Written Assignment 3 (due on Tuesday, October 23rd)

Written Assignment代写 ou are asked to conduct an event study of the effect of merger announcements on the stock price of target firms.

Part I. Merger Announcement Event Study Written Assignment代写

You are asked to conduct an event study of the effect of merger announcements on the stock price of target firms. To this end, return data of 10 mergers is posted in the Assignment 3 folder in Merger data.xlsx.

Names of the acquirers and target firms along with the announcement dates are listed in the left-most work sheet called Merger list. Each event has its own work sheet. For each merger, the event time is listed in column D and the announcement date is zero. The Price column and SP500 columns have prices of the stocks and the market portfolio. You can compute the daily return on day t as rt = (Pt – Pt-1)/Pt-1, where P is the stock price or the level of the S&P 500 stock index.

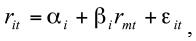

For each target, i, determine the normal returns of the target firm using the market model

Usually we subtract the risk-free rate from stock returns, but you can ignore it here since it is very small on a daily basis.

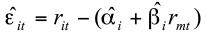

Let the announcement date be day 0. Choose the estimation period to go from t = -125 to t = -26, while the event period goes from day t = -25 to day t = 25. Estimate the abnormal returns of target i,

Compute the cumulative abnormal returns (CARit) of target i on event day t as follows:

(i) Plot CARit against t for each firm, i.

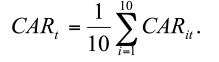

Compute the cross-sectional average of the cumulative abnormal return (CARt):

(ii) Plot CARt against t. Discuss and interpret your findings in relation to the efficient market hypothesis.Written Assignment代写

Part II. Valuation Ratios and Returns in International Markets Written Assignment代写

Historically, US firms’ book-to-market ratio and their size appears to be correlated with their subsequent returns, but does this carry over to other markets with different accounting conventions? This exercise looks at the evidence in the Hong Kong stock market and considers the stability of the value and small-cap premium.

To this end, consider the file HongKong.xlsx. The data were downloaded from Ken French’s web site and provide monthly percentage returns from 1975-2017 on the market portfolio (Mkt, col B), a risk-free asset (Rf, col C), and portfolios of high book-to-market (col D), low book-to-market (col E), high dividend yield (col F) and low dividend yield (col G) stocks.Written Assignment代写

Please answer the following questions:

(ⅰ)Did value stocks (high BM, column D) earn higher mean returns than growth stocks (low BM stocks, column E) over the sample? Comment on the economic and significance of your findings.

(ⅱ)Did high yield (column F) stocks earn higher mean returns than low yield stocks (column G) over the sample? Comment on the economic and significance of your findings.

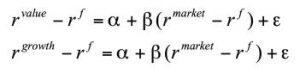

(ⅲ)Can the performance of value and growth stocks be explained by the CAPM? To answer this, subtract the risk-free rate (column C) from the returns on value (column D) and growth (column E) stocks. Then regress their excess returns on the excess return on the local market (column B minus column C) and an intercept:

If the CAPM is true, the intercept term (the ‘alpha’) should be insignificantly different from zero and the beta should be higher for the stocks with the highest mean returns. Is this what you find – or is this implication of the CAPM rejected? Comment on both the statistical significance (t-statistic of alpha) and the economic significance (annualized alpha).Written Assignment代写

(ⅳ)Repeat the exercise in (iii) for the high yield and low yield stocks. What do you find?

更多其他:数据分析代写 程序代写 Analysis Workload代写 analysis代写 assignment代写 code代写 数据分析代写 算法代写