Assignment

企业金融代写 Task Guidance For guidance on this assignment, please access the assignment vodcast available through Canvas Assignment Task

| Programme Title | MSc Enterprise Management |

| Module Title | Entrepreneurial Finance |

| Module Code | 1531 |

| Assignment Title | ENTREPRENEURIAL FINANCE COURSEWORK |

| Level | 7 |

| Weighting | 100% |

| Assignment Format | Question and Answer Format |

| Assignment Word Count | 2000 |

| Presentation Duration | N/A |

| Module Learning Outcomes covered in this assignment | i. Undertake financial decisions based on financial information available

ii. Utilise forecasting models to determine future revenue iii. Apply financial tools and techniques for financial decision making |

Task Guidance 企业金融代写

For guidance on this assignment, please access the assignment vodcast available through Canvas

Assignment Task

you are required to improve on your original submission for this resit

- You are required to complete all sections A, B, C, D and E, providing your answer under each question.

- You must show your working out under each section.

- You should use the formulae and tables provided.

- In-text citations and reference list must follow UCB Referencing Guide.

- Your work must comply with UCB presentation standards and are advised to refer to the guidance for submitting assignments in the Student Handbook.

SECTION A: CASH BUDGETS 企业金融代写

Chung Limited is applying for additional bank overdraft finance to enable the company to make the plant and machinery purchase described below. The directors have has asked you to draw up a cash budget for the 6 months to 30 June 2020 to prove to the bank that that overdraft finance will be repaid by 30 June 2020. The company provides you with the following financial information:

| Month | Sales | Purchases | Wages | Overheads |

| £ | £ | £ | £ | |

| November 2019 (actual) | 45,800 | 18,400 | 9,600 | 6,000 |

| December 2019 (actual) | 34,600 | 13,900 | 9,800 | 14,000 |

| January 2020 (budgeted) | 42,200 | 16,800 | 10,500 | 7,000 |

| February 2020 (budgeted) | 44,000 | 17,600 | 11,200 | 7,500 |

| March 2020 (budgeted) | 54,000 | 21,600 | 13,500 | 18,800 |

| April 2020 (budgeted) | 57,600 | 23,000 | 14,400 | 8,000 |

| May 2020 (budgeted) | 61,800 | 24,700 | 15,300 | 9,200 |

| June 2020 (budgeted) | 63,700 | 25,500 | 15,900 | 9,800 |

Notes: 企业金融代写

i. The bank balance at 1 January 2020 is expected to be £25,000.

ii. 60% of sales are for cash with the other 40% being on credit. 70% of credit sales pay in the month following the month of sale with the other 30% paying 2 months after the month of sale.

iii. 50% of purchases are paid for in the month after the month in which they are made with the remainder being paid 2 months after the month in which the purchases were made.

iv. 70% of wages are paid in the current month with the other 30% (representing tax and national insurance deductions) being paid over to the taxation authorities in the following month.

v. Overheads are paid in the month in which they are incurred. Overheads include £4,000 of plant and machinery depreciation each month.

vi. The directors of Ming Chung Limited expect to make a payment of £100,000 in January 2020 to acquire new plant and machinery.

Question 1 (12 marks)

Prepare the cash budget for Chung Limited for the 6 months ended 30 June 2020.

Question 2 (8 marks)

Discuss the steps that the directors of Chung Limited could take to fund the company’s operations if the bank refuses to agree to the required overdraft.

SECTION B: WORKING CAPITAL MANAGEMENT 企业金融代写

RYSC plc manufactures seats for luxury cars. The business has been trading for the last 15 years in a highly competitive market. Expand the business into international market. The CEO has hired a financial consultant to evaluate the financial position to undertake research to invest internationally. The consultant has been asked to provide an analysis based ion the information given by the financial statements. The company’s financial statements for the years ended 31 December 2019 and 31 December 2018 are presented below:

