Advanced International Trade Theory

Problem Set 4 – 100 points

Don’t lose points – read these instructions carefully!

Carefully answer each of the questions below.

You need to show your work, not just the final answer

Please make sure your work is legible & each problem and step are properly numbered/lettered in order

You can write or type your answers for the questions

Please put your name and PSU ID number at the top of the 1st page

You may use as many sheets of paper as you need.

If you did parts by hand:

Scan your entire document (including the parts you typed and the parts done by hand)

Save the file on your computer (.PDF is the only acceptable formats).

Merge the separate PDFs into one file using a service such as (PDFMerge!)

Failure to submit a single file will result in points being deducted

Upload it to the CANVAS dropbox for this homework assignment

If you typed everything:

Save the file on your computer (.PDF is the only acceptable formats) and then upload it to the CANVAS dropbox for this homework assignment.

Be sure your assignment is all on one file. Failure to submit a single file will result in points being deducted

Pages must be scanned in proper order

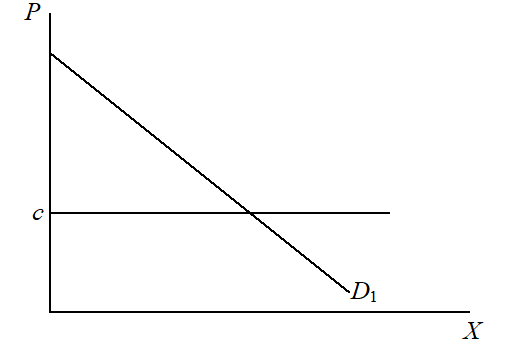

1. (18 points total, 6 points each part.) Consider a monopolist in equilibrium who faces the linear demand curve D1 shown below, and whose marginal cost is constant at c.

a. Show on the graph above the profit-maximizing equilibrium Q1 and P1 for this monopolist. [Hint: Recall from Econ 302 what the MR curve looks like for a linear demand curve. In particular, every point on the MR curve is halfway between the demand curve and the Y axis.]

b. Now suppose that the demand curve becomes more elastic at all points, but continues to pass through the same price-quantity point that you found to be optimal in part (a). Call this new curve D2. (That is, if the profit-maximizing monopolist was producing Q1 and selling it for P1 in part (a), quantity Q1 still has price P1 on the new, more elastic, demand curve.) [Hint: Think very hard about how the new MR2 curve will compare to MR1.] Construct the new equilibrium for the monopolist (Q2, P2) and compare it to the old, in terms of quantity, price, and profit.

c. Explain what your answer to part (b) could have to do with international trade.

2. (20 points, 10 points each part.)

a. We often expect the gains from trade in an industry with imperfect competition to be larger than they are with perfect competition. In a paragraph or two, and possibly with a picture to illustrate, clearly explain why.

b. Claim: If a country is going to trade in any case, then it would be better off if its industries were imperfectly competitive in the first place instead of perfectly competitive. In this way, our country would get to enjoy those larger gains from trade. Agree or disagree, explain in words (one or two paragraphs) and illustrate using production possibility frontiers and community indifference curves.

3.

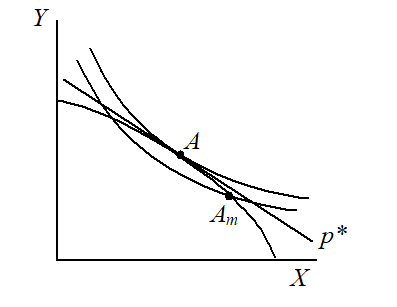

(16 points, 8 points each part) The accompanying graph shows an economy in which industry Y is a monopoly that charges some markup over marginal cost. In autarky, production and consumption take place at point Am. Autarky equilibrium with a perfectly competitive Y industry would be at A. The country is small, and the world price is given by price line p*, which happens coincidentally to be tangent to the PPF at A.

a. How does the autarky relative price of Y paid by consumers at Am compare to the free trade price?

b. If the country now opens to free international trade, the single producer of good Y in the country will become a price-taker at world prices, what will happen to a) production and consumption of X and Y, b) to the relative price of Y paid by consumers, c) to the profits of the firm that produces Y, and d) to consumer welfare?

4. (24 points total. 6 points each part) Suppose the Beer industry (good X) is characterized by Monopolistic Competition in both the Home and Foreign country. The different producers offer differentiated products based on the tastes of their beer. Otherwise, the beer producers are in all ways identical. They each face a linear demand curve of the type described in Lesson 8:

![]()

for any firm i. Fixed Costs are F=$10M, Marginal costs are constant C=$20 per keg. b=.01. The size of the home market is 10M kegs, and foreign is 25M kegs. [Review your Lesson 8 notes/videos for details on the terms of the equation in addition to how to solve the problem.]

a. How many firms will produce in the home market in autarky? How much output for each firm? What is the price per keg of beer?

b. How many firms will produce in the foreign market in autarky? How much output for each firm? What is the price per keg of beer? (If your answer is not a round number, round DOWN to get n. Fractions of a firm don’t make sense.)

c. Why should we only round n down in problems like this rather than follow conventional rounding rules? Explain in a short paragraph.

d. How many firms will produce in equilibrium when the countries open for trade? How much output for each firm? What is the price per keg of beer?

5. (22 points) Suppose it is costly to transport exports. Let this cost be equal to some number T per unit. We are going to investigate some features of how the presence of T impacts the monopolistic competition model with trade. Assume all firms are the same in each country, and that each country is the same size.

The problem is written to help guide you to the solution in a series of (hopefully) not too demanding steps. (Most of these steps I sort of do for you.)

a. Let Phh be the price a home firm charges in the home country, Phf be the price a home firm charges in the foreign country, Pfh be the price a foreign firm charges in the home country, and Pff be the price a foreign firm charges in the foreign country.

b. Also adopt notation where Xhh is the quantity of beer a home country sells at home, with other Xs defined the same way.

c. (4 points) A firm considering the prices to charge in each market will evaluate each market separately, since the trade cost introduces a friction that makes each market imperfectly integrated. When we had no transaction costs, we found in lecture that

![]()

. The term equalled 1/n since we had total symmetry, which was nice. Since firms now need to charge different prices in each country, this new asymmetry will not allow for the same simplification here. Write out four MR relationships. For instance, MRhh will be

d. (4 points) Set the MRs equal to MC. Note that when a firm is exporting, the MC=C+T.

e. (4 points) Calculate the Markup over MCs for the Home firm in both markets. For instance,

f. (4 points) Will the markup be larger for the home firm when selling at home or foreign? Why? [Hint: Think about what will happen to its market share in foreign now that it has to pay a transportation cost.]

g. (2 points) Given your answer to g, write down an inequality relating how the value Phh compares to the Phf minus transport costs.

h. (4 points) The result for g describes a phenomenon called “dumping.” The price charged by the home country firm in the foreign market, minus the cost of transport, is actually lower than the price the firm charges at home. “Dumping” is frowned upon by many governments. Suggest a couple reasons why. As an economist, what is your view?

更多 国际贸易代写 商科代写