Final Project

代做金融课业 Task 1 (5 points) 1- A five-year bond provides a coupon of 5% per annum payable semiannually. Its price is 104. What is the bond’s yield?

Task 1 (5 points)

1- A five-year bond provides a coupon of 5% per annum payable semiannually. Its price is 104. What is the bond’s yield? You may find Excel’s Solver useful.

2- Suppose that LIBOR rates for maturities of one month, two months, three months, four months, five months and six months are 2.6%, 2.9%, 3.1%, 3.2%, 3.25%, and 3.3% with continuous compounding. What are the forward rates for future one month periods?

Task 2 (10 points) 代做金融课业

You are hired by a mid-sized bank who wants to make a new investment product available to small investors. The investment product should track the S&P500 Index as closely and as cheaply as possible. Your job is to make a small report (not more than 2 pages) comparing a couple of alternatives. Hint: One approach must include using a swap structure and the other could be buying an ETF.

You should explain:

1- In what way are the two approaches different?

2- How are the two approaches done in practice?

3- What are the costs involved in each approach?

4- What are the risks involved?

Task 3 (5 points) 代做金融课业

A bank offers a corporate client a choice between borrowing cash at 11% per annum and borrowing gold at 2% per annum. (If gold is borrowed, interest must be repaid in gold. Thus, 100 ounces borrowed today would require 102 ounces to be repaid in one year.) The risk-free interest rate is 9.25% per annum, and storage costs are 0.5% per annum. Discuss whether the rate of interest on the gold loan is too high or too low in relation to the rate of interest on the cash loan. The interest rates on the two loans are expressed with annual compounding. The risk-free interest rate and storage costs are expressed with continuous compounding.

Task 4 (10 points)

Explain what is securities lending? How is it used to increase revenue on an exchange traded fund (ETF)?

Limit your answer to a maximum of one page. In you answer include:

1- What are ETFs (focus on index tracking ETFs) and why they are popular with investors?

2- How is an ETF created and who can issue ETFs?

3- What is securities lending? Use an ETF which does that as an example.

4- Who benefits from securities lending?

Task 5 (10 points) 代做金融课业

Company A, a British manufacturer, wishes to borrow U.S. dollars at a fixed rate of interest. Company B, a US multinational, wishes to borrow sterling at a fixed rate of interest. They have been quoted the following rates per annum (adjusted for differential tax effects):

| Sterling | US Dollars | |

| Company A | 7.8% | 6.1% |

| Company B | 7.5% | 5.2% |

Design a swap that will produce a gain for a bank, acting as intermediary, as well as for the two companies.

Task 6 (20 points)

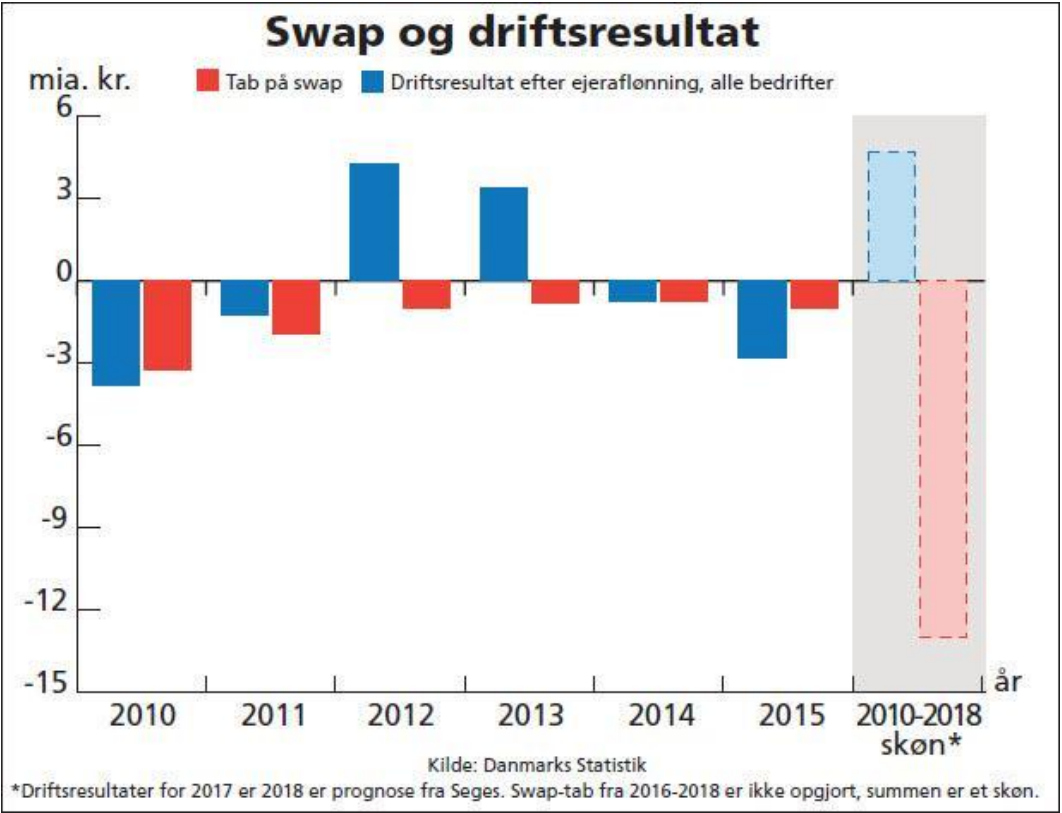

Here is an article postulating that Danish farmers have lost more than 10 years of their earnings because of their use of swap loans? In this assignment you should examine how that could be?

https://landbrugsavisen.dk/swaps-har-kostet-landm%C3%A6nd-mere-end-10-%C3%A5rs-indtjening

Limit your answer to a maximum of two pages. In you answer include:

1- Explain the swap loan contracts using an example of 10-year contract that was initiated back in 2008 swapping a variable rate for a fixed rate of 5%?

2- What is the benchmark for the loss? In other words, what alternative should the farmers have chosen instead of the swap loans in order not to have incurred this loss?

3- The farmers are very dissatisfied with the financial advice that they have received from the banks. Explain what are the main reasons for this dissatisfaction and whether it has merits?

4- Couldn’t the farmers re-finance their swap loans, say in 2010? Compare that with the scenario where the farmers instead had chosen 10-year fixed rates mortgage loans with embedded call options with an exercise right at par.

Task 7 (10 points) 代做金融课业

The American International Group, better known as AIG would have gone bankrupt, wasn’t it for a USD 150 billion bailout in 2008? Give a one-page summary of what they did wrong.

In you answer include:

1- What product(s) were the main cause of AIG’s near-death experience in 2008?

2- What would have been the cascading effects of AIG going bankrupt? In other words, why AIG was considered too big to fail?

3- What happens if AIG goes bankrupt today?

更多代写:Linux shell代写 gre作弊被抓 英国财务代考 写essay教学 sop格式要求 Stanford斯坦福申请代写