LUBS5006M International Business Finance

商业金融课业代写 Exchange rates (questions 1-6) 1.DUBOIS AND KELLER Chantal DuBois lives in Brussels. She can buy a U.S. dollar for €0.7600/$. Christopher Keller,

Exchange rates (questions 1-6) 商业金融课业代写

1.DuBois and Keller

Chantal DuBois lives in Brussels. She can buy a U.S. dollar for €0.7600/$. Christopher Keller, living in New York City, can buy a euro for $1.3200/€. What is the foreign exchange rate between the dollar and the euro?

2.Mexican Peso Changes

In December 1994 the government of Mexico officially changed the value of the Mexican peso from 3.2 pesos per dollar to 5.5 pesos per dollar. What was the percentage change in its value? Was this a depreciation, devaluation, appreciation, or revaluation? Explain.

3.Hong Kong Dollar and the Chinese Yuan 商业金融课业代写

The Hong Kong dollar has long been pegged to the U.S. dollar at HK$7.80/$. When the Chinese Yuan was revalued in July 2005 against the U.S. dollar from Yuan8.28/$ to Yuan8.11/$, how did the value of the Hong Kong dollar change against the Yuan?

4.Ranbaxy (India) in Brazil

Ranbaxy, an Indian-based pharmaceutical firm, has continuing problems with its cholesterol reduction product’s price in one of its rapidly growing markets, Brazil. All product is produced in India, with costs and pricing initially stated in Indian rupees (Rps), but converted to Brazilian reais (R$) for distribution and sale in Brazil. In 2009, the unit volume was priced at Rps21,900, with a Brazilian reais price set at R$895. But in 2010, the reais appreciated in value versus the rupee, averaging Rps26.15/R$. In order to preserve the reais price and product profit margin in rupees, what should the new rupee price be set at?

5.Toyota Exports to the United Kingdom 商业金融课业代写

Toyota manufactures in Japan most of the vehicles it sells in the United Kingdom. The base platform for the Toyota Tundra truck line is ¥1,650,000. The spot rate of the Japanese yen against the British pound has recently moved from ¥197/£ to ¥190/£. How does this change the price of the Tundra to Toyota’s British subsidiary in British pounds?

6.Chinese Yuan Revaluation

Many experts believe that the Chinese currency should not only be revalued against the U.S. dollar, as it was in July 2005, but also be revalued by 20% or 30%. What would the new exchange rate value be if the yuan was revalued an additional 20% or 30% from its initial post-revaluation rate of Yuan 8.11/$?

The market for foreign exchange (questions 7-12) 商业金融课业代写

7.Visiting Guatemala

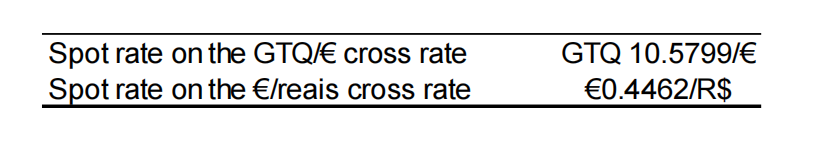

Isaac Díez Peris lives in Rio de Janeiro. While attending school in Spain he meets Juan Carlos Cordero from Guatemala. Over the summer holiday Isaac decides to visit Juan Carlos in Guatemala City for a couple of weeks. Isaac’s parents give him some spending money, R$4,500. Isaac wants to exchange it to Guatemalan quetzals (GTQ). He collects the following rates:

What is the Guatemalan quetzal/Brazilian reais cross rate?

How many quetzals will Isaac get for his reais?

8.Forward Premiums on the Japanese Yen

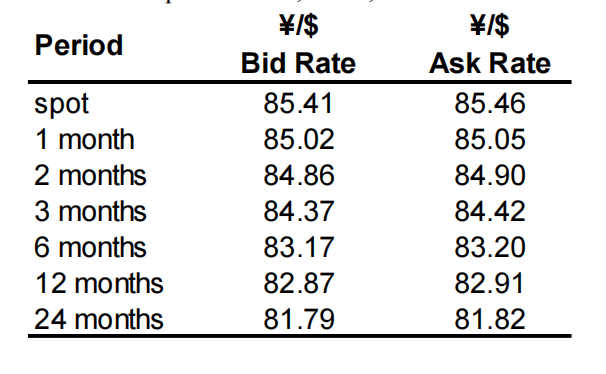

Use the following spot and forward bid-ask rates for the Japanese yen/U.S. dollar (¥/$) exchange rate from September 16, 2010, to answer the following questions:

What is the mid-rate for each maturity?

What is the annual forward premium for all maturities?

Which maturities have the smallest and largest forward premiums?

9.Forward Premium on the euro

Calculate the forward premium on the euro if the spot rate is €1.3300/$ and the 3-month forward rate is €1.3400/$.

10.Speculation in the Forward Market

The 3 month forward rate is currently $1.50/£. Based on your analysis of the exchange rate, you are pretty confident that the spot exchange rate will be $1.52/£ in 3 months’ time. Assume you want to speculate on the $/£ spot rate by buying or selling £1m in the forward market.

(a) Explain how you could speculate in the forward market and calculate your expected $ profit from speculation.

(b) Calculate your speculative $ profit if the spot exchange rate actually turns out to be $1.46/£.

11.Triangular Arbitrage Using the Swiss France

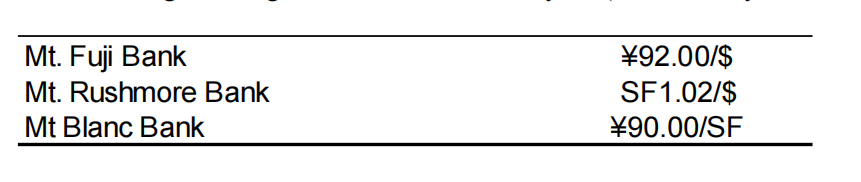

The following exchange rates are available to you. (You can buy or sell at the stated rates.)

Assume you have an initial SF12,000,000. Can you make a profit via triangular arbitrage? If so, show the steps and calculate the amount of profit in Swiss francs.

12.Transatlantic Arbitrage

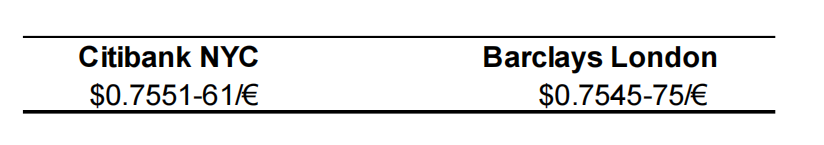

A corporate treasury with headquarters in Vienna and operations in New York simultaneously calls Citibank in New York City and Barclays in London. The two banks give the following quotes at the same time on the euro:

Using $1 million or its euro equivalent, show how the corporate treasury could make geographic arbitrage profit with the two different exchange rate quotes.

更多代写:代做java 雅思代考价格 英国地理assignment代写 多伦多网课Essay写作 电影report代写 英文推荐信代写