cash hold

企业金融论文代写 An interesting phenomenon in the study of corporate finance is that corporate investment in tangible assets has substantially decreased

1.Introduction

An interesting phenomenon in the study of corporate finance is that corporate investment in tangible assets has substantially decreased in the past 30 years, while cash holdings have increased at the same time. How to explain for this phenomenon has become a hot topic in the researches on corporate finance. For example, Bates et al. (2009) find that the average cash-to-assets ratio for U.S. industrial firms more than doubles from 1980 to 2006 and they propose that the increase of firms’ cash ratios is partly due to the increase of their volatilities. Jones and Philippon (2016) argue that a secular decline in competition can explain for weak corporate investment. Gutiérrez and Philippon (2017) find that US firms have been under-invested relative to Tobin’s Q since the 2000s and they claim that this phenomenon is partly due to the decline of competition.企业金融论文代写

译文:

1.简介 企业金融论文代写

企业金融研究中一个有趣的现象是,过去30年企业对有形资产的投资大幅减少,而同时持有现金却在增加。 如何解释这一现象已成为公司财务研究的热点。 例如,贝茨等人。 (2009) 发现美国工业企业的平均现金资产比率从 1980 年到 2006 年增加了一倍多,他们提出企业现金比率的增加部分是由于其波动性的增加。 Jones 和 Philippon (2016) 认为,竞争的长期下降可以解释企业投资疲软的原因。 Gutiérrez 和 Philippon (2017) 发现自 2000 年代以来,美国公司相对于托宾 Q 的投资不足,他们声称这种现象的部分原因是竞争下降。

This paper seeks to examine if the explanation for the increase of firms’ cash ratios in Bates et al. (2009) still holds when more recent data is included.

To be specific, this paper will use a dataset of the 100 largest US firms over the period 1980 to 2017 to replicate the finding in Bates et al. (2009) to examine if increased volatility can still explain the increase of firms’ cash holdings.企业金融论文代写

Historically, a lot of theories have been proposed to explain why there is an increase of firms’ cash holdings. For example, according to Jensen (1986), firms which have agency problems tend to have higher cash holdings. Also, to understand why cash holdings increase can help us better understand the leverage of firms. With this background. it is relevant to examine if the increase of cash volatility can explain for the recent increase of firms’ cash holdings. Following Bates et al. (2009), the ordinary least square regression method is used in this study.企业金融论文代写

The rest of this paper will be organized as follows. Section 2 introduces literature background. Section 3 describes the data. Section 4 presents the empirical results. Section 5 gives the discussion on the results. Section 6 concludes.

译文:

本文旨在检验 BATES 等人增加公司现金比率的原因。 (2009) 在包含更多最新数据时仍然成立。

具体而言,本文将使用 1980 年至 2017 年期间美国 100 家最大公司的数据集来复制 Bates 等人的发现。 (2009) 检验波动性增加是否仍然可以解释公司现金持有量的增加。

从历史上看,人们提出了许多理论来解释为什么公司的现金持有量增加。例如,根据 Jensen (1986),有代理问题的公司往往持有较多的现金。此外,了解现金持有量增加的原因可以帮助我们更好地了解公司的杠杆作用。有了这个背景。检验现金波动性的增加是否可以解释近期公司现金持有量的增加是相关的。继贝茨等人之后。 (2009),本研究使用普通最小二乘回归方法。

本文的其余部分将按如下方式组织。第 2 节介绍了文献背景。第 3 节描述了数据。第 4 节介绍了实证结果。第 5 节给出了对结果的讨论。第 6 节结束。

2. Literature Background

Historically, a lot of studies have been conducted to examine the determinants of firms’ cash holdings. For example, Miller and Orr (1966) set up a model to solve for the optimal demand for cash. In their setting, a firm faces transaction costs in which it need to convert a financial asset with less liquidity into cash to make payments. In the setting of Miller and Orr (1966), large firms need less cash due to economies of scale. Jensen (1986) claims that entrenched managers in the firms which has high cash flow are less willing to pay out cash.企业金融论文代写

In this way, they propose that agency conflicts can explain for the change of firms’ cash holdings. Dittmar, Mahrt-Smith, and Servaes (2003) use a cross-country data and find that firms in countries which have greater agency problems tend to hold more cash. Almeida, Campello, and Weisbach (2004) set up a model in which firms hold cash out of the precautionary demand. They propose that financially constrained firms tend to invest more in cash. Foley, Hartzell, Titman, and Twite (2007) find that corporations in United States which have tax burden related with earnings from other countries tend to hold more cash.