Statements of Financial Position

| 2019

£m |

2018

£m |

||

| Non-current assets | |||

| Property, plant and equipment | 320 | 240 | |

| Current assets | |||

| Inventories | 75 | 30 | |

| Receivables | 63 | 42 | |

| Cash and cash equivalents | 10 | 50 | |

| 148 | 122 | ||

| Total assets | 468 | 362 | |

| Current liabilities | |||

| Trade and other payables | 61 | 38 | |

| Current taxation | 33 | 22 | |

| Total liabilities | 94 | 60 | |

| Net assets | 374 | 302 | |

| Equity | |||

| Share capital (£1 shares) | 125 | 125 | |

| Share premium | 50 | 50 | |

| Retained earnings | 199 | 127 | |

| Total equity | 374 | 302 |

Statements of profit or loss for the years ended 31 December

| 2019 | 2018 | ||

| £m | £m | ||

| Revenue | 575 | 400 | |

| Cost of sales | 368 | 260 | |

| Gross profit | 207 | 140 | |

| Distribution costs | 20 | 16 | |

| Administrative expenses | 26 | 20 | |

| Operating profit | 161 | 104 | |

| Finance income | 4 | 8 | |

| Profit before tax | 165 | 112 | |

| Income tax | 33 | 22 | |

| Profit for the year | 132 | 90 |

Additional Information: 企业金融代写

- RYSC plc sells its car seats to the major global automobile manufacturers. The company has long term supply contracts with their customers. These long term supply contracts have an average of eight years to run before RYSC submits proposals for their renewal. Two new ten year contracts were signed with customers during the year ended 31 December 2019.

- RYSC plc buys components from its suppliers on credit and trades with its customers on credit.

- The company paid a dividend during the year ended 31 December 2019 of £60m.

- Depreciation of £30m was provided on property, plant and equipment during the year ended 31 December 2019.

Question 3 (7 Marks)

Calculate the following ratios for 2019 and 2018 for RYSC plc:

a. Current ratio

b. Quick ratio

c. Gearing ratio

d. Inventory days

e. Receivable days

f. Trade payables days

g. Cash conversion cycle

Your ratio calculations should be made to two decimal places.

Question 4 (13 marks)

Evaluate the liquidity and financial stability of RYSC plc.

SECTION C: FORECASTING MODELS 企业金融代写

MOVING AVERAGE

EN2PRZ Ltd is a retailer of party and gift products. The company is currently facing financial difficulties due to the current economic crisis where the management team is aware of the challenging business environment and its impact on the business and its ability to generate future income. The business is therefore interested in forecasting their future sales to ascertain sufficient stock of goods in order to establish the likely demand.

The following breakdown of sales has been obtained from EN2PRZ Ltd.

| Month | Time Period | Actual Sales

A |

| January | 1 | 350.00 |

| February | 2 | 383.00 |

| March | 3 | 371.00 |

| April | 4 | 390.00 |

| May | 5 | 409.00 |

| June | 6 | 432.00 |

| July | 7 | 468.00 |

| August | 8 | 485.00 |

| September | 9 | 431.00 |

| October | 10 | 450.00 |

| November | 11 | 508.00 |

| December | 12 | 591.00 |

Question 5 (5 marks)

Using a three month moving average, calculate the Mean Absolute Deviation

WEIGHTED AVERAGE 企业金融代写

On reflection, EN2PRZ Ltd considers that the closest time period is a more accurate predictor of future sales than previous time periods. Therefore, they have assigned the following weighting: W1 = 0.2, W2 = 0.3 and W3 = 0.5.

Question 6 (5 marks)

Calculate the Mean Absolute Deviation using the weighted averages given.

| Month | Time Period | Actual Sales

A |

| January | 1 | 350.00 |

| February | 2 | 383.00 |

| March | 3 | 371.00 |

| April | 4 | 390.00 |

| May | 5 | 409.00 |

| June | 6 | 432.00 |

| July | 7 | 468.00 |

| August | 8 | 485.00 |

| September | 9 | 431.00 |

| October | 10 | 450.00 |

| November | 11 | 508.00 |

| December | 12 | 591.00 |

LINEAR REGRESSION

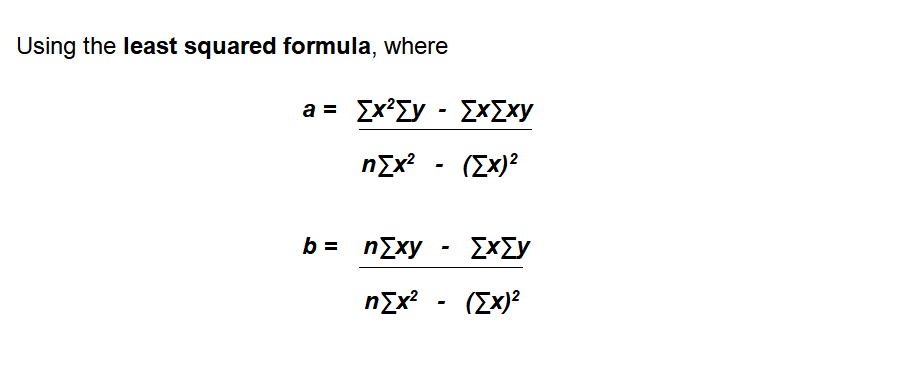

In addition, EN2PRZ Ltd want to forecast their sales longer term, using the Least Squared Regression method.

