COMP226 Assignment 2: Strategy Development

trading applications代写 Learning Outcomes Assessed This assignment will address the following learning outcomes Understand the spectrum

The latest version of this document can be found here: https://www2.csc.liv.ac.uk/~rahul/teaching/comp226/_downloads/a2.pdf

| Continuous Assessment Number | 2 (of 2) |

| Weighting | 10% |

| Assignment Circulated | 10:00 Monday 23 April 2018 |

| Deadline | 12:00 Thursday 10 May 2018 |

| Submission Mode | Electronic only |

| Learning Outcomes Assessed | This assignment will address the following learning outcomes:

• Understand the spectrum of computer-based trading applications and techniques, from profit-seeking trading strategies to execution algorithms. • Be able to design trading strategies and evaluate critically their historical performance and robustness. • Understand the common pitfalls in developing trading strategies with historical data. • Understand methods for measuring risk and diversification at the portfolio level. |

Summary of Assessment |

The goal of this assignment is to implement and optimize a well-defined trading strategy within the backtester_v5.0

framework. The assignment will be assessed via the testing of 6 trading applications代写 functions that you need to implement. The input and output behaviour of each function is fully specified and a code template is provided as a starting point. In addition to addressing the learning outcomes above, another purpose of this assignment is for students to familiarize themselves with the backtester framework that will also be used in COMP396. |

| Marking Criteria | Individual marks are attributed for each of 6 functions that should be implemented. If all 6 function implementations pass all the automated tests then a mark of 100% will be achieved. Partial credit for a function may be awarded if some but not all automated tests for that function are passed. The marks available for each function are given below. |

| Submission necessary in order to satisfy module requirements | No trading applications代写 |

| Late Submission Penalty | Standard UoL policy; note that no resubmissions after the deadline will be considered. |

| Expected time taken | Roughly 8 hours |

Introduction: the backtester framework trading applications代写

You will write a strategy that should run in the backtester framework, which is available from

http://www2.csc.liv.ac.uk/~rahul/teaching/comp226/bt.html#backtester

The first thing you should do is download and unzip backtester_v5.0.zip, which will create a directory backtester_v5.0 on your hard drive.trading applications代写

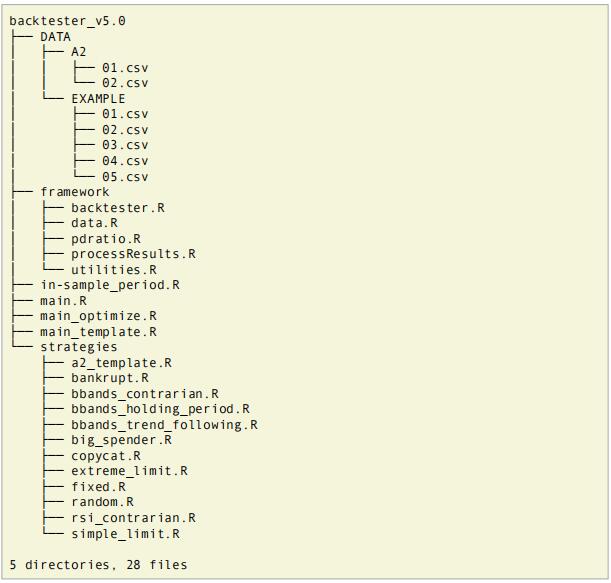

Here is a listing of the zip file contents:

Next you should open R and set the working directory to the backtester_v5.0 directory on your hard drive. You can now try the example code as follows:

source(‘main.R’)

If this doesn’t work, first make sure you are have set the working directory correctly, and then make sure you have installed all the required packages (see the error messages you get to figure out what the problem is).

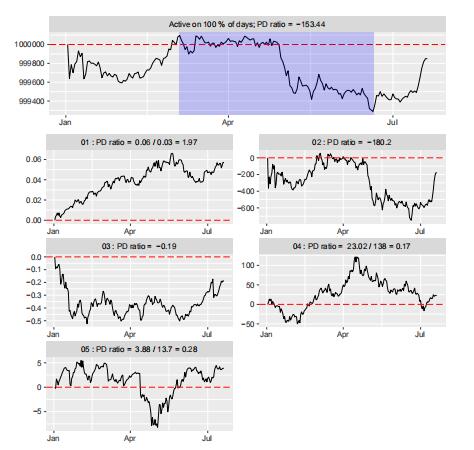

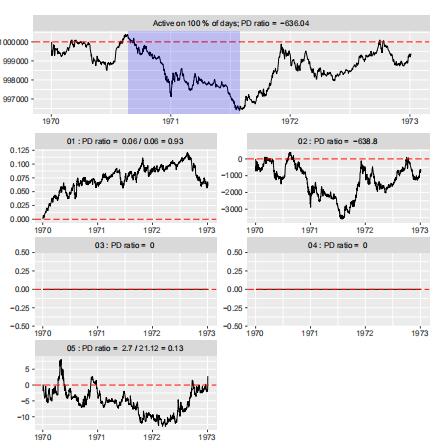

When it works it will produce a plot like the following:

There is one equity curve for each series in the data (5 of them in this case), and one aggregate equity curve. Let’s go through main.R and see what the individual parts do.

First we source the framework itself.

source(‘framework/data.R’);

source(‘framework/backtester.R’)

source(‘framework/processResults.R’)

Next, we load in the data using the function getData that is defined in framework/data.R. It returns a list of xts objects. These will be passed to the function backtester, though we may first change the start and end dates of the xts objects (which we will do in assignment 2).trading applications代写

# load data

dataList <- getData(directory=“EXAMPLE”)

There are 5 series in the directory backtester_5.0/DATA/EXAMPLE/, and therefore the list

dataList has 5 elements too.

> length(dataList)

[1] 5Each element is an xts:

> for (x in dataList) print(class(x))

[1] “xts” “zoo”[1] “xts” “zoo”

[1] “xts” “zoo” [1] “xts” “zoo” [1] “xts” “zoo”All the series have the same start and end dates:

> for (x in dataList) print(paste(start(x),end(x)))trading applications代写

[1] “1970-01-02 1973-01-05” [1] “1970-01-02 1973-01-05” [1] “1970-01-02 1973-01-05” [1] “1970-01-02 1973-01-05” [1] “1970-01-02 1973-01-05”The individual series contain Open, High, Low, Close, and Volume columns:

The next thing we do in main.R is source a strategy file.

# load in strategy and params

load_strategy(strategy) # function from example_strategies.R

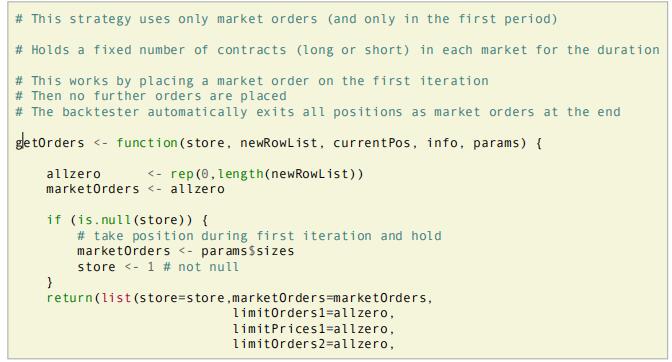

Here is the contents of the strategy file backtester_v5.0/strategies/fixed.R:

The backtester framework runs a strategy by calling getOrders. The arguments to getOrders are fixed, i.e., they are the same for all strategies. In the example strategy fixed.R, getOrders is the only function.

The arguments to getOrders are as follows:

- store: contains all data you choose to save from one period to the next

- newRowList: new day’s data (a list of single rows from the series)

- currentPos: the vector of current positions in each series

- params: a list of parameters that are sent to the function

![]()

Here’s how the strategy fixed.R works. In the very first period the backtester always (for every strategy) passes store to getOrders with NULL as its value. Thus in the first period, and the first period only, the vector marketOrders will be set to the parameter params$sizes, which should be a vector of positions with length equal to the number of series, which is 5 in this case. In main.R we see this parameter params$series,

which is the only parameter for fixed.R, set as follows:

params <- list(sizes=rep(1,5))trading applications代写

With these sizes, we buy and hold one unit in every series. We can change the parameters and take positions in only some series and go short in some series, e.g., with:

params <- list(sizes=c(1,2,0,0,-1))

Compare with the equity curves above and note that for series 1 they are the same, for series 2 the new one is scaled by 2, for series 3 and 4 we no longer trade, and for series 5 we now take a short position, so the new series 5 is a reflection of the old series 5 equity curve.

The next thing in main.R is a subsetting of the time period for the backtest as follows:

inSampDays <- 200

# in-sample period

dataList <- lapply(dataList, function(x) x[1:inSampDays])

So we are only using the first 200 days.

Hint trading applications代写

You should adapt this use of lapply on dataList in order to define the in-sample

period in assignment 2.

