Pricing American Option with Discrete Cash Dividend

美式期权定价代写 The purpose of this project is to explore and implement various option pricing models to price American options with discrete cash dividends.

1.Project objective

The purpose of this project is to explore and implement various option pricing models to price American options with discrete cash dividends.

2.Background

The incorporation of dividends in equity price models that are used to price derivatives on an underlying stock constitutes an important and non-trivial extension of such models. If a continuously paid dividend yield is used, or one is willing to specify the future dividends as a fixed percentage of the stock price at dividend dates, then the classicial option pricing model of Merton (1973), Black and Scholes (1973) can be used with only some minor modifications, but in reality option market makers prefer to specify dividends in terms of a fixed cash value instead of a percentage.

This destroys the very feature which makes all option pricing computations so easy in the Black–Scholes model: the lognormal distribution of future stock prices. Standard approximation schemes such as the Cox, Ross and Rubinstein (1979) binomial tree methods can no longer be applied, or it becomes extremely inefficient from a computational point of view to do so.

3.Requirement 美式期权定价代写

3.1 Starting with XOM (very liquid option)

3.2 You can use options with approximate 1-year expiry for this exercise.

3.3 You can ignore short borrow cost (these names are easy to borrow)

3.4 You can assume flat interest rate curve (constant r).

3.5 Using option data, construct American option pricing model with discrete dividends (see reference paper)

3.6 The model should be able to handle up to four cash dividends and ex-dates as input. The dividend amount can be identical or different.

3.7 The option pricing model should have the following inputs (option type: call or put; stock price; interest rate; strike price; dividend (amounts and ex-dates)) and output will be the option price

3.8 Once built the model, input some random parameters to generate the option prices. Compare the result with option price with continuous dividend yield.

3.9 Now assuming dividend ex-dates are known (same as data), but volatility and dividend amount unknown. Perform calibration (optimization) to find out the implied volatility (σ) and implied discrete dividend (d), assuming dividend is paid at the ex-dates with amount d.

4.Data 美式期权定价代写

Options data for 4 stocks, each has 10 near the money call and 10 near the money put with the same expiry, strike interest rate and dividends.

5.Coding Language

Python

6. Instructions

You need to build model by yourself based on ideas and methodology from reference papers. External library such as Quanlib is NOT allowed. Other packages like numpy, pandas and scipy can be used.

Write a brief report to summarize results.

7.Discrete dividend specific notes 美式期权定价代写

Our inputs included a dataframe which could take as many dividends as required (including how long until the dividend was paid and the amount of the dividend)

i.

Note at this point that there is no guarantee the dividend will fall exactly on a time step. To ensure this is the case, we can allow flexibility in how big the time steps are. So, for example:

- 100 steps

- 365 days

- Dividend paid after 60 days

- If there was no discrete dividend, we would have 100 steps which were each 3.65 days long.

- However, our discrete dividend would fall between two time steps.

Determine the closest time step for the dividend (assume rounding up): 17

We now allow 17 steps for the period up to the dividend, and 83 steps for the period after the dividend

The size of time step pre-dividend is now 60/17 = 3.53 days

The size of the time step post-dividend is now 305/83 = 3.67 days

- You can apply this reasoning for x dividends, and create a tree which had x+1 different sections, each with potentially different sized steps

- We also enforced a minimum number of steps in each section. For a model which had a total of 1000 time steps, we would use 15 time steps as the minimum number per section. This may mean the final number has more than 1000 time steps.