译文:

2. 文献背景 企业金融论文代写

从历史上看,已经进行了大量研究来检查公司现金持有量的决定因素。例如,Miller 和 Orr (1966) 建立了一个模型来求解最优现金需求。在这种情况下,公司面临交易成本,需要将流动性较差的金融资产转换为现金以进行支付。在 Miller 和 Orr (1966) 的背景下,由于规模经济,大公司需要更少的现金。 Jensen (1986) 声称拥有高现金流的公司中根深蒂固的经理不太愿意支付现金。

通过这种方式,他们提出代理冲突可以解释公司现金持有量的变化。 Dittmar、Mahrt-Smith 和 Servaes (2003) 使用跨国数据发现,代理问题较多的国家的公司往往持有更多现金。 Almeida、Campello 和 Weisbach (2004) 建立了一个模型,在该模型中,企业出于预防性需求而持有现金。他们提出,财务受限的公司倾向于更多地投资现金。 Foley、Hartzell、Titman 和 Twite(2007 年)发现,美国公司的税收负担与来自其他国家的收入相关,往往持有更多现金。

Following Bates et al. (2009), this study will examine how the increase of cash volatility contributes to the increase of firms’ cash holdings.

In recent years, there is an increase in idiosyncratic risk. According to Irvine and Pontiff (2008), the increase of idiosyncratic risk mirrors an increase in the volatility of cash flow. These results indicate that firms are now facing higher unhedgeable risks, therefore, they have higher precautionary demand for cash, which leads to the increase of cash holdings.企业金融论文代写

Han and Qiu (2007) provides a theoretical evidence that an increase in the volatility of cash flow can lead to the increase of cash holdings in financially constrained firms, for other firms, the effect is ambiguous. They also provide an empirical evidence which shows that the cash holdings of firms which are financially constrained increase when the volatilities of cash flow increase. This study will replicate the analysis in Bates et al. (2009) to examine if the increase of cash volatility can explain the increase of firms’ cash holdings for the past 38 years. The hypothesis is that firms’ cash holdings are increase with the volatility of cash holdings. We will use the dataset of the 100 largest firms in United States from 1980 to 2017 to do the analysis. The cash holdings are measured as the ratio of firms’ total assets. Time trend is also included in our analysis.

译文:

跟随贝茨等人。 (2009),这项研究将检验现金波动性的增加如何促进公司现金持有量的增加。

近年来,异质风险有所增加。根据 Irvine 和 Pontiff (2008) 的说法,异质风险的增加反映了现金流波动性的增加。这些结果表明,企业现在面临更高的不可对冲风险,因此他们对现金有更高的预防性需求,从而导致现金持有量增加。

Han and Qiu (2007) 提供了一个理论证据,即现金流波动性的增加会导致财务受限企业现金持有量的增加,对于其他企业来说,效果是不明确的。他们还提供了一个经验证据,表明当现金流的波动性增加时,财务受限的公司的现金持有量增加。本研究将复制 Bates 等人的分析。 (2009) 检验现金波动性的增加是否可以解释过去 38 年公司现金持有量的增加。假设是公司的现金持有量随着现金持有量的波动而增加。我们将使用 1980 年至 2017 年美国 100 家最大公司的数据集进行分析。现金持有量以公司总资产的比率来衡量。时间趋势也包含在我们的分析中。