Finally we actually do the backtest and plot the results as follows:

# Do backtest

results <- backtest(dataList,getOrders,params,sMult=0.2)

pfolioPnL <- plotResults(dataList,results)

The arguments to the function backtest are the following:

- dataList- list of (daily) xts objects (with identical indexes)

- getOrders- the strategy

- params- the parameters for the strategy

- sMult- slippage multiplier (proportion of overnight gap)

Results for individual series are available in results$pnlList. The portfolio results are available in pfolioPnL, which is produced by plotResults(dataList,results). This function also automatically plots individual and aggregate equity curves, and computes variant of the Calmar Ratio that we call the Profit Drawdown Ratio (PD ratio for short) – it is the final profit divided by the maximum drawdown in terms of profit and loss, or if the strategy makes a loss overall the PD ratio is just that loss (which is negative). You do not need to write code to compute this, since it has already been done for you. In assignment 2 we will optimize the aggregate PD ratio – this value is stored in pfolioPnL$fitAgg, e.g., for our first example we have:

> print(pfolioPnL$fitAgg)trading applications代写

[1] -153.44This matches up with the PD ratio that appears at the top of the aggregate equity curve produced by plotResults.

Recall that market orders specify volume and direction (but not price), and limit orders specify price, volume, and direction. In the backtester framework, trading decisions are made after the close of day k, and trades are executed on day k+1. For each day, the framework supports one market order for each series, and two limit orders for each series.

These orders are returned from getOrders as follows:

return(list(store=store,marketOrders=marketOrders,

limitOrders1=limitOrders1,

limitPrices1=limitPrices1,

limitOrders2=limitOrders2,

limitPrices2=limitPrices2))

Market orders will be executed at the open on day k+1. They incur slippage (20% of the overnight gap for assignment 2). Market orders are specified by

- size(number of units to trade)trading applications代写

- direction(buy/sell)

The sizes and directions of market orders are encoded in the vector marketOrders of the return list of getOrders. For example, the vector

c(0,-5,0,1,0)

means place a market order for 5 units short in series 2, and 1 unit long in series 4.

We will not use limit orders for assignment 2, so you can leave limitOrders1, limitPrices1, limitOrders2, limitPrices2 as zero vectors when you do assignment 2 (i.e., you do not need to edit that part of the template). We will introduce the limit order functionality in detail in COMP396.

As well as fixed.R, two other example strategies are available now: copycat.R, bbands.R. It is left to you to explore how these work. These strategies implement the copycat strategy and mean-reversion Bollinger bands strategies from slides 06, respectively. Note that bbands.R and a2_template.R make use of the store to remember past data. You will need to adapt the store for COMP396, but for now, for COMP226 assignment 2 you just need to understand how close prices can be retrieved from the store as described below.trading applications代写

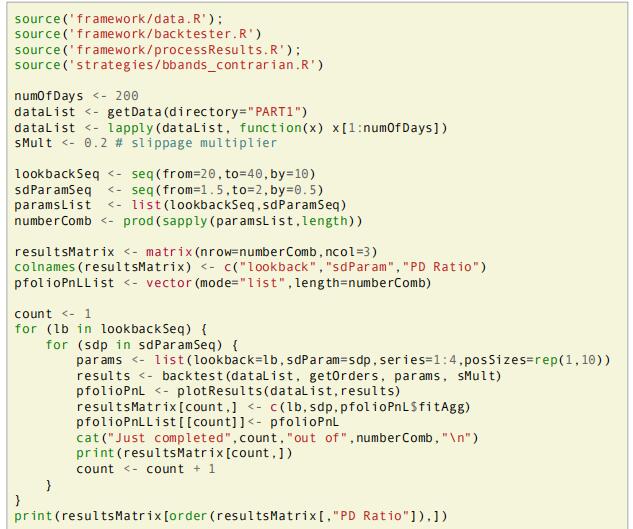

Before we move on to assignment 2, we will briefly look at an example of parameter optimization that will be useful for assignment 2. To make it easier to carry out parameter optimizations, getOrders takes an argument params. This can be used to pass a parameter combination to a strategy. This is turn can be used to do a parameter optimization as main_optimize.R demonstrates. Here is the source code for main_optmize.R:

The code template and data for assignment 2

You are now ready to start working on assignment 2. To do so you should read and work through the rest of this document very carefully.

As a first step, try to run main_template.R. It uses strategies/a2_template.R which is a code template that should serve as your starting point. If you try to source main_template.R you will get an error as follows:

Error in if (store$iter > params$lookbacks$long) { :

argument is of length zero

If you read on you will see that the final strategy requires a parameter called lookbacks. Read on to see what form this parameter should take.