ii. 美式期权定价代写

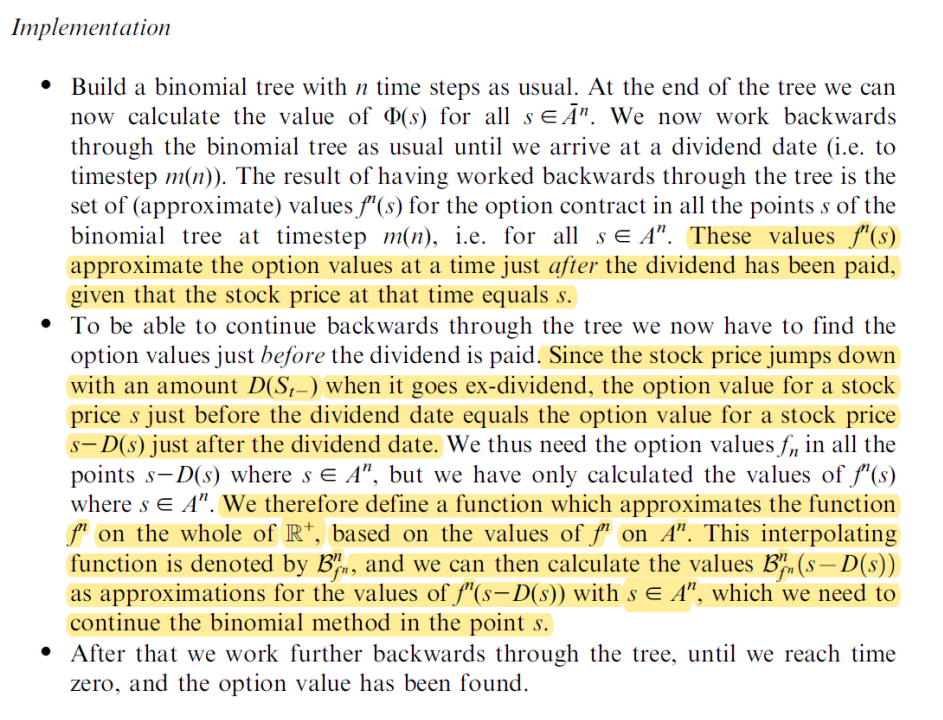

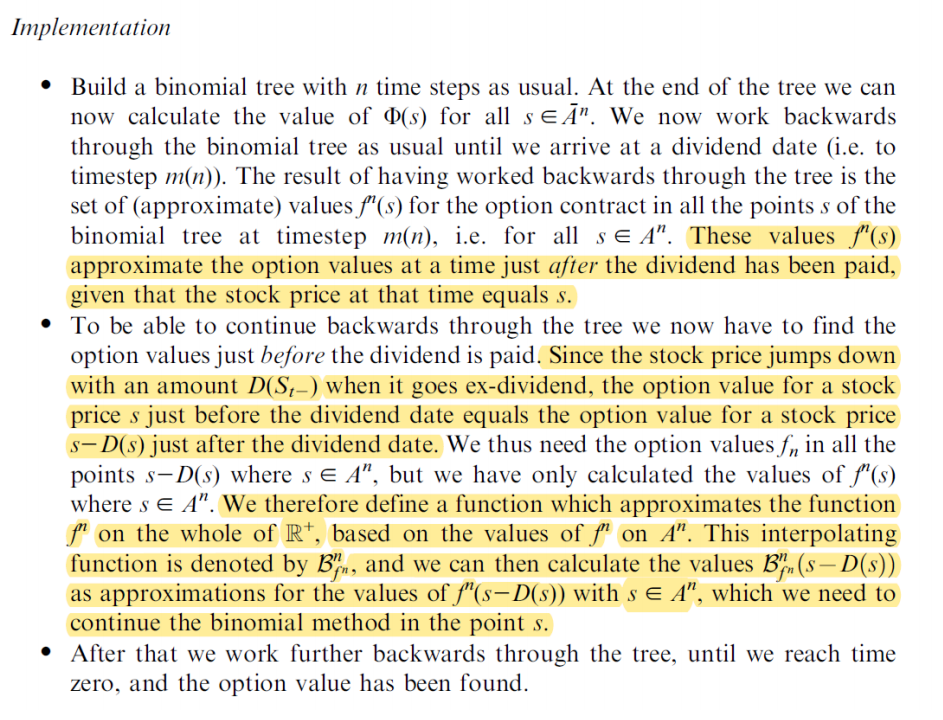

The big challenge with discrete dividends is that the tree is no longer recombining once the dividend has paid. To fix this, we would adjust the prices at the dividend time step

- Determine the number of nodes N at the time step

- Take the largest and smallest ex-dividend prices and fix these

- Use interpolation to adjust the N-2 points in the middle, such that they will recombine again

- This becomes the new data at the time of the dividend, but it is important to store the pre-dividend data at the node, because when you go backwards through the tree you would need to adjust the values back at that point.

更多代写:澳洲计算机科学网课代修 澳洲Final exam代考 英国历史(History)网课代修 本科经济学英文econ essay代写 北美Business Plan代写 经济作业代做