3. Methodology and data

Following Bates et al. (2009), this paper will use the Ordinary Least Square regression method to study how the increase of cash volatility contributes to the increase of firms’ cash holdings. To be specific, First, an analysis is conducted to find out the average increase of cash holdings (measured as the ratio of total asset). A regression of cash holdings on year is used to get the result. The preliminary model is

![]()

In the regression, the year variable is calculated as the actual year minus 2000. 企业金融论文代写

Then, following Bates et al. (2009), the volatility of firms’ cash holdings is added in the regression to examine how it contributes to the increase of firms’ cash holdings. The model is extended as follows

Finally, by comparing the values of coefficients of these two models and check for the significances of the coefficients, we can find how the increase of cash volatility contributes to the increase of firms’ cash holdings.

译文:

3. 方法论和数据 企业金融论文代写

继贝茨等人之后。 (2009),本文将使用普通最小二乘回归方法研究现金波动性的增加如何促进公司现金持有量的增加。 具体而言,首先进行分析,找出现金持有量的平均增幅(以占总资产的比率衡量)。 使用年度现金持有量的回归来获得结果。 初步模型是

在回归中,年份变量计算为实际年份减去 2000。

然后,跟随贝茨等人。 (2009),在回归中加入了公司现金持有量的波动性,以研究它如何促进公司现金持有量的增加。 模型扩展如下

最后,通过比较这两个模型的系数值并检验系数的显着性,我们可以发现现金波动率的增加对企业现金持有量增加的贡献。

The sample data comes from the database of The Center for Research in Security Prices (CRSP) and Compustat provided in Wharton Research Data Services (WRDS) for the period 1980 to 2017.

The dataset covers the financial indicators of the 100 largest firms and the firm-year volatility (measured by taking the standard deviation in firms’ cash holdings over a 5-year period).企业金融论文代写

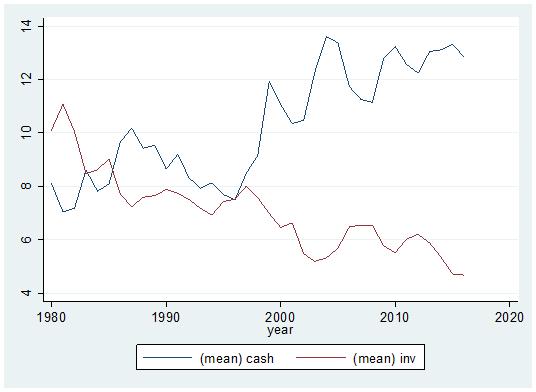

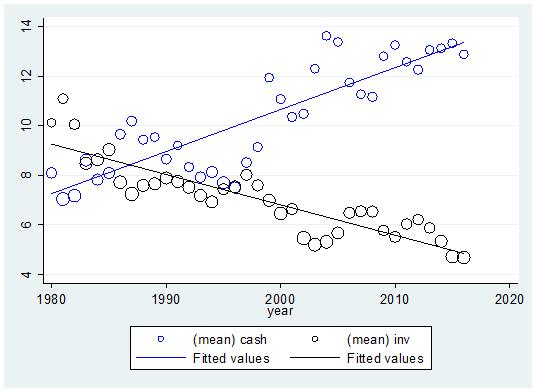

To get an intuitive understanding of the decrease of corporate investment and the increase of cash holdings in the sample over the past 38 years, the plot of cash holdings as percentage of book value of assets and investment as percentage of book value of assets over time is presented as follows (Figure 1 and Figure 2).