The function getPosSignFromTMA should use a function getTMA.

The position size, i.e., the number of units to be long or short, will be determined by the function getPosSize. Finally, as usual in the backtester framework for COMP226 and COMP396, the position sizes are given to the backtester in the function getOrders. Here are the detailed specification and marks available for these first 4 functions.

| Function name | Input parameters | Expected behaviour | Marks available for a correct implementation |

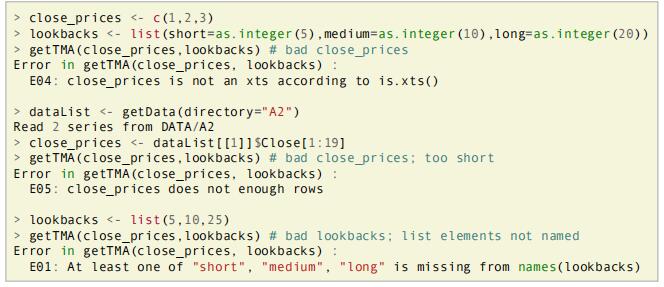

| getTMA | close_prices; lookbacks. The specific form that these arguments should take is | You should first implement the checks as described in the template. Hints of how to implement them are given below. | 18% (3% per check)trading applications代写 |

| specified in the

template code via the 6 checks that you need to implement. |

The function should return a list with three named elements (named short, medium, and long). Each element should be equal to the value of a simple moving average with the respective window size as defined by lookbacks. The windows should all end in the same period, which should be the final row of close_prices. | 12% | |

getPosSign FromTMA |

tma_list is a list with three named elements, short, medium, and long. These correspond to the simple moving averages as returned by getTMA.

Note: You do not need to check the validity of the function argument in this case, or for the remaining functions either. |

This function should return a single number that should be 0, 1, or -1.

If the short value of tma_list is less than the medium value, and the medium value is less than the long value, then the return value should be 1 (indicating a long position). If the short value of tma_list is greater than the medium value, and the medium value is greater than the long value, then the return value should be -1 (indicating a short position). Otherwise, the return value should be 0 (indicating a flat position). |

15%trading applications代写 |

| getPosSize | current_close: this is the current close for one of the series; it does not have a default value.

constant: this argument should have a default value of 1000. |

The function should return (constant divided by current_close) rounded down to the nearest integer. | 5% |

| getOrders | The arguments to this function are always the same for all strategies used in the backtester framework. | This function should implement the strategy outlined above and again below in “Strategy specification”.trading applications代写 | 20% |

Strategy specification trading applications代写

The strategy should apply the following logic independently for both series.The strategy does nothing until there have been params$lookbacks$long-many periods. In the params$lookbacks$long-th period, and in every period after, the strategy computes three simple moving averages with window lengths equal to:

- params$lookbacks$short

- params$lookbacks$medium

- params$lookbacks$long

The corresponding windows always end in the current period. The strategy should in this period send market orders to assume a position (make sure you take into account positions from earlier) according to getPosSignFromTMA and getPosSize.(Limit orders are not required at all, and can be left as all zero.)

Hints trading applications代写

For the checks for getTMA you may find the following functions useful:

- The operator ! means not, and can be used to negate a boolean.

- sapply allows one to apply a function element-wise to a vector or list (e.g., to a vector list c(“short”,”medium”,”long”)).

- all is a function that checks if all elements of a vector are true (for example,it can be used on the result of sapply).

- %in% can be used to check if a element exists inside a vector.To compute the moving average in getTMA you can use the function SMA from the TTR package.

Note: The list returned by getTMA should work as input to the functiongetPosSignFromTMA.

For getPosSize, to round down to the nearest integer you can use the function floor.

As in the template, use the negative of currentPos summed with the new positions you want to take to make sure that you assume the correct position.trading applications代写

In order to help you check whether you have implemented the functions correctly, we next give some examples of how correct implementations of the functions will behave. These examples assume that you have correctly implemented the first 4 functions in a2_template.R and sourced the resulting code to make the functions available in the R environment.

Example output for getTMA

First you should make sure that you have correctly implemented all 6 checks on the function arguments. Here are 3 examples of expected behaviour:

Here is an example where we give the function valid arguments.

