional information is made suggesting that for your best customers, the model KS is 40. How would you react to thisinformation?

While the scorecard appears to work well on the segment targeted for the card, the overall KS is not good enough at the policy cutoff to warrant moving the model into production.

- The Platinum Card model as it is known is showing that 25% of customers that have never gone delinquent on a credit card payment would be rejected for a Platinum card. What kind of error isthis?Treasury bonds代写

The model makes a Type I error since it incorrectly rejects loans it should have otherwise made.

- It is also established through the validation exercise that 15% of customers having gone at least 30 days past due over the last 6 months in their credit card payments would be approved by the model. What type of error isthis?

This is an example of Type II error where the model approves loans that otherwise it should not.

更多其他:代码代写 金融代写 python代写 web代写 物理代写 数学代写 考试助攻 计算机代写 C语言代写 经济代写 金融经济统计代写 金融代写