Figure 1: Cash holdings and Investment

Figure 2: Cash holdings and Investment (with fitted line)

From Figure 1 and Figure 2, we can see that in general, cash holdings as percentage of book value of assets has increased over time. The cash holding ratio has increased from about 8% in 1980 to about 13% in 2017, which means the cash ratio increases 5 percentage points in 38 years. At the same time, the investment as percentage of book value of assets has decreased. The investment as percentage of book value of assets is about 10% in 1980 and it has decreased to about 5% in 2017, which means the investment ratio decreases 5 percentage points in 38 years.企业金融论文代写

译文:

样本数据来自证券价格研究中心 (CRSP) 的数据库和沃顿研究数据服务 (WRDS) 提供的 1980 年至 2017 年期间的计算机数据库。

该数据集涵盖了 100 家最大公司的财务指标和公司年波动率(通过采用公司 5 年期间现金持有量的标准差来衡量)。

为直观了解样本中近 38 年企业投资减少和现金持有量增加情况,现金持有量占资产账面价值百分比和投资占资产账面价值百分比随时间变化的图为呈现如下(图 1 和图 2)。

从图 1 和图 2 中,我们可以看到,总体而言,现金持有量占资产账面价值的百分比随着时间的推移而增加。现金持有率从1980年的8%左右上升到2017年的13%左右,这意味着38年现金比例增加了5个百分点。同时,投资占资产账面价值的比例有所下降。 1980年投资占资产账面价值的比例约为10%,2017年下降到5%左右,即投资比例38年下降5个百分点。

4.Results

In this section we present empirical evidence on how the increase of cash volatility contributes to the increase of firms’ cash holdings. The results are in Table 1, Table 2 and Table 3.

First, to get a preliminary quantitative understanding about how cash ratio and investment ratio of book value of assets change over years, two regressions for cash ratio and investment ratio are made on the year variable. The results of the two regressions on year are displayed in Table 1.

Table 1: Regression on year

| (1) | (2) | |

| 企业金融论文代写 | Cash holdings | Investment |

| year | 0.1760*** | -0.1059*** |

| (0.018043) | (0.007035) | |

| Constant | 10.4717*** | 6.7264*** |

| (0.183824) | (0.071675) | |

| R-Square | 0.0293 | 0.0671 |

| Number of Observation | 3151 | 3151 |

Then, the volatility of cash ratio is included in the analysis to examine if it can explain for the decrease of cash ratio and increase of investment ratio. The results of these two regressions on year and volatility are displayed in Table 2.企业金融论文代写

Table 2: Regression on year and volatility

| (1) | (2) | |

| 企业金融论文代写 | Cash holdings | Investment |

| year | 0.1201*** | -0.0986*** |

| (0.016474) | (0.007023) | |

| Volatility | 1.4489*** | -0.1896*** |

| (0.055034) | (0.023461) | |

| Constant | 6.4168*** | 7.2569*** |

| (0.226774) | (0.096674) | |

| R-Square | 0.2045 | 0.0861 |

| Number of Observation | 3151 | 3151 |

Note that extreme points such outliers can have extraordinary influence on analysis result, which makes the conclusion unreliable. To exclude the influence of extreme points in the sample, a robust check is made for the above results. The robust analysis is made by removing the 5 largest values (outliers) of cash holdings and volatility. After removing the 5 largest values (outliers) of cash holdings and volatility, the regression results in ii) and iii) are updated in Table 3 and Table 4.

Table 3: Regression on year

| (1) | (2) | |

| Cash holdings | Investment | |

| year | 0.1772*** | -0.1065*** |

| 企业金融论文代写 | (0.017571) | (0.007024) |

| Constant | 10.3856*** | 6.7433*** |

| (0.179139) | (0.071604) | |

| R-Square | 0.0314 | 0.0682 |

| Number of Observation | 3142 | 3142 |

Table 4: Regression on year and volatility

| (1) | (2) | |

| Cash holdings | Investment | |

| 企业金融论文代写 | ||

| year | 0.1039*** | -0.0989*** |

| (0.015468) | (0.007046) | |

| Volatility | 1.8571*** | -0.1923*** |

| (0.058564) | (0.026678) | |

| Constant | 5.2935*** | 7.2707*** |

| (0.223829) | (0.101963) | |

| R-Square | 0.2664 | 0.0834 |

| Number of Observation | 3142 企业金融论文代写 | 3142 |

译文:

4.结果 企业金融论文代写

在本节中,我们将提供有关现金波动性增加如何导致公司现金持有量增加的实证证据。结果见表1、表2和表3。

首先,为了初步定量了解资产账面价值的现金比率和投资比率随年份的变化情况,对年度变量进行现金比率和投资比率的两次回归。两次回归的年度结果显示在表 1 中。

表 1:年度回归

然后,将现金比率的波动纳入分析,以检验它是否可以解释现金比率的下降和投资比率的增加。这两个关于年份和波动率的回归结果显示在表 2 中。

表 2:年份和波动率的回归

请注意,此类异常值的极端点会对分析结果产生极大的影响,从而使结论不可靠。为了排除样本中极值点的影响,对上述结果进行了稳健检查。稳健分析是通过去除现金持有量和波动性的 5 个最大值(异常值)进行的。去除现金持有量和波动率的 5 个最大值(异常值)后,ii) 和 iii) 中的回归结果更新在表 3 和表 4 中。

表 3:年度回归

表 4:年份和波动率的回归

5.Discussion

From Table 1, The first regression result displays that the average increase in cash holdings is 0.176 (measured as percentage of book value) per year. The second regression result displays that the average decrease in investments is 0.106 (measured as percentage of book value) per year. The coefficients are both highly significant (significant at 1% level). These results display quantitatively that there is an increasing time trends for cash ratio and a decreasing time trend for investment ratio.企业金融论文代写

From Table 2, we can see that the coefficient on volatility in the first regression is positive and highly significant. This suggests that the increase of volatility can at least partly explain why the cash holding ratio increase over recent years. The R-square of this model is about 20%, note that the model includes only two independent variables, this result suggests that this regression model has a relatively strong explanatory power.

译文:

5.讨论

从表 1 中,第一个回归结果显示现金持有量平均每年增加 0.176(按账面价值的百分比衡量)。 第二个回归结果显示,投资平均每年减少 0.106(以账面价值的百分比衡量)。 系数都非常显着(在 1% 的水平上显着)。 这些结果定量地表明现金比率有增加的时间趋势和投资比率的减少时间趋势。

从表 2 中我们可以看出,第一次回归中的波动系数为正且非常显着。 这表明波动性的增加至少可以部分解释为什么近年来现金持有率增加。 这个模型的R平方在20%左右,注意这个模型只包含了两个自变量,这个结果说明这个回归模型有比较强的解释力。

From the result of the first regression in Table 3 and Table 4, we can see that after removing the 5 largest values (outliers) of cash holdings and volatility, the key results remain similar.

Further, we can see that the coefficient on year for the regression of Cash holdings ratio to asset decreased from 0.177 to 0.104 after controlling for cash volatility, which means the trend effect on cash ratio has decreased by (0.177- 0.104)/ 0.177=41% when the impact of the volatility of cash ratio has been considered.企业金融论文代写

This suggests that 41% of the trend in cash holding ratio is due to volatility increase when outliers are removed. These results indicate that the increase of the volatility of cash ratio can explain a large portion of the trend in cash ratio. So, our results provide an empirical evidence that are similar to the analysis in Bates et al. (2009), implying that the increase of the volatility of cash ratio still contributes a lot to the increase of firms’ cash holding when the most recent data are used.

译文:

从表 3 和表 4 中的第一次回归结果可以看出,在去除现金持有量和波动率的 5 个最大值(异常值)后,关键结果仍然相似。

进一步可以看出,在控制现金波动率后,现金持有比率与资产的回归系数从0.177下降到0.104,这意味着现金比率的趋势效应下降了(0.177-0.104)/0.177=41 %,当考虑现金比率波动的影响时。

这表明,41% 的现金持有率趋势是由于去除异常值后波动性增加。这些结果表明,现金比率波动性的增加可以在很大程度上解释现金比率的趋势。因此,我们的结果提供了类似于 Bates 等人的分析的经验证据。 (2009), 表明当使用最新数据时,现金比率波动率的增加仍然对公司现金持有量的增加有很大贡献。

6.Conclusion

In the past 38 years, firms’ cash holdings have increase substantially. A lot of studies have been conducted to explain for this phenomenon. According to precautionary demand theory for firms’ cash holdings, higher volatility risk can cause firm to hold more cash. Then it becomes a relevant question if the increase of firms’ cash holdings in the recent 38 years can be explained by the increase of the volatility of cash holdings.