Question 7 (8 marks)

complete the table above and calculate the linear regression equation in the form

y = a + bx

Question 8 (2 marks)

Using your equation what will be the forecasted sales for 18 months?

SECTION D: TIME VALUE OF MONEY 企业金融代写

Question 9 (2 marks)

What will a £7000 investment be worth in four years’ time if the interest rate is 1.5% compounded annually? Give your answer to the nearest whole pence.

Question 10 (2 marks)

You plan to invest £25000 in the shares of a company. If the value of the shares increases by 4.25% each year, what will the value of the shares be in 12 years’ time?

Question 11 (2 marks)

You have received an unexpected inheritance sum of £15000. You are keen to invest this for the future and have researched various saving accounts. Which savings account offers the best return on your inheritance?

A. 8% over one year

B. 6% over two years

C. 5% over three years

D. 3% over four years

Question 12 (2 marks)

As a loyalty incentive your new employer offers you a bonus of £6750 if you remain with them for six years. You anticipate inflation will increase by 2% each year. What is the bonus valued at today?

Question 13 (4 marks)

A competing employer wants to lure you away from the above employers and offers you an alternative incentive. The offer includes a £4500 bonus over five years. This consists of a £400 signing bonus, £650 for year 1, £700 for year 2, £750 for year 3, £800 for year 4 and £1200 for year 5. What is the present value of the bonus today if you anticipate inflation will increase on average by 2% each year?

ANNUITIES 企业金融代写

Question 14 (2 marks)

Each year you receive an end of year bonus of £1500 from your employers. You are keen to save this bonus and put it towards a deposit on a house. You have identified a savings account offering 3% annual interest. After three years how much money you would have towards the deposit?

Question 15 (2 marks)

You are also in a position to save £325 at the start of each month towards the deposit needed for the house. You have identified a saving account which offers 12% annual interest. After three years how much money would you have towards the deposit?

Question 16 (2 marks)

As a promising tennis player, a company wishes to sponsor you for the next three years to advertise their business. If you win the County League they will pay you £2500 at the end of each annual season. The company uses an account that offers 3% annual interest. How much does the company need to deposit today to ensure you receive £2500 each year?

Question 17 (2 marks)

On further negotiations you discuss with the company the benefit, for both parties, of receiving the £2500 sponsorship at the beginning of each annual season as this would allow you the opportunity to pay for more coaching in order to improve your performance. Assuming the terms remain the same (as in question 16), how much money does the company need to deposit in the account today if they agree to this option?

SECTION E: INVESTMENT APPRAISAL 企业金融代写

RYCH Limited has £800,000 to invest. The company is considering two investment projects A and B but only has sufficient cash to accept one of them. The projected cash flows of the two potential investments are presented below. The directors have asked for your help and advice in reaching a decision on which investment project to accept. RYCH Limited has a cost of capital of 9%.

| A | B | |

| Cash flows | £000 | £000 |

| Initial investment | (800) | (800) |

| Cash inflows year 1 | 250 | 150 |

| Cash inflows year 2 | 300 | 250 |

| Cash inflows year 3 | 200 | 300 |

| Cash inflows year 4 | 200 | 240 |

| Cash inflows year 5 | 150 | 200 |

| Cash inflow from sale of the investment at the end of year 5 | 100 | 150 |

Question 18 (4 marks)

For both investment projects calculate payback period.

Question 19 (12 marks)

For both investment projects calculate

a) The accounting rate of return

b) Net present value

Question 20 (4 marks)

Using the information on cash inflows and the results of your investment appraisal calculations, briefly discuss which project should be selected by the directors, providing a justification for your recommendation.

更多代写:CS加拿大网课代上推荐 思培代考 英国会计网课全包 加拿大MATH数学论文代写 加拿大法律Assignment代写 代写留学sci论文