Example output for getPosSignFromTMAtrading applications代写

Here are three examples of correct output:

> getPosSignFromTMA(list(short=10,medium=20,long=30))

[1] 1> getPosSignFromTMA(list(short=10,medium=30,long=20))

[1] 0> getPosSignFromTMA(list(short=30,medium=20,long=10))

[1] -1Example output for getPosSize trading applications代写

Here are two examples of correct output:

> current_close <- 100.5

> getPosSize(current_close)

[1] 9> getPosSize(current_close,constant=100.4)

[1] 0Example output for getOrders

To check your implementation of getOrders, see part 2 for examples of correct output for the function getInSampleResult below.

Part 2: in-sample tests trading applications代写

There are two more functions that you need to implement: getInSampleResult and getInSampleOptResult. For both functions you will need to compute your own in-sample period, which is based on your computer science (CS) username. This ensures that for part 2 there are different answers for different students. To get your in-sample period you should use in-sample_period.R as follows. Source it and run the function getInSamplePeriod with your CS username as per the following example. Then use the first number in the returned vector as the start of the in-sample period and the second number as the end.

> source(‘in-sample_period.R‘)

> getInSamplePeriod(‘x4xz1’)

[1] 230 644

So for this example username the start of the in-sample period is day 230 and the end is 644. Note: you may need to install the package digest to use this code.trading applications代写

Once you have your own in-sample period (and a correct implementation of getOrders), you are ready to complete the implementation of getInSampleResult.

| Function name | Input parameters | Expected behaviour | Marks available for a correct implementation |

| getInSampl eResult | None | This function should return the PD ratio that is achieved when the strategy is run with short lookback 10, medium lookback 20, and long lookback 30, on your username-specific

in-sample period. |

10% |

To complete the final function getInSampleOptResult you need to do an in-sample parameter optimization using the following parameter combinations for the:

- short lookback

- medium lookback

- long lookback trading applications代写

You should not optimize the constant used with getPosSize, and leave it as 1000 as defined in the template code.

The parameter combinations are defined by two things: parameter ranges and a further restriction. Make sure you correctly use both to produce the correct set of parameter combinations. The ranges are:

| Parameter | Minimum value | Increment | Maximum Value |

| short lookback | 100 | 5 | 110 |

| medium lookback | 105 | 5 | 120 |

| long lookback | 110 | 5 | 130 |

The further restriction is the following:

Further restriction on parameter values

You should further restrict the parameter combinations as follows:

- The medium lookback should always be strictly greater than the short lookback.

- The long lookback should always be strictly greater than the medium lookback.

You need to find the best PD ratio that can be achieved one this set of parameter combinations for the in-sample period that corresponds to your username, and set it as the return value of getInSampleOptResult.trading applications代写

Hint

The correct resulting number of parameter combinations is 28.

You can adapt backtester_v5.0/main_optimize.R. It is probably easiest to use three

nested for loops in order to ensure that you only check valid parameter combinations

(where the short < medium < long for the respective window lengths).

| Function name | Input parameters | Expected behaviour | Marks available for a correct implementation |

| getInSampl eOptResult | None | This function should return the best PD ratio than can be achieved with the stated allowable parameter combinations on your username-specific

in-sample period. |

20% |

Next we give some example output for these two functions.

Example output for getInSampleResult trading applications代写

To help you check the correctness of your code, here are three example return values for made up usernames:

| Username | Correct return value |

| x1xxx | -1664.35 |

| x1yyy | -541.94 |

| x1zzx | -1776.39 |

Example output for getInSampleOptResult

To help you check the correctness of your code, here are three example return values for made up usernames:

| Username | Correct return value |

| x1xxx | 3.28 |

| x1yyy | 1.42 |

| x1zzx | 3.01 |

Marks summary

| Function | Marks |

| getTMA | 30 |

| getPosSignFromTMA | 15 |

| getPosSize | 5 |

| getOrders | 20 |

| getInSampleResult | 10 |

| getInSampleOptResult | 20 |

Submission

You need to submit a single R file that contains your implementation of 6 functions. Submission is via the department electronic submission system: http://www.csc.liv.ac.uk/cgi-bin/submit.pl

In what follows replace x1xx by your CS username (which you use to log on to the submission system).trading applications代写

Submit one ascii R file

- x1xx.R – an R – an R file containing your code (implementations of all the functions)

Warning

Your code will be put through the department’s automatic plagiarism and collusion

detection system. Student’s found to have plagiarized or colluded will likely receive a

mark of zero. Do not discuss or show your work to other students.

更多其他:C++代写 考试助攻 C语言代写 finance代写 计算机代写 report代写 project代写 物理代写 数学代写 经济代写 java代写 python代写 程序代写