Following Bates et al. (2009), this paper uses the most updated data to examine how the increase of the volatility of cash ratio contributes to the increase of firms’ cash ratios. This study documents that there is a significant increasing time trend in firms’ cash holdings. Also, the empirical results present a positive and significant correlation between firms’ cash ratios and the volatility of cash ratio.企业金融论文代写

Further, the results show that the increase of the volatility of cash ratio can explain a large portion (41%) of the increase of cash ratio, which indicates that the cash flow risk is still big factor that affects firms’ decisions for the amounts of cash holdings for the most recent data. This result suggests that the finding in Bates et al. (2009) can still help to explain why firms’ cash ratios have been increasing during recent years. The result in this study provide a support for precautionary demand theory for firms’ cash holdings and it helps to explain why firms’ cash holdings increase over the past 38 years.

译文:

6.结论 企业金融论文代写

在过去的 38 年中,公司的现金持有量大幅增加。已经进行了大量研究来解释这种现象。根据公司现金持有量的预防需求理论,较高的波动风险会导致公司持有更多现金。那么近38年企业现金持有量的增加是否可以用现金持有量波动性的增加来解释就成为一个相关的问题。

继贝茨等人之后。 (2009),本文使用最新数据来检验现金比率波动性的增加如何促进公司现金比率的增加。该研究表明,公司现金持有量有显着增加的时间趋势。此外,实证结果表明,公司现金比率与现金比率波动之间存在显着正相关。

此外,研究结果表明,现金比率波动性的增加可以解释很大一部分(41%)现金比率的增加,这表明现金流风险仍然是影响企业对现金比率决策的重要因素。最新数据的现金持有量。该结果表明 Bates 等人的发现。 (2009) 仍然可以帮助解释为什么近年来公司的现金比率一直在增加。本研究结果为企业现金持有量的预防性需求理论提供了支持,并有助于解释为什么企业现金持有量在过去 38 年中增加。

Reference

Almeida, H., Campello, M., & Weisbach, M. S. (2004). The cash flow sensitivity of cash. The Journal of Finance, 59(4), 1777-1804.

Bates, T. W., Kahle, K. M., & Stulz, R. M. (2009). Why do US firms hold so much more cash than they used to? The journal of finance, 64(5), 1985-2021.

Dittmar, A., Mahrt-Smith, J., & Servaes, H. (2003). International corporate governance and corporate cash holdings. Journal of Financial and Quantitative analysis, 38(1), 111-133.

Foley, C. F., Hartzell, J. C., Titman, S., & Twite, G. (2007). Why do firms hold so much cash? A tax-based explanation. Journal of Financial Economics, 86(3), 579-607.

Gutiérrez, G., & Philippon, T. (2017). Declining Competition and Investment in the US (No. w23583). National Bureau of Economic Research.

Han, S., & Qiu, J. (2007). Corporate precautionary cash holdings. Journal of Corporate Finance, 13(1), 43-57.

Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. The American economic review, 76(2), 323-329.

Jones, C., & Philippon, T. (2016). The Secular Stagnation of Investment? Unpublished manuscript, New York University, December.

Lee, D., Shin, H., & Stulz, R. M. (2016). Why does capital no longer flow more to the industries with the best growth opportunities? (No. w22924). National Bureau of Economic Research.

Miller, M. H., & Orr, D. (1966). A Model of the Demand for Money by Firms. The Quarterly journal of economics, 80(3), 413-435.

其他代写:代写CS C++代写 java代写 r代写 金融经济统计代写 paper代写 matlab代写 web代写 app代写 作业代写 物理代写 数学代写 考